There’s no denying the benefits of a college education: the ability to compete in today’s job market, increased earning power, and expanded horizons. But these advantages come at a price. And yet, year after year, thousands of students graduate from college. So how do they do it?

There’s no denying the benefits of a college education: the ability to compete in today’s job market, increased earning power, and expanded horizons. But these advantages come at a price. And yet, year after year, thousands of students graduate from college. So how do they do it?

Many families finance a college education with help from student loans and other types of financial aid such as grants and work-study, private loans, current income, gifts from grandparents, and other creative cost-cutting measures. But savings are the cornerstone of any successful college financing plan.

College Costs Keep Climbing

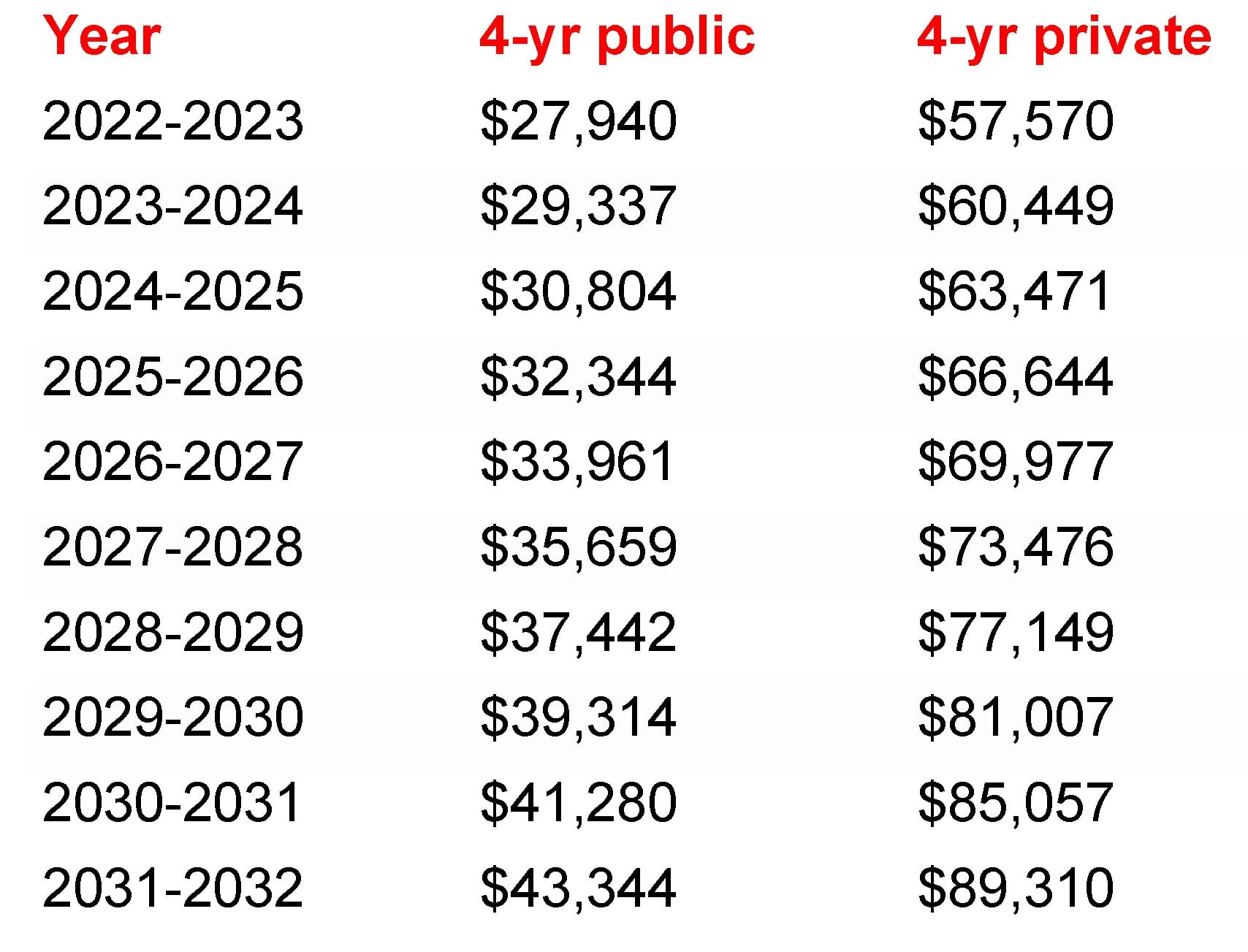

It’s important to start a college fund as soon as possible, because next to buying a home, a college education might be the biggest purchase you ever make. According to the College Board, for the 2022-2023 school year, the average total cost of attendance at a four-year public college for in-state students is $27,940, while the average cost at a four-year private college is $57,570. Many private colleges cost substantially more. (Costs include tuition, fees, room and board, plus a fixed sum for books, transportation, and personal expenses.)

Though no one can predict exactly what college might cost in 5, 10, or 15 years, annual price increases in the range of 3% to 5% would certainly be in keeping with historical trends.

This chart shows what future costs might be, based on the most recent cost data and an average annual college inflation rate of 5%. (Source: College Board, Trends in College Pricing and Student Aid 2022)

Focus On Your Savings

The more you save now, the better off you’ll likely be later. Start with whatever amount you can afford, and add to it over the years with raises, tax refunds, unexpected windfalls, and the like. If you invest regularly over time, you may be surprised at how much you can accumulate in your child’s college fund.

This is a hypothetical example of mathematical principals, is used for illustrative purposes only, and does not reflect the actual performance of any investment. Fees, expenses, and taxes are not considered and would reduce the performance shown if they were included. Actual results will vary. All investing involves risk, including the possible loss of principal, and there can be no guarantee that any investing strategy will be successful.

College savings options

College savings options

You’re ready to start saving, but where should you put your money? It’s smart to consider tax-advantaged strategies whenever possible. Here are some options.

529 plans

529 plans are one of the most popular tax-advantaged college savings options. Contributions accumulate tax deferred, and withdrawals are tax-free at the federal level if the money is used for qualified education expenses. States may also offer their own tax advantages. (For withdrawals not used for qualified expenses, earnings are subject to income tax and a 10% federal penalty.) 529 plans are open to anyone, and lifetime contribution limits are high, typically $350,000 and up (limits vary by state). In 2023, lump-sum gifting up to $85,000 is allowed ($170,000 for joint gifts) with no gift tax implications if certain requirements are met.

There are two types of 529 plans: savings plans and prepaid tuition plans. A 529 savings plan is an individual investment account similar to a 401(k) plan where you direct your contributions to one or more of the plan’s investment portfolios. Funds in the account can be used to pay tuition, fees, room and board, books, and supplies at any accredited college in the United States or abroad. Funds can also be used to pay K-12 tuition expenses, up to $10,000 per year. By contrast, the less common 529 prepaid tuition plan allows you to purchase college tuition credits at today’s prices for use in the future at a limited group of colleges that participate in the plan, typically in-state public colleges.

Coverdell ESA

A Coverdell education savings account (ESA) is a tax-advantaged education savings vehicle that lets you contribute up to $2,000 per year for a beneficiary’s K-12 or college expenses. Your contributions grow tax deferred, and earnings are tax-free at the federal level if the money is used for qualified education expenses. You have complete control over the investments you hold in the account, but there are income restrictions on who can participate, and the $2,000 annual contribution limit isn’t likely to put much of a dent in college expenses.

Custodial account (UTMA/UGMA)

A custodial account allows a minor to hold investment assets in his or her own name with an adult as custodian. All contributions to the account are irrevocable gifts to your child, and assets in the account can be used to pay for college. When your child turns 18 or 21 (depending on state law), he or she will gain control of the account. Earnings and capital gains generated by the account are taxed to your child each year under the “kiddie tax” rules. Under the kiddie tax rules, a child’s unearned income over a certain threshold ($2,500 in 2023) is taxed at parent income tax rates.

Roth IRA

Though technically not a college savings option, some parents use Roth IRAs to save and pay for college. Contributions to a Roth IRA can be withdrawn at any time and are always tax-free. For parents age 59½ and older, a withdrawal of earnings is also tax-free if the account has been open for at least five years. For parents younger than 59½, a withdrawal of earnings — typically subject to income tax and a 10% premature distribution penalty — is spared the 10% penalty if the withdrawal is used to pay for a child’s college expenses.

A Word on Financial Aid

Many families rely on some form of financial aid to pay for college, which may include loans, grants, scholarships, and work-study. Financial aid can be based on financial need or on merit. To determine financial need, the federal government and colleges look primarily at your family’s income.

To get an idea of how much grant aid your child might be eligible for at a particular college, you can use a net price calculator, which is available on every college website. The bottom line, though, is to beware of too much borrowing to pay for college. Excessive student loan debt — and parent debt — can negatively affect borrowers for years. The more you save now, the less you and your child will potentially need to borrow later.

Scarlet Oak Financial Services can be reached at 800.871.1219 or contact us here. Click here to sign up for our weekly newsletter with the latest economic news.

Source:

Broadridge Investor Communication Solutions, Inc. prepared this material for use by Scarlet Oak Financial Services.

Broadridge Investor Communication Solutions, Inc. does not provide investment, tax, legal, or retirement advice or recommendations. The information presented here is not specific to any individual’s personal circumstances. To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on individual circumstances. Scarlet Oak Financial Services provide these materials for general information and educational purposes based upon publicly available information from sources believed to be reliable — we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.