What is the forecast for college cost increases?

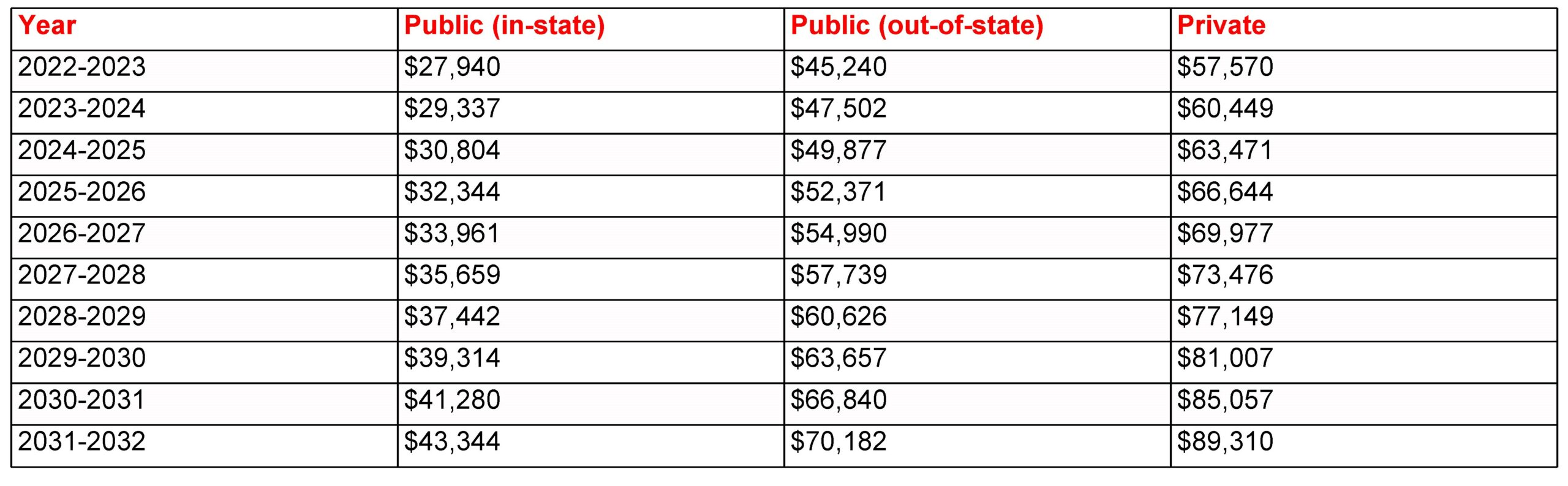

A college education is expensive. It’s crucial to estimate college costs when you begin to save for them. All those benefits of personal growth, expanded horizons, and increased lifetime earning power come at a price, a price that increases every year. According to the College Board’s annual Trends in College Pricing Report, for the 2022-2023 academic year, the average cost of attendance at a four-year public college for in-state students is $27,940, the average cost of attendance at a four-year public college for out-of-state students is $45,240, and the average cost of attendance at a four-year private college is $57,570. Many private colleges cost substantially more. The total cost of attendance includes direct billed costs for tuition, fees, room, and board, plus a sum for books, personal expenses, and transportation.

For decades, college costs have outpaced annual inflation, and this trend is expected to continue. Annual college cost increases in the range of 3% to 5% would be a reasonable projection based on historical averages.

The following table shows what college costs might be in 5 or 10 years based on current costs and a 5% annual college inflation rate.

What expenses are included in the cost of college?

In the academic world, the cost of college is generally referred to as the cost of attendance (COA). Each college has its own COA. The COA consists of five items (three are “direct” costs generally billed by the college and two are “indirect” costs that aren’t billed):

-

-

- Tuition and fees: These expenses are generally the same for all students.

- Books and supplies: These expenses can vary depending on the courses selected.

- Room and board: These expenses can vary depending on where the student lives (e.g., dorm, off-campus apartment, at home) and the meal plan chosen.

- Transportation: This expense can vary depending on how far the student lives from the college. It can involve daily commuting expenses, three round-trip flights home a year, or anything in between.

- Personal expenses: This category also can vary by student.

-

Twice per year, the federal government recalculates the COA for each college and then adjusts the figures for inflation. The government then uses the COA figures to determine your child’s particular financial need come financial aid time.

Why should you start saving early?

Next to buying a home, a college education is the largest expenditure most parents will ever make (and perhaps the biggest expenditure when more than one child is in the family picture). Faced with such a daunting task, you might be inclined to ignore the problem and wait until you are more financially settled before you start saving. But that would be a mistake.

The key to sanity in the area of education planning is advance planning. The earlier in the process you become informed about the potential costs and your saving options, the greater chance you will start saving. And the more money you save now, the less money you or your child will need to borrow later.

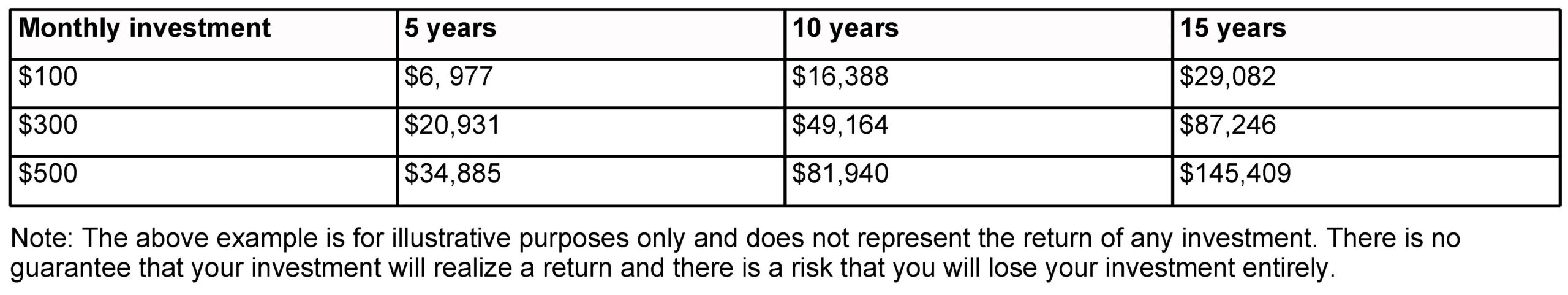

It is important to begin saving as early as possible so you can earn interest, dividends, and/or capital gains on as much money as possible. With a long-term savings strategy, you can hopefully keep ahead of college inflation.

Regular investments add up over time. By investing even a small amount of money on a regular basis, you have the potential to accumulate a significant amount in your child’s college fund. The following table illustrates how your monthly investment can grow over time (assuming an approximate 6 percent after-tax return rate):

How much do you need to save?

How much you need to save obviously depends on the estimated cost of college at the time your child is ready to attend. Often, these numbers are staggering. For many parents, the question of how much they should save becomes how much they can afford to save.

To determine how much you can afford to save for your child’s college each month, you will need to prepare a budget and examine your monthly income and expenses. Don’t be discouraged if you can save only a minimal amount at first. The key is to start saving early and consistently, and to add to it whenever you can from raises, bonuses, or unexpected gifts.

After you determine how much you can save each month, you will need to choose one or more college saving options. There are many possibilities for college savings 529 plans, Coverdell education savings accounts, custodial accounts, bank accounts, and mutual funds. To help make your nest egg grow, you will want to maximize the after-tax return on your savings while minimizing risk.

Finally, keep in mind that most parents are not able to save 100 percent of their child’s college education (after all, do you know anybody who purchased a home entirely with his or her own savings?). Instead, parents generally supplement their savings at college time with a combination of personal loans, the child’s financial aid (student loans, grants, scholarships, and work-study), and tax credits to cover college costs. Having realistic conversations with your child(ren) about expectations regarding how much savings will cover and what will need to be borrowed for college is vital. These budget conversations might guide decisions in the application process and beyond.

We can help with those conversations and a more personalized estimate of college costs.

Scarlet Oak Financial Services can be reached at 800.871.1219 or contact us here. Click here to sign up for our weekly newsletter with the latest economic news.

Source:

Broadridge Investor Communication Solutions, Inc. prepared this material for use by Scarlet Oak Financial Services.

Broadridge Investor Communication Solutions, Inc. does not provide investment, tax, legal, or retirement advice or recommendations. The information presented here is not specific to any individual’s personal circumstances. To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on individual circumstances. Scarlet Oak Financial Services provide these materials for general information and educational purposes based upon publicly available information from sources believed to be reliable — we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.