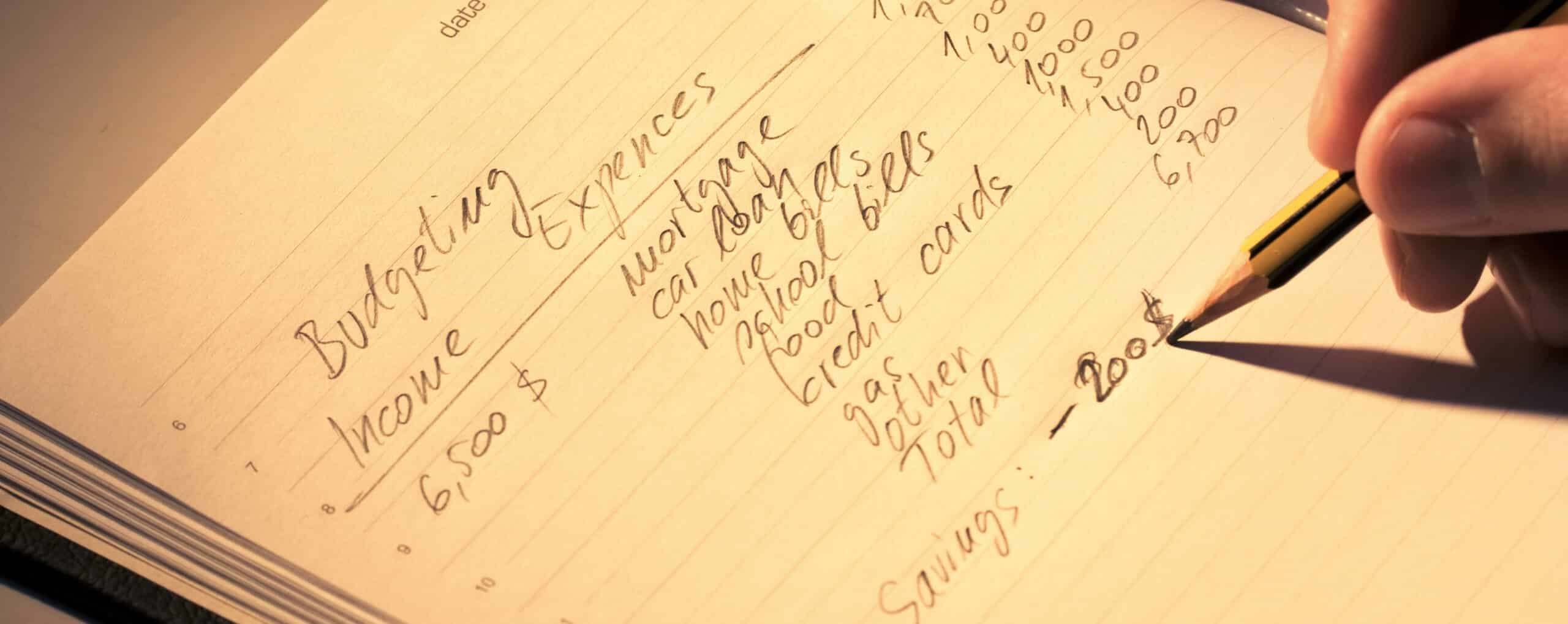

Creating a home buying budget is an essential step in the home purchasing process. It may be easier to go through the pre-approval stage and choose to let that guide your budget. But sometimes, what you can get approved for and what would work for your long-term budget, financial goals, retirement, and financial stability DON’T align. There is probably nothing financially worse than owning a home that you can’t maintain. Being house poor can create debt, delay retirement, stress a couple’s relationship, and breed resentment.

A good rule of thumb is that household expenses should not exceed 25%-30% of your gross income.

But remember your mortgage isn’t the only recurring expense that will occur – maintenance and repairs, utilities, property taxes, mortgage insurance, homeowner’s insurance, HOA fees, yard maintenance, pest prevention, additional flood insurance, and more- will need to be considered. All of these different recurring expenses need to be part of the 25%-30%.

In addition, most people will have to come up with a down payment to secure a home loan. This down payment can be from 0%- 20% of the total mortgage, depending on the loan you qualify for FHA, Conventional, VA, USDA, etc. You’ll also need cash to cover closing costs which are a separate expense from the down payment. Closing Costs usually add up to another 2% to 5% of the mortgage. The bigger the mortgage, the higher all these costs are, so creating a realistic homebuying budget can be important short and long term for your wallet.

One-time significant expenses will occur with moving into your own home.

Moving costs, hookup fees for utilities, appliances -washer, dryer, refrigerator, and miscellaneous home essentials that you haven’t required before, i.e., a lawnmower, are just some of the items you might need to cover. Additional budget strains occur at move-in that might improve your enjoyment of your new property like furniture, painting or redecorating money, window coverings, and security systems.

Remember, a larger emergency fund will be needed to be saved before or after your home purchase.

With a home, your emergencies become larger- a new roof, water heater, AC replacement, or repair can create large amounts of debt if you don’t have the savings to cover them. By controlling your home buying budget, you prevent endangering your future financial stability, and you are taking advantage of the benefits of homeownership- building equity, tax breaks, etc. If you’d like to set up a professional review of your finances before you start your home purchasing process,

Scarlet Oak Financial Services can be reached at 800.871.1219 or contact us here.

Sources:

- https://www.thebalance.com/what-percentage-of-your-income-should-go-to-rent-4688840

- https://www.zillow.com/mortgage-calculator/house-affordability/

- https://www.listenmoneymatters.com/buying-a-house-hidden-costs/

- https://www.clevergirlfinance.com/blog/house-poor/

- https://www.rocketmortgage.com/learn/what-is-a-down-payment

- https://www.fortunebuilders.com/benefits-of-homeownership/

This material has been prepared for informational purposes.