Scarlet Oak Financial Services’ Tax Center aims to help you with resources you may need for the tax season ahead. We hope the general information about deadlines, charts on key numbers, and custodial account holder FAQs might make this tax season a bit less stressful.

Scarlet Oak Financial Services can’t give tax advice and will always recommend that you speak with an accountant, CPA, or tax advisor for specific questions concerning your tax situation. But, if you need assistance finding tax help, we have a referral list of trusted tax professionals that our clients and we have worked with through the years. Please contact Faye at [email protected]; she will be happy to send you a list of contacts.

Federal Tax Season Starts

The Internal Revenue Service will begin accepting and processing 2024 tax returns on Monday, Jan. 27, 2025.

Tax Tips

Tips for making filing easier

To speed refunds and help with tax filing, the IRS suggests the following:

- First, gather your necessary documents, such as W-2s, 1099s, and other income documentation.

- Ensure your deductions and credits, such as charitable donations and medical expenses, are documented.

- Check the tax law changes for the current year. Make sure you’re aware of any deductions or credits you might be eligible for by going to irs.gov. Gather the documentation for these new deductions or credits you might not have previously been tracking.

- Set aside time in your schedule to complete your taxes. It might be wise to engage a tax professional who can help with the process and maximize your savings. In addition, these professionals can help you navigate an ever-expanding tax law landscape that changes yearly.

- Ensure you have received Form W-2 and other earnings information, such as Form 1099, from employers and payers. The dates for furnishing such information to recipients vary by form, but they are generally not required by January 31st. You may need to allow additional time for mail delivery. Check for errors on these documents.

- Try to file electronically and use direct deposit. Electronic filing allows you to check whether your return was accepted within hours of filing and your refund status after 24 hours. Filing by mail can take 6 to 8 weeks to process your return.[i]

Key Filing Dates

Late January 2025: The IRS begins processing 2024 tax returns.

January 31, 2025: Employers must mail W-2 forms for 2024.

April 15, 2025:

-

- First Estimated Tax Payment: The first estimated tax payment for tax year 2025 is due.

- IRA and Solo 401(k) Contributions: Final day to contribute to IRAs and Solo 401(k) accounts for 2024.

- 2024 Tax Filing Deadline: The filing deadline for 2024 taxes applies to most individual filers, self-employed individuals, and single-member LLCs.

| Entity Type | Filing Deadline | Extension Deadline |

|---|---|---|

| Individual Filers | April 15, 2025 | October 15, 2025 |

| Individual Filers Living Abroad | June 16, 2025 (due to holiday) | October 15, 2025 |

| Self-Employed Filers | April 15, 2025 | October 15, 2025 |

| S Corporations | March 17, 2025 (due to weekend) | September 15, 2025 |

| C Corporations | April 15, 2025 | October 15, 2025 |

| Partnerships | March 17, 2025 | September 15, 2025 |

| Single-Member LLCs | April 15, 2025 | October 15, 2025 |

| Multi-Member LLCs | March 17, 2025 | September 15, 2025 |

| Non-Profits | May 15, 2025 | November 15, 2025 |

[1] Taxfyle

[2] IRS: U.S. Citizens and Resident Aliens Abroad

June 16, 2025: The second estimated tax payment for 2025 is due (adjusted for weekend/holiday).

September 15, 2025: The third estimated tax payment for 2025 is due.

October 15, 2025: Extended deadline to file 2024 tax returns.

January 15, 2026: The fourth estimated tax payment for 2025 is due.

[3] AARP Tax Deadlines

Surprised you owed money?

It is always a good idea to ensure you pay your taxes throughout the year with the correct withholding on your paycheck.

Especially if you have

- had an increase in your salary.

- Started a second job.

- Are you earning income from a sideline like driving Uber or selling goods online

- started a business.

- Had a lifestyle change like marriage, divorce, birth or adoption of a child, home purchase, retirement, or filed chapter 11 bankruptcy.

- Are you not claiming a dependent that you have in previous years? [i]

To check your withholding, use this estimator calculator.

[i] https://www.irs.gov/newsroom/how-to-get-tax-withholding-right

Tax Refunds

The IRS encourages taxpayers seeking a tax refund to file their tax returns as soon as possible. The IRS anticipates most tax refunds being issued within 21 days of the IRS receiving a tax return if the return is filed electronically, any tax refund is delivered through direct deposit, and there are no issues with the tax return. To avoid delays in processing, the IRS encourages people to avoid paper tax returns whenever possible. You can check your refund status here.[1]

[1] https://sa.www4.irs.gov/irfof/lang/en/irfofgetstatus.jsp

What are common tax filing mistakes?

- Underreporting income: All income is taxable unless it’s specifically excluded, as is the case with certain gifts and inheritances. In most instances, the income you earn will be reported to both you and the government on an information return, such as a Form 1099 or W-2. If the income you report doesn’t match the IRS’s records, you could face problems down the road. Be sure to include the income from all of the following forms that are applicable to your situation: 1099-B, 1099-DIV, 1099-MISC, 1099-NEC, 1099-R, Form 1099-INT, Form SSA-1099, and Form W-2.

- Misreporting investment gains: When you sell an investment, you’ll need to know both the cost basis (what you paid for the investment) and the sale price to determine your net gain or loss. The cost basis of your investment may need to be adjusted to account for commissions, fees, stock splits, or other events, which could help reduce your taxable gain or increase your net loss. Financial institutions are required to adjust your investments’ cost basis and provide that information on a Form 1099. However, brokerages aren’t required to report the cost basis for investments purchased prior to a certain date, which means you’ll be responsible for supplying that information.

- Choosing the wrong filing status: Your filing status determines your tax rate, standard deduction, and eligibility for certain credits and deductions. Be sure to choose the correct filing status based on your marital status and family situation.

- Math errors: Math errors can delay the processing of your return and potentially result in penalties. To avoid math errors, double-check all numbers on your return for accuracy and make sure that there are no unexplained differences or items that were left off.

To avoid these mistakes, it’s important to take your time and be as accurate as possible when preparing your tax return. You can also compare this year’s tax return with last year’s to ensure that there are no unexplained differences or items that were left off.

Sources: schwab.com, irs.gov , investopedia.com, creditkarma.com , moneylion.com

What are the tax implications of having stock options or company shares?

If you have been compensated with stock options or company shares, you will need to pay taxes on them. The taxation of stock options depends on the type of option you receive and when you exercise it.

Here is a summary of the tax implications of different types of stock options:

- Incentive stock options (ISOs): You generally aren’t taxed until you sell the stock after exercising your options, giving them a potentially more favorable tax treatment than NQSOs. However, you must meet certain requirements to take full advantage. If you hold the stock for more than two years after the date the options were granted and at least one year after exercising them, the spread is taxed at the long-term capital gains rate, which is generally lower than your income tax rate. This is called a qualifying disposition. If you sell before these criteria are met, the spread at the exercise date is taxed as ordinary income, and any gains after the exercise date will be taxed as either a short- or long-term capital gain, depending on the holding period. This is called a disqualifying disposition.

- Non-qualified stock options (NSOs): You are taxed when you exercise your options. The tax is based on the spread between the stock’s fair market value and the exercise price of the option. The value of the spread is treated as compensation and subject to ordinary income and payroll taxes.

- Restricted stock: The value of the stock grant (less the cost basis) is treated as compensation and is subject to ordinary income and payroll taxes. You’re allowed to make a so-called section 83(b) election within 30 days of the grant. This notifies the IRS that income tax on the stock should be assessed based on the valuation at the grant date (rather than later, when it vests). Once you pay taxes based on the stock’s value at the time of the grant, any future gains in the stock’s price will be treated as long- or short-term capital gains, depending on the holding period.

Scarlet Oak Financial Services can’t give tax advice and will always recommend that you speak with an accountant, CPA, or tax advisor for specific questions concerning your tax situation. But, if you need assistance finding tax help, we have a referral list of trusted tax professionals that our clients and we have worked with through the years. Please contact Faye at [email protected]; she will be happy to send you a list of contacts.

Sources: turbotax.intuit.com, nerdwallet.com, investopedia.com, cookwealth.com

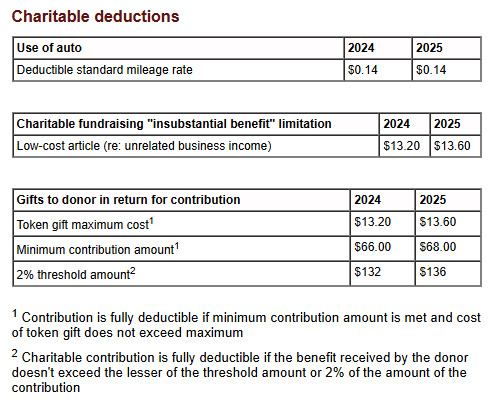

What are the tax tips for charitable contributions, especially stock donations?

Here are some helpful tax tips for your charitable contributions, including stock donations:

- Request a receipt if you donate $250 or more to a single charity. If the donation is in cash, regardless of the amount, you’ll need a receipt or supporting bank records.

- Get an independent, written appraisal for gifts of property in excess of $5,000 ($10,000 for closely held stock). You won’t need an appraisal for exchange-traded funds, bonds, or mutual funds.

- Subtract the value of any benefits you received for your charitable donation (for example, books, tapes, meals, entertainment, and so on) before you deduct it .

- Itemize your deductions on your tax return if you think your total donations will exceed your standard deduction 1 and you want to receive a tax benefit for your charitable donations. If your standard deduction is higher, your donations won’t reduce your tax bill, but you’ll still be supporting your favorite charity—which is a good reason on its own to give.

- For donations of non-cash assets held for more than one year, the limit is 30% of your adjusted gross income (AGI). Your deduction limit will be 60% of your AGI for cash gifts.

- Stock donations made to specific types of qualifying organizations may be deducted up to 50% of the AGI limit. Examples of these types of organizations include but are not limited to Churches or associations of churches Educational organizations, Hospitals or certain medical research organizations, and Private operating foundations.

Sources: schwab.com, givedirectly.org, investopedia.com, kiplinger.com

Scarlet Oak Financial Services can’t give tax advice and will always recommend that you speak with an accountant, CPA, or tax advisor for specific questions concerning your tax situation.

Are qualified retirement rollovers taxable?

If you have performed a retirement account rollover, you may need to report it on your tax return. According to the Internal Revenue Service (IRS), most pre-retirement payments you receive from a retirement plan or IRA can be “rolled over” by depositing the payment in another retirement plan or IRA within 60 days. You can also have your financial institution or plan directly transfer the payment to another plan or IRA 1.

When you roll over a retirement plan distribution, you generally don’t pay tax on it until you withdraw it from the new plan. By rolling over, you’re saving for your future and your money continues to grow tax-deferred. If you don’t roll over your payment, it will be taxable (other than qualified Roth distributions and any amounts already taxed) and you may also be subject to additional tax unless you’re eligible for one of the exceptions to the 10% additional tax on early distributions 1.

The IRS provides detailed information on rollovers of retirement plan and IRA distributions on their website 1. Scarlet Oak Financial Services can’t give tax advice and will always recommend that you speak with an accountant, CPA, or tax advisor for specific questions concerning your tax situation.

Sources:[1] irs.gov, irs.gov, nerdwallet.com

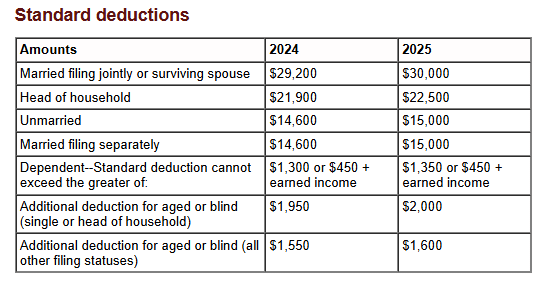

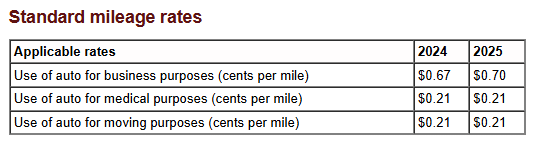

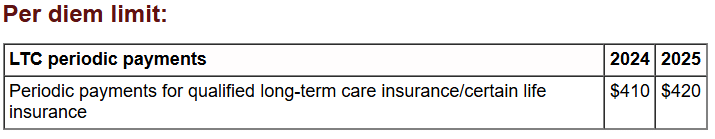

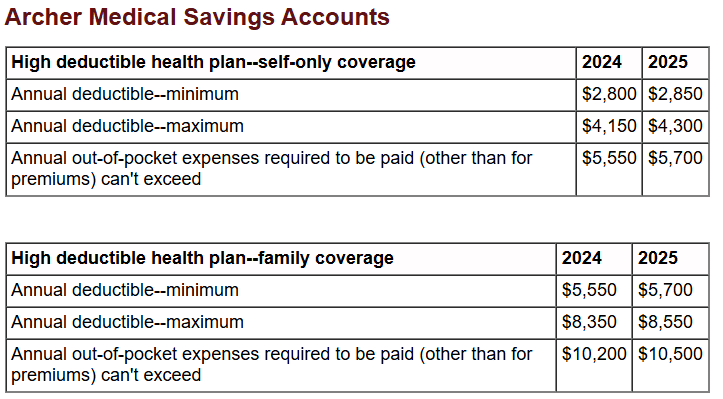

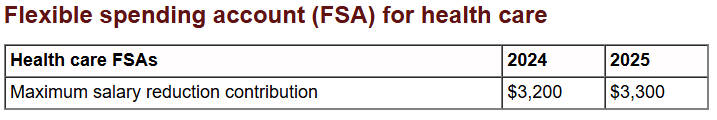

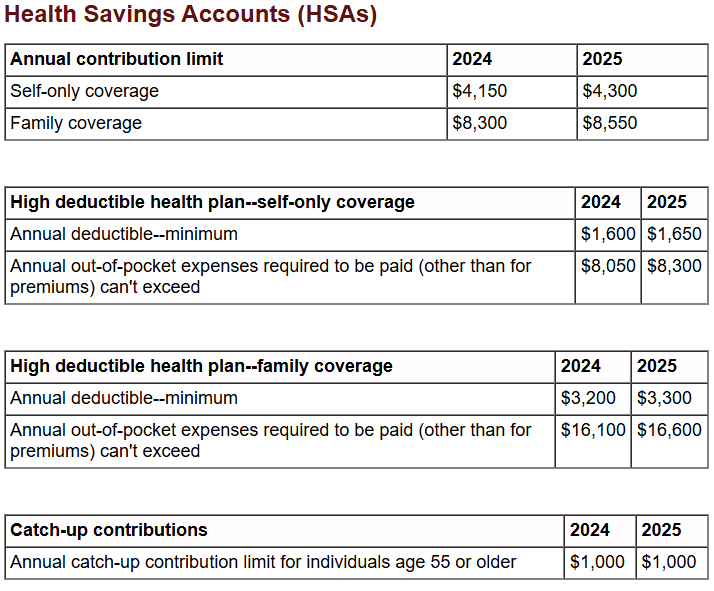

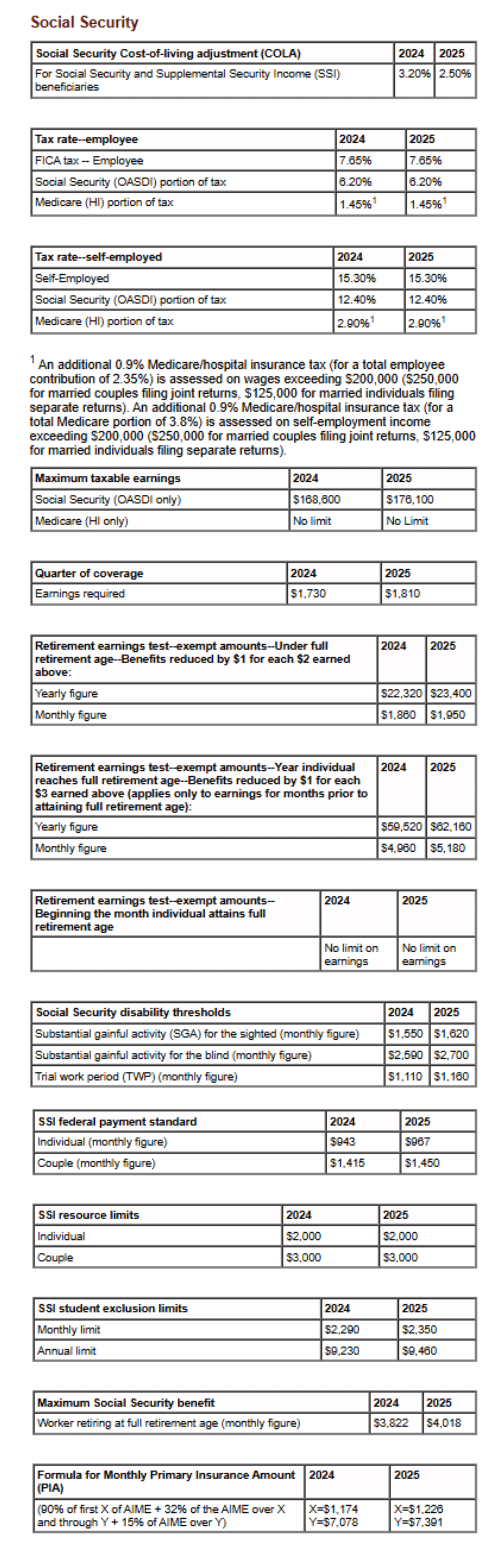

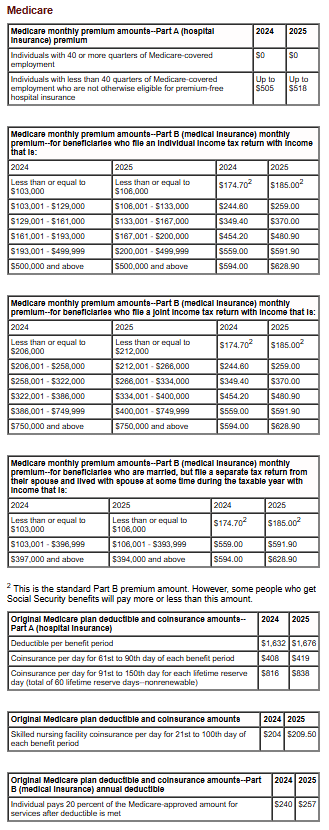

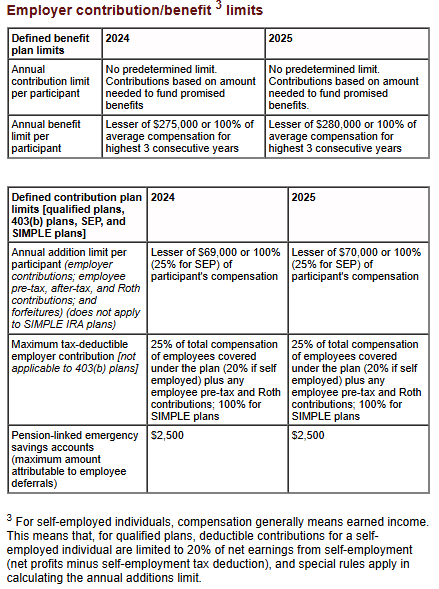

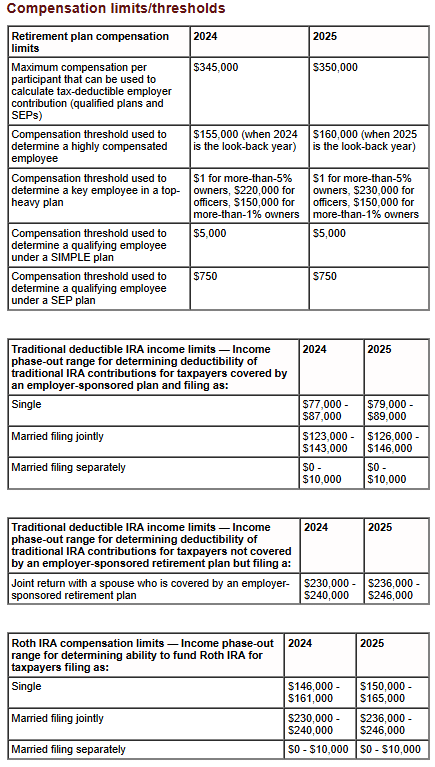

Download a simplified version of these key numbers below.

Individual Income Tax Planning

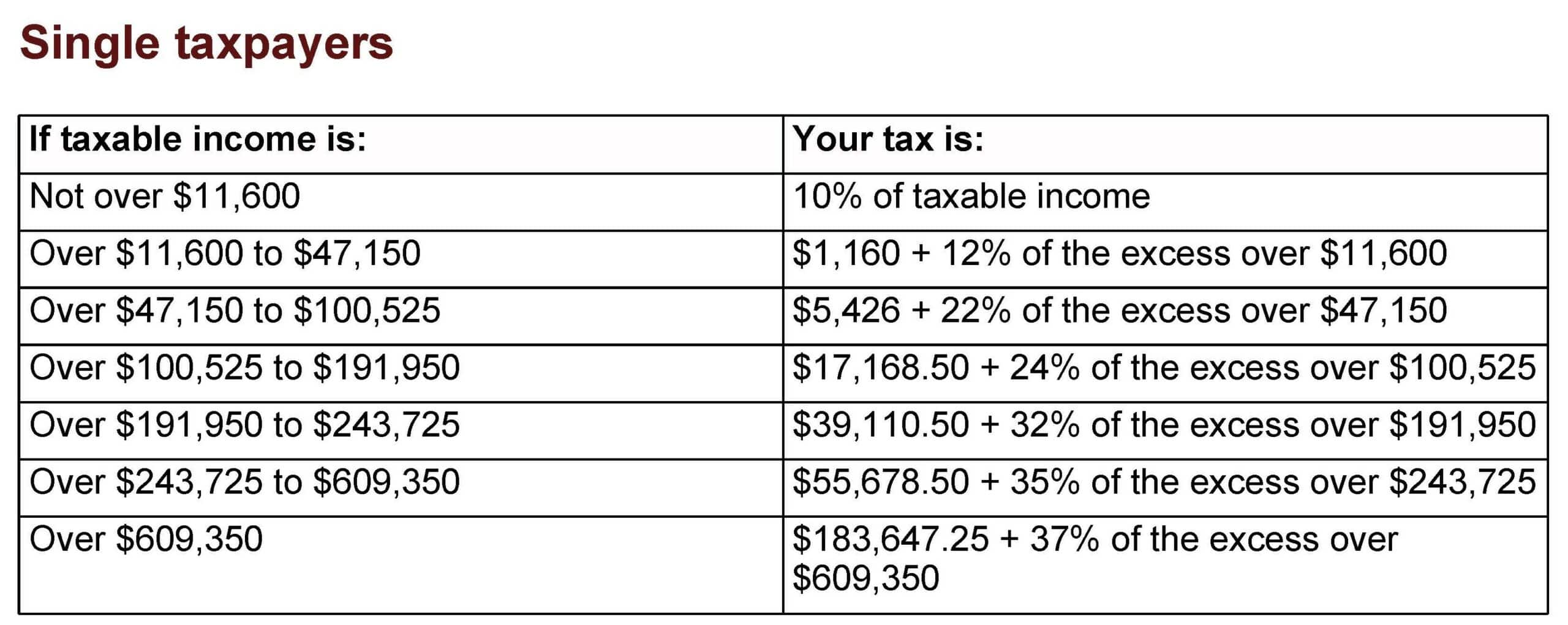

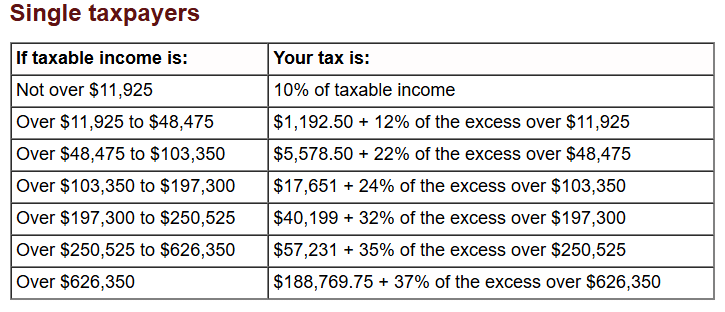

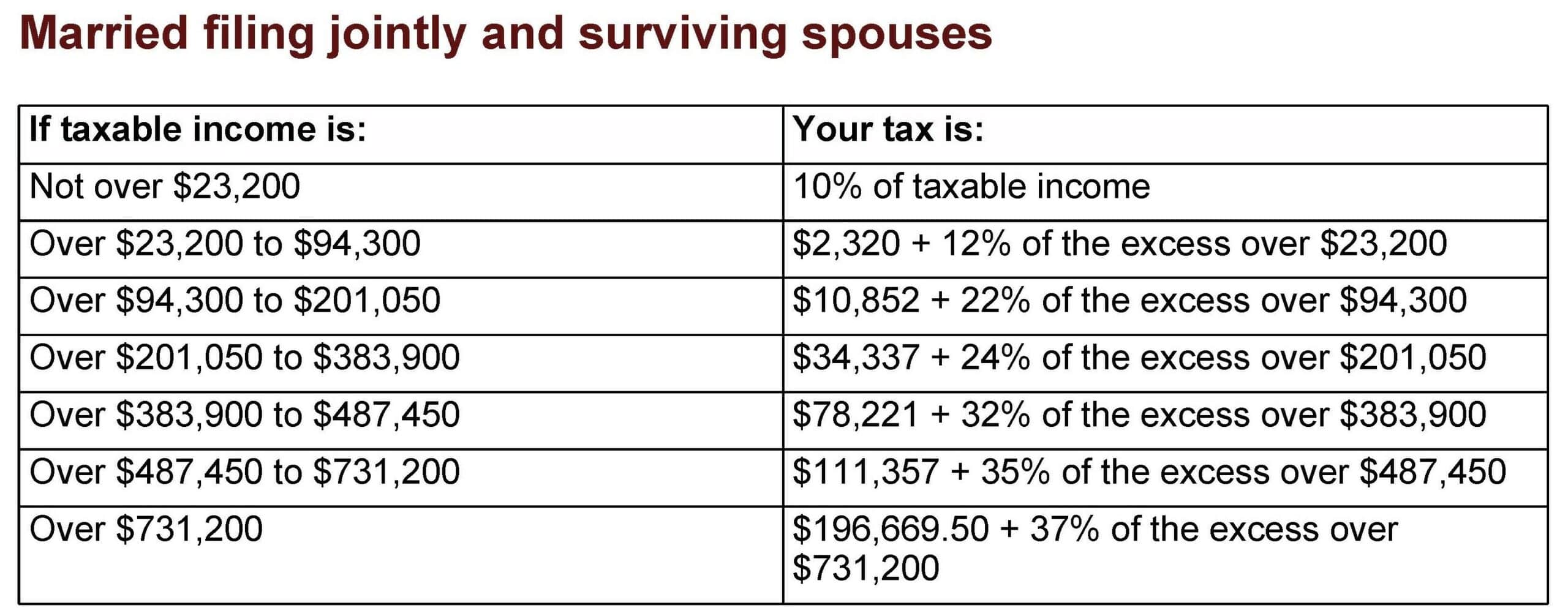

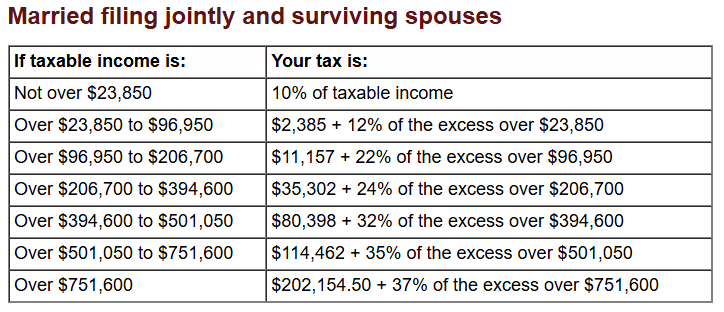

Federal Income Tax Rate Schedules

(Individuals, Trusts, and Estates)

- 2024 Single Taxpayers

- 2025 Single Taxpayers

- 2024 Married Filing Jointly And Surviving Spouses

- 2025 Married Filing Jointly And Surviving Spouses

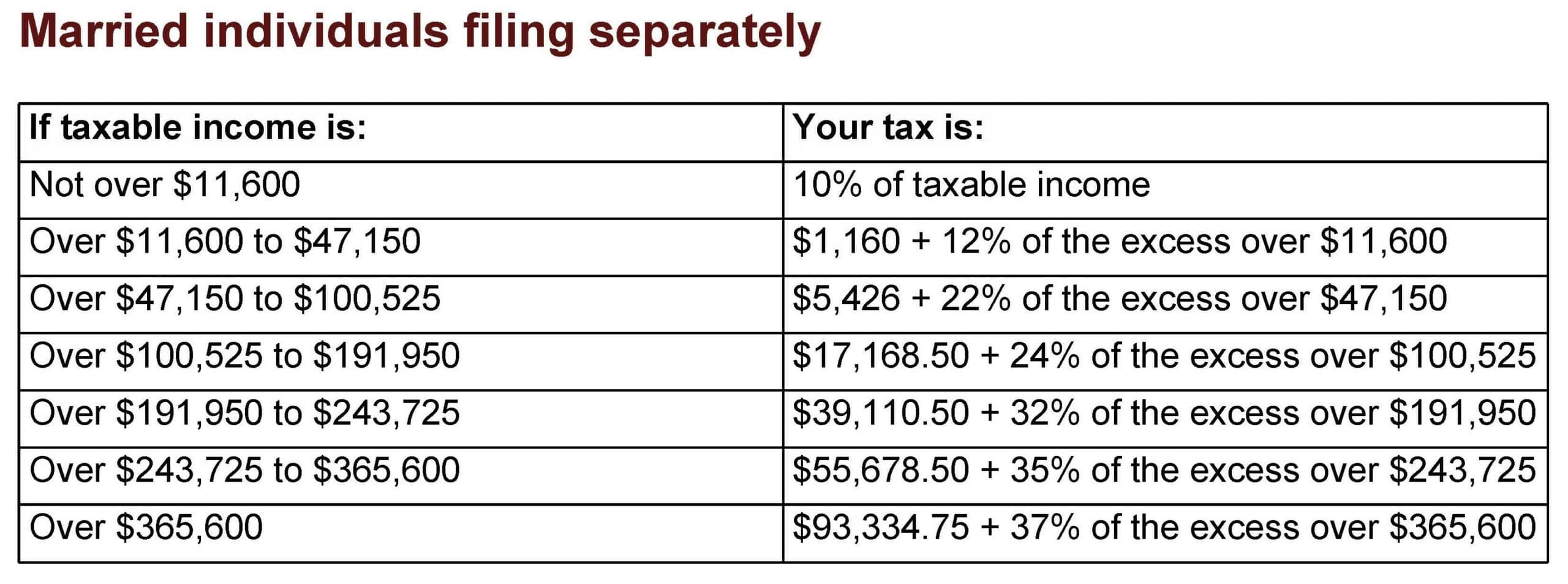

- 2024 Married Individuals Filing Separately

- 2025 Married Individuals Filing Separately

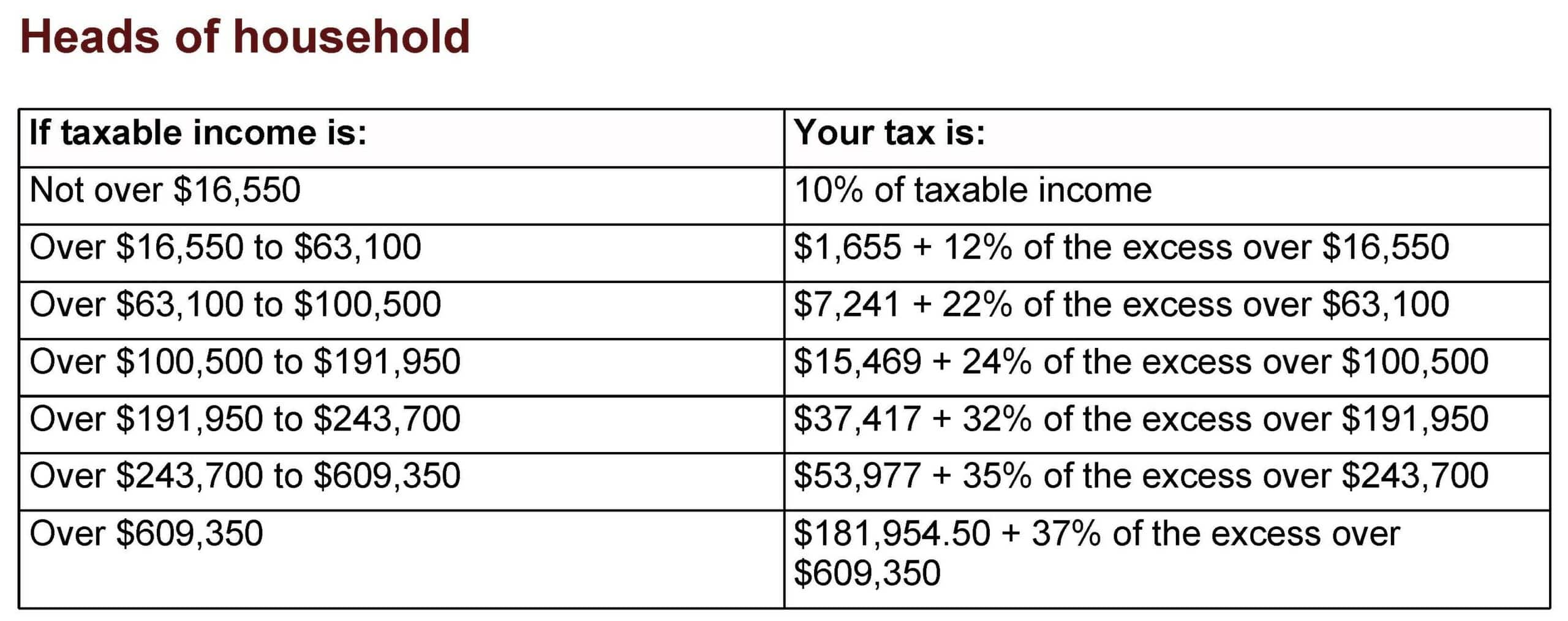

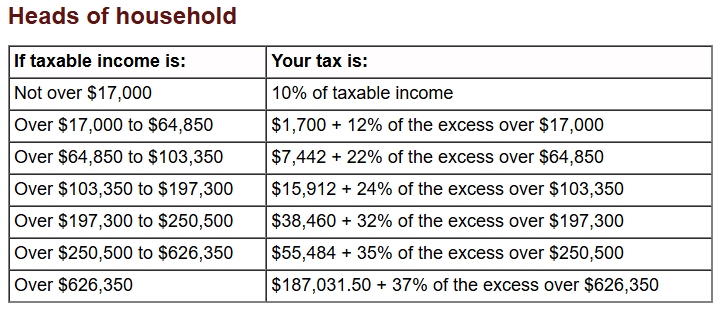

- 2024 Heads of Household

- 2025 Heads of Household

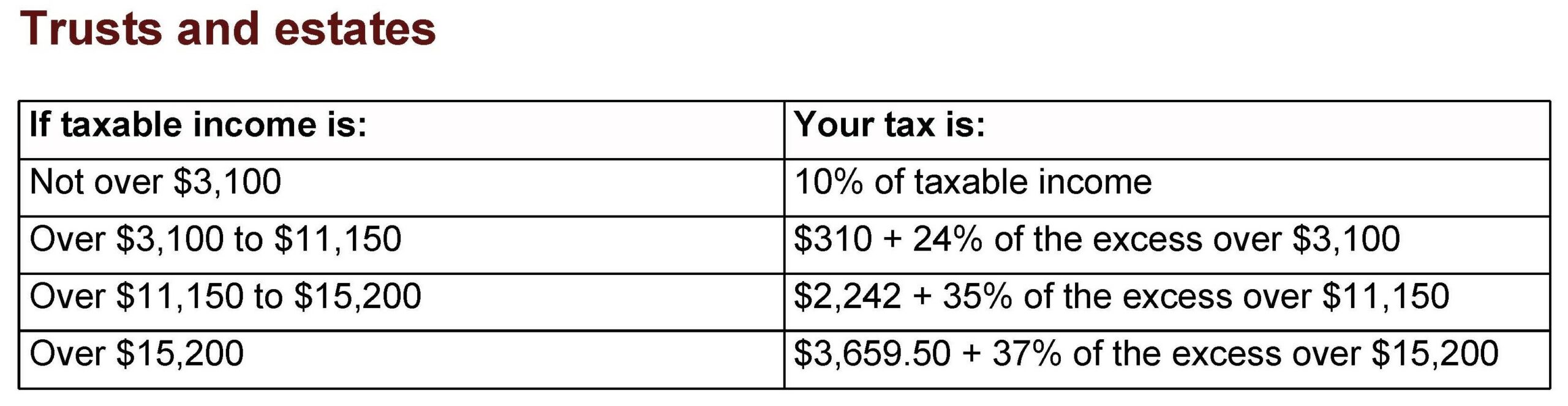

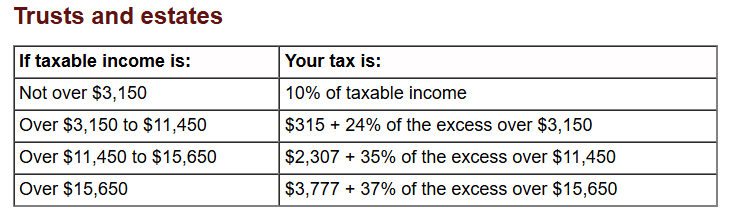

- 2024 Trusts And Estates

- 2025 Trusts And Estates

Business Planning

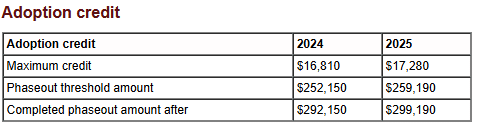

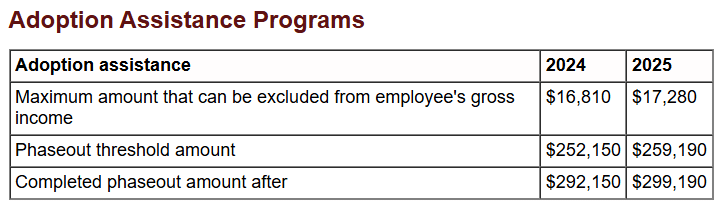

- Adoption Assistance Programs

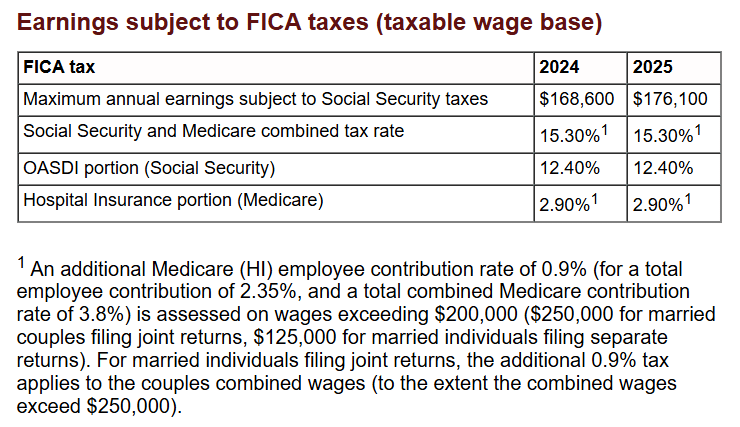

- Earnings Subject to FICA Taxes (Taxable Wage Base)

- Health Insurance Deduction for Self-Employed

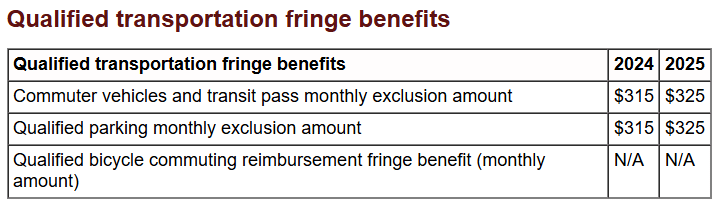

- Qualified Transportation Fringe Benefits

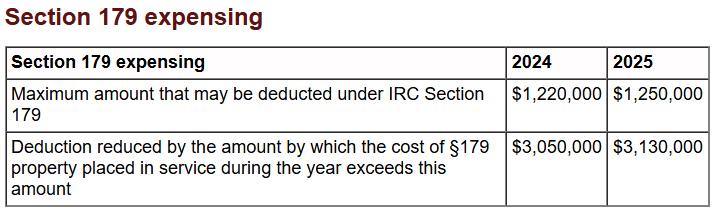

- Section 179 Expensing

- Small Business Tax Credit for Providing Health-Care Coverage

- Special Additional First-Year Depreciation Allowance

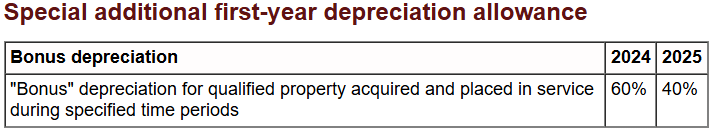

- Standard Mileage Rate (Per Mile)

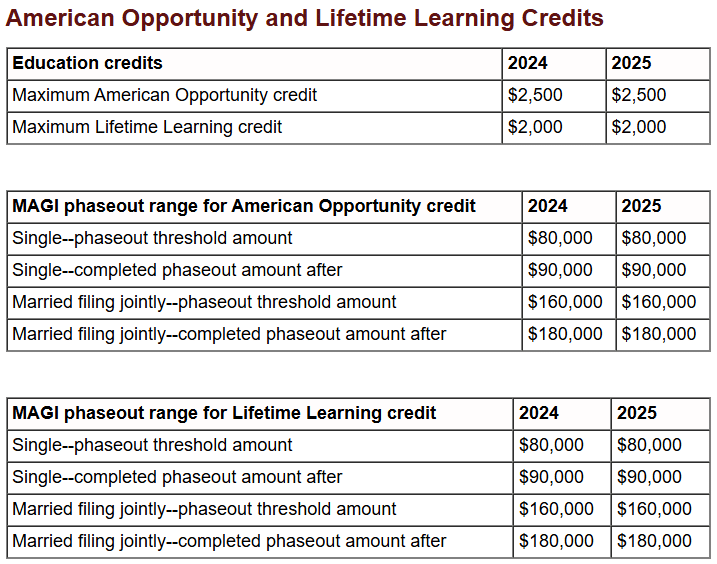

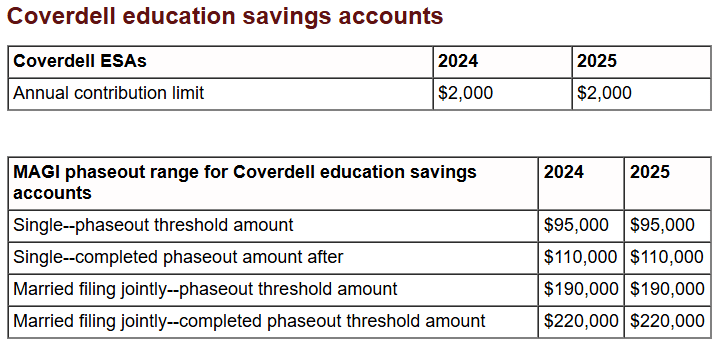

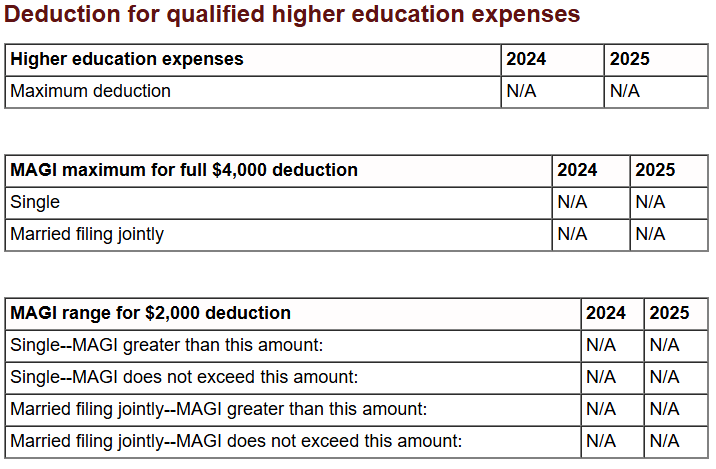

Education Planning

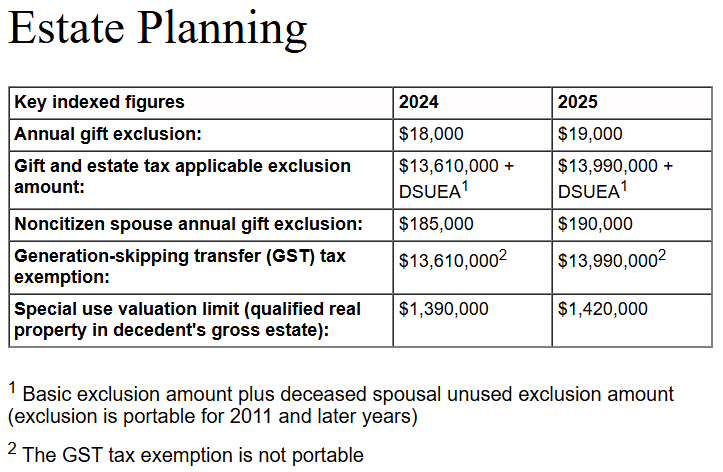

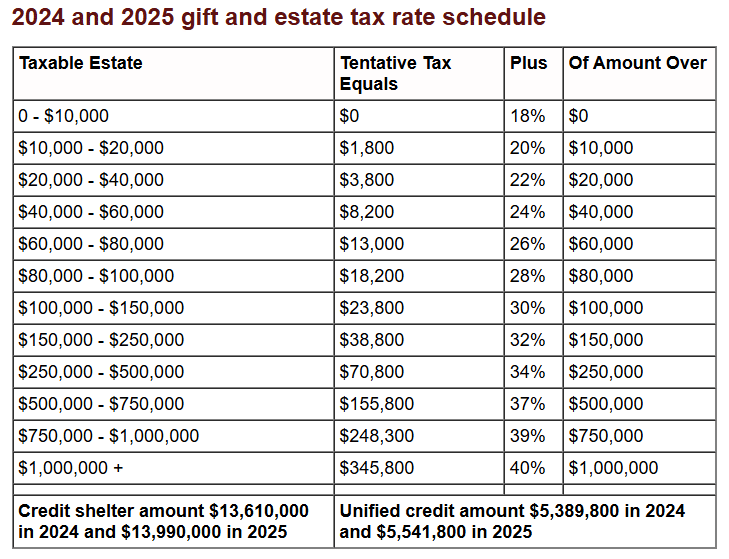

Estate Planning

Investment Planning

Retirement Planning

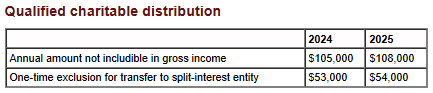

LPL Financial Tax Information

Corrected Forms Information

Corrected Forms

Even with our weekly mailing schedule, further delayed reporting and reclassification can

sometimes occur, resulting in clients receiving corrected 1099 forms. Some examples

include:

- Mutual funds revise their financials to include the amount of gross-ups for foreign

withholding, tax-exempt payments subject to alternative minimum tax, and the portion of

the distributions derived from U.S. Treasury obligations - After year-end auditing, real estate investment trusts determine depreciation and other

deductions reduce earnings so that distributions are changed from income

to return of capital - Any corrections to cost basis

Because brokers are required by the IRS to amend any 1099 tax form that has an

adjustment greater than $100, you may receive an amended 1099 tax form after March 15.

An income reclassification announcement could prompt an amended 1099 at any point

during the year. However, income reclassification events typically occur less frequently

after March.

If you need to file an amended tax return, it’s recommended you discuss the situation with

your tax advisor prior to refiling so they can determine the best course of action based on

your individual circumstances.

If you need to request a corrected tax form, please contact your financial professional.

How do I view Preliminary 1099 in my LPL Financial Account View?

Account View from LPL Financial gives you online access to your accounts, statements, and secure documents. This online access is also where you can change your preference for paper notices to electronic, change beneficiary information on your accounts, can set up contributions or withdrawals to your individual or joint nonqualified accounts (retirement contributions and withdrawal setup require communication with Scarlet Oak directly), upload documents to us in a secure and encrypted manner, receive tax documents and much more.

- Sign into your Account View online account. If you haven’t set up an Account View account, please contact Teresa at [email protected] or 871.1219 Ext 2.

- From the Account View profile, select the Documents & Statements tab.

- In Documents & Settings, select Tax Forms. Note: Ensure the correct tax year is selected.

- Click the hyperlink “LPL 1099 Prelim” to access the tax statement.

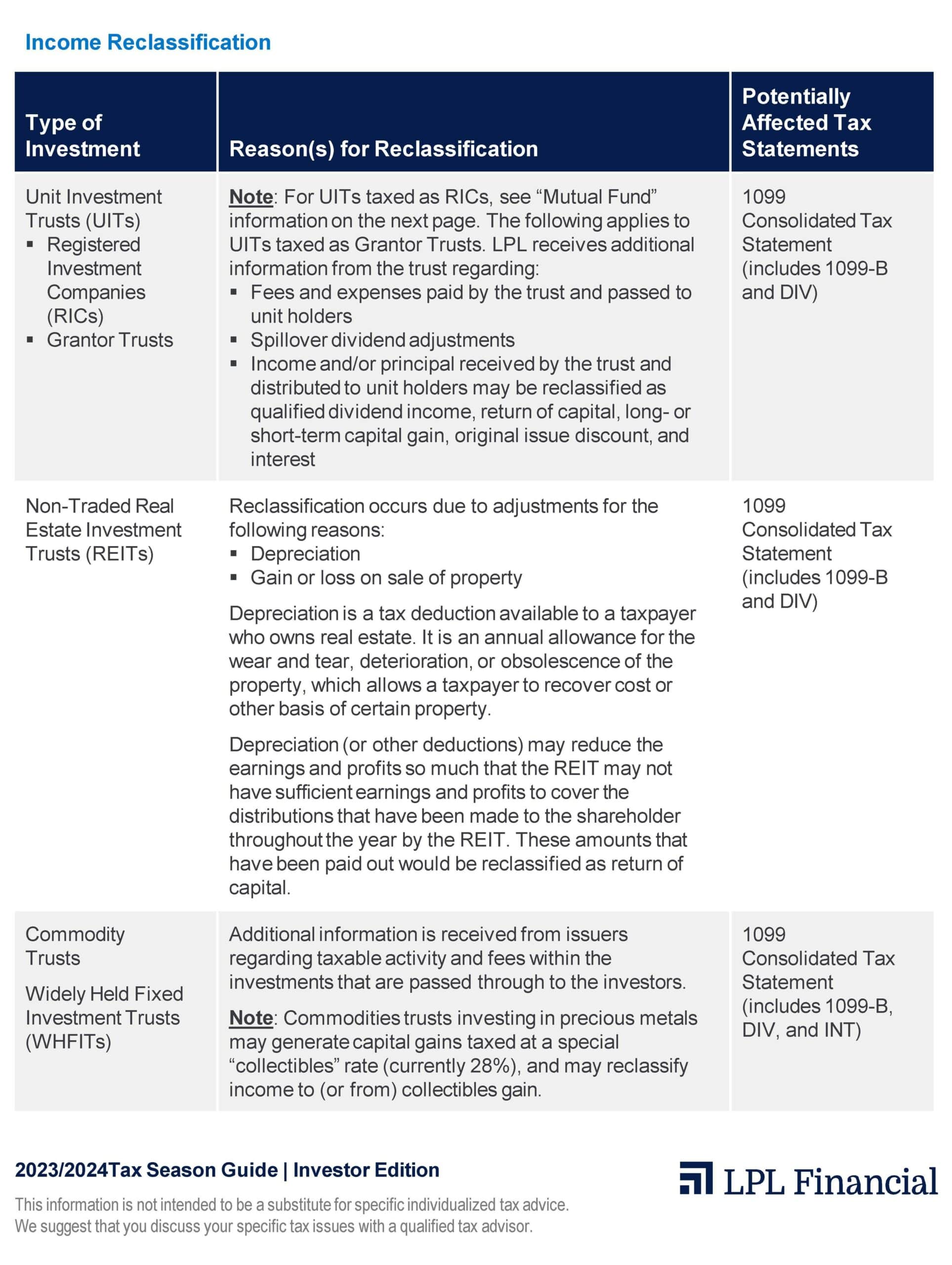

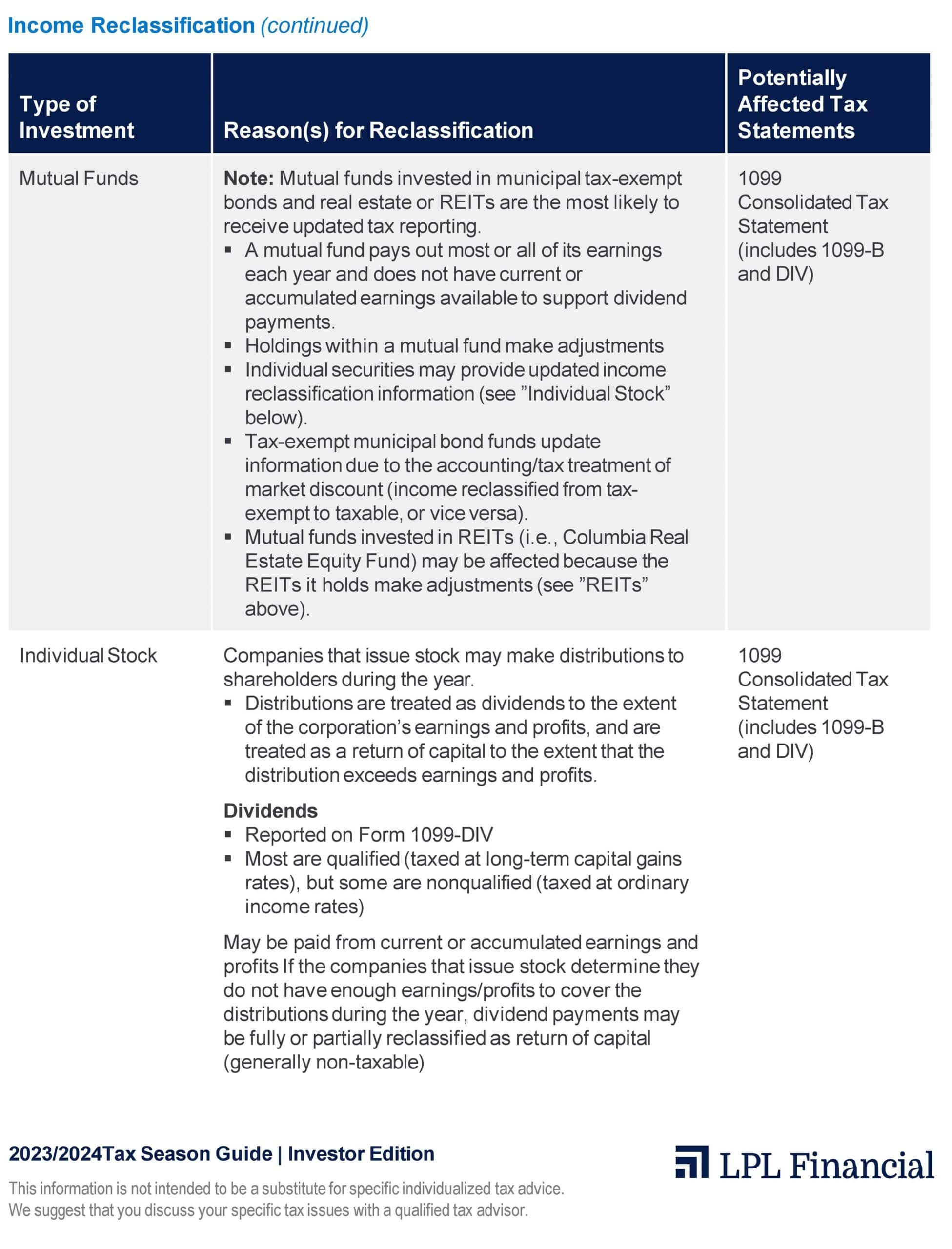

Income Reclassification

What is income reclassification?

Income reclassification is an annual process where security issuers change the tax characterization of distributions that were paid during the tax year. Often, the result of income reclassification is a more favorable tax treatment.

When does income reclassification occur?

The income reclassification process takes place after the end of the tax year, during the first quarter, when security issuers announce their income reclassification for the previous tax year.

How does income reclassification impact my tax statements?

The income reclassification process affects income distributions you may have received during the previous tax year. The IRS requires final income reclassification to be reported to you on Form 1099.

Example: An investor receives a $200 distribution from XYZ Fund on July 1. At the time of the distribution, XYZ Fund characterizes the distribution as a nonqualified dividend. After the end of the year, XYZ Fund announces that the distribution is actually composed of 50% qualified dividend and 50% return of capital; and, your 1099 is amended to reflect the current tax characterization of the distribution.

Which investment types are likely to reclassify each year?

Registered investment companies (RICs), commonly referred to as mutual funds and REITs, are pass-through vehicles for tax reporting purposes. As such, the tax character of distributions made by these investments is more likely to change at the conclusion of the year than, for example, an equity that pays dividends from current or retained earnings. Additionally, mutual funds must determine the amount of gross-ups for foreign with tax-exempt payments subject to alternative minimum tax, and the portion of the distributions derived from U.S. Treasury obligations.

The table below provides an explanation of why certain investments are more likely to experience income reclassifications and the tax statements that may be impacted. The investment types are listed in the order most likely to receive corrected tax statements due to reclassification.

All Mortgage-Backed Income Reporting (AMBIR) Information

All Mortgage-Backed Income Reporting (AMBIR) Information

Information for tax year 2024, AMBIR reporting will be included within the 1099 Consolidated Tax Statement. REMICs and mortgage pools have a reporting deadline of March 15. As a result, LPL will extend the mailing date of original 1099 Consolidated Tax Statements until March 15 for clients who hold particular types of investments. If you invested in any of the securities listed below, the original 1099 Consolidated Tax Statement will be mailed by March 15, 2025.

- Unit investment trusts organized as grantor trusts

- Royalty trusts

- Commodity trusts

- Holding company depositary receipt trusts

- Mortgage-backed pass-through pools

Filing Extensions

How to know if you should file an extension?

It’s always a good idea for you to maintain an open line of communication with your financial professional and your tax advisor throughout the year to ensure the best tax strategy and outcomes for you. This dialogue will help you decide if filing an extension is the best course of action. There are many reasons why filing an extension might make sense for you. For example, the volume of data or complexity of certain transactions inside or outside your account may require additional time to address. Also, if you’re expecting to receive your 1099 in the third or fourth mailing wave in March, it may be reasonable to consider filing an extension to allow sufficient time for your tax advisor to accurately complete your tax return forms. LPL Financial does not have a method to verify in advance which mailing wave your account(s) will fall under.

What filing an extension accomplishes?

Filing an extension grants additional time (six months) to submit a complete and accurate tax return. However, you’ll still need to estimate whether you’ll owe any taxes and pay that estimated balance by April 15. Extending the return allows you and your tax advisor more time to prepare and ensure filing of an accurate tax return. In many cases, you may still be waiting for additional information, such as your Schedule K-1 or corrected 1099s, to complete your tax return.

Benefits of extending a tax return

Filing an extension allows additional time to file returns without penalty when you’re waiting for missing information or tax documents (such as corrected 1099s).

Please remember: An extension provides additional time to file, but not additional time to pay. Penalties may be assessed if sufficient payment is not remitted with the extension. It’s often less expensive (and easier) to file an extension rather than rushing to meet the deadline and having to amend the tax return later.

Extensions and Audits

Extending will not increase the likelihood of being audited by the IRS. It’s better to file an extension rather than to file a return that’s incomplete or doesn’t give you adequate time to review carefully before signing.

Should I do anything differently if I’m filing an extension?

No, you should give your tax advisor whatever information you have as early as possible or as soon as it becomes available. You should expect to pay any anticipated taxes owed by April 15.

If you’re required to make quarterly estimated tax payments, your first quarter estimated tax payment is still due April 15. Your tax advisor may recommend that you pay the balance due for last year and your first quarter estimated tax payment for this year with the extension.

If you’re anticipating a large refund, your tax advisor will likely try to get the extended return done as soon as possible once all tax information is available. Your tax advisor may also want to discuss tax planning opportunities with you so that in future years, you don’t give the IRS an interest-free loan!

For more information on filing extensions, please visit www.irs.gov.

LPL Financial 1099s

What is a Preliminary 1099-Consolidated Tax Information Statement?

A preliminary 1099-Consolidated Tax Information Statement is an advanced draft copy of your 1099-Consolidated tax forms.

Can I use the preliminary 1099-Consolidated Tax Information Statement to file my taxes?

No, this draft form should NOT be considered final and should NOT be used for the purpose of filing tax returns with the IRS or with any state or other regulatory authority. All pages of this document are for informational purposes only and may assist you with tax preparation.

Even though this is a preliminary 1099 Consolidated Tax Statement, is this information final?

No, your 1099 Tax Information Statement is not finalized because your account holds certain securities that are subject to income reclassification and/or subject to special reporting requirements.

Before your statementcan be finalized, additional tax reporting information is required from these securities and has not yet been provided by the issuers of these securities.

When will the preliminary 1099 Consolidated Tax Statement be available?

January 17, 24 & 31: Accounts with the simplest tax information and not subject to income reclassification

February 7 & 14: Accounts holding more complex securities, for which issuers provided final tax information after January 24

February 21, 28 & March 7: Accounts where security issuers did not further tax information to LPL in time for the Anticipated mailing date

Will the preliminary 1099C Consolidated Tax Statement be mailed?

No, the preliminary 1099C Consolidated Tax Statement will not be mailed.

Will the preliminary 1099C tax form be viewable on a 3rd party tax accounting site?

No, not at this time.

Will I receive a preliminary tax statement for any other tax forms?

No, preliminary tax statements are ONLY available for 1099C Consolidated Tax Statement.

How will I know which document is the preliminary 1099C Consolidated Tax Statement in AccountView?

The preliminary tax statements will be watermarked with the message “Preliminary- Do not use for tax return.”

Why did I receive a 1099 Consolidated Tax Statement this year?

You received a 1099 this year because you received more than $10 in taxable income this year in the form of dividend income, interest income, or proceeds from share sales income.

Didn’t I previously receive my 1099-C forms at the end of January? Why did it change?

In the fall of 2008, the IRS recognized there wasn’t sufficient time to make the necessary changes, verify the data, print the forms, and mail them by January 31, so the IRS filing deadline was changed from January 31 to February 15. Additionally, many brokers, including LPL also request a 30-day filing extension which extends the filing date to March 15. However, for clients with the simplest holdings, LPL Financial will mail your 1099 Consolidated Tax Statement shortly after data is finalized, often before March 15.

Can I download my tax data to TurboTax®?

If you use TurboTax or H&R Block, you’ll be able to import the information shown on your original or corrected 1099 tax information statement directly into the software. To upload your tax data into the software, you’ll need your full 8-digit LPL account and 11-digit Document ID listed on your tax statement. Forms will be available for download once your tax statement is available. We recommend you wait to download your tax statements until you have received all tax statements in the mail.

For technical questions, please contact Intuit TurboTax® or visit http://turbotax.intuit.com/support/.

If you use TurboTax® or H&R Block, you’ll be able to import the below information shown

on your original or corrected 1099 Tax Information Statement directly into the software.

Specific statement information available for download includes:

• 1099-DIV: Dividends and Distributions

• 1099-INT: Interest Income

• 1099-MISC: Miscellaneous Income, except for Line 3 (other income)

• 1099-B: Proceeds from Broker and Barter Exchange Transactions

• 1099-OID: Original Issue Discount

• 1099-R

Specific statement information NOT available for download includes:

• 1099-Q

• 5498-IRA

• 5498-ESA

Forms will be available for download once all of the forms for your account(s) are

available. We recommend you wait to download your tax statements until you have

received all tax statements in the mail and/or access electronically to compare the data

and ensure the TurboTax and/or H&R Block download is complete and accurate.

Will I be able to import the cost basis information from the Realized Gains and Losses statement from Account View into TurboTax® and/or H&R Block?

No. The cost basis data is imported into TurboTax® from your 1099 Consolidated tax statement. To ensure accuracy, compare the data imported into TurboTax® to data shown on your 1099 Consolidated Tax Statement.

Required Minimum Distributions

RMD Helpful Information

Required minimum distributions (RMDs) are minimum amounts a retirement plan account owner must withdraw annually starting with the year they reach age 73; or later for employer-sponsored plans where participants are allowed to defer RMDs until the year in which the participant retires or separates from service.

Important information regarding required minimum distributions from your IRA

Secure Act 2.0 Change: Required Minimum Distributions (RDMs) need to start at 70 1/2 if you were born before 7/1/49; 72 if you were born on or after 7/1/49 or in 1950; 73 if born between 1951 and 1958; 75 if born in 1960 or later. If you were born in 1959, federal guidance is needed to determine if your Required Beginning Date is age 73 or 75.

Are there deadlines for taking your RMD each year?

You must satisfy your RMD by December 31 of each year. There’s an IRS provision that applies to the first year in which you must take out a RMD, where the IRS provides you with the option to defer your first RMD to be taken by April 1 of the following year.

For example, you turned age 73 in 2025 and are now required by the IRS to take a RMD. You have the option of deferring your first RMD until April 1 of 2026 instead of taking it by December 31 of 2025. If you choose to postpone your first RMD withdrawal to April 1 of 2026, then you will have to take out a second RMD by December 31 of 2026. Deferring your first RMD will result in you taking two RMD withdrawals within the same tax year, which could potentially cause a taxable issue for you. We recommend that you consult with a tax professional before implementing this strategy.

How much do I need to take out of my IRA?

Your RMD is calculated by dividing the market value of your IRA as of December 31 of the prior year by your life expectancy factor taken from the IRS’s Uniform Lifetime Table. If you have multiple IRAs, you must calculate your RMD separately for each one, but you may combine your RMD amounts and take a distribution from one IRA or across several IRA accounts (excluding inherited IRAs). Your quarterly statements from LPL include a section specific to your RMD to help you track your year-to-date distributions.

You should receive an RMD calculation from the Scarlet Oak Financial Service team at the beginning of the year. Please get in touch with Melinda at [email protected] or 800.871.1219 Ext 1 with any questions about this communication or your RMD. We encourage you to meet with your financial professional or tax advisor to evaluate your individual situation and help you make an informed decision about your IRAs and your RMDs.

What action is required on my part?

We cannot make distributions from your IRA without specific directions from you. If you don’t take your RMD in a timely manner, you may be subject to a 25% penalty assessed by the IRS on the amount you should have withdrawn.

You should receive an RMD calculation from the Scarlet Oak Financial Service team at the beginning of the year. Please get in touch with Melinda at [email protected] or 800.871.1219 Ext 1 about your RMD and withdrawal options.

How do I request my RMD?

If you have a pre-existing arrangement with your financial professional to meet your RMD, no further action should be required from you. Otherwise, contact Melinda at [email protected] or 800.871.1219 Ext 1, and she can help you determine the best method to meet your specific needs and assist you with setting up your RMD withdrawal.

I’m older than 70½, can I still make a contribution to my IRA?

Due to the tax law changes contained in the SECURE Act which became effective on January 1, 2020, there is no age limit for making regular contributions to a traditional or Roth IRA.

Where can I obtain additional information about RMD requirements?

Contact Melinda at [email protected] or 800.871.1219 Ext 1, and she can help you with your RMD information.

Return of Excess and Recharacterization Deadline

What happens if I over-contributed to a retirement account or contributed to the wrong account?

If an error with a contribution has occurred, please immediately contact Melinda at [email protected] or 800.871.1219 Ext 1.

If you over-contribute or erroneously contribute to your retirement account, there are processes you can use to resolve these mistakes. The IRS deadline for processing prior year return of excess and recharacterizations is the tax return due date for the tax year of the contribution (including extensions).

If you have excess contributions for 2024, there are several options available. If the 2024 excess contribution occurred between January 1, 2024, and April 15th, 2025, we can accept a letter of instruction or form CM100 asking LPL to change the reporting to a 2024 contribution. By changing the tax year of the contribution to 2024, you can leave the funds in the account as a current-year contribution or remove it by October 16, 2025.

In general, if the excess contributions for a year are not withdrawn by the date your return for the year is due (including extensions), you are subject to a 6% tax. You must pay the 6% tax each year on excess amounts that remain in your account at the end of your tax year.

Unfortunately, we cannot recharacterize any prior-year 2023 contributions after the deadline. Please discuss this with your tax professional before making any decisions.

Resolving Over-Contributions for 2024: If you have over-contributed to your retirement account, you may need to process a return of excess. To withdraw an excess contribution from an IRA, you need to complete the Move Money, IRA Distribution, Excess Contribution (CM108) form.

Gifting

How can I impact my current tax position through charitable giving?

Charitable giving is one way you can positively impact your current tax position. One way to maximize charitable giving is to gift stock or mutual funds rather than cash. When you decide to gift rather than sell long-term appreciated shares, you’ll potentially get to take a reduction for the full fair market value of shares and avoid tax on the long-term capital gain.

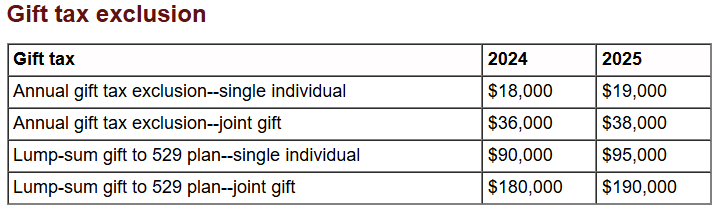

You also have the option of reducing your taxable estate by gifting up to $18,000 in 2024 ($19,000 in 2025) for single or $36,000 in 2024 ($38,000) for a couple without any tax ramifications to you or the recipients of the gift. This allows the beneficiary to benefit from the gift much sooner than if the inheritance was tied up in the estate until death.

Gifting Shares to Recipient at Another Financial Institution: To facilitate a year-end gifting request, we need to fill out the appropriate form to gift shares from your account to a third party as a charitable donation. The third party’s account must already be established at an eligible receiving institution. Signed instructions must be received no later than the first week of December of the year the deduction is wished to be taken in to ensure the gifting of shares takes place and settles in the desired account by year-end. Any requests received on or after the first week of December will be processed on a best-efforts basis.

Please note: Other types of gifting requests are due by the first day of November, so contact Scarlet Oak Financial Services as soon as possible to discuss the best option for your request. Gifting for 2024 must have been completed before January 1, 2025.

For additional questions about gifting and your investment accounts, please get in touch with Faye at [email protected] or 800.871.1219 Ext 3.

Tax Harvesting

What is tax harvesting?

Tax harvesting is defined as selling securities at a loss to offset a capital gains tax liability. Tax gain or loss harvesting is typically used to limit the recognition of short-term capital gains, which are normally taxed at higher federal income tax rates than long-term capital gains. For many investors, tax harvesting is the single most important tool for reducing taxes now and in the future. If properly applied, it can save you money in taxes and help diversify your portfolio. However, you shouldn’t take the decision to sell lightly, and you should carefully consider the timing of any sale. Properly and improperly timed sales can directly affect the overall return you receive from your investments. Consider working with your tax advisor to determine if tax harvesting is a good strategy this year.

For additional questions about tax harveting, please get in touch with Faye at [email protected] or 800.871.1219 Ext 3.

*There is no guarantee that a diversified portfolio will enhance the overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

Charles Schwab Tax Information

Source

When can I expect to receive my 1099 from Charles Schwab?

Schwab sends its 1099s in two waves. The first wave is typically sent out at the end of January, and the second wave goes out by mid-February. If you have more than one brokerage account, you’ll receive a 1099 Composite for each account you hold.

You’ll receive an email notification either when your 1099 Composite is available to view online or download from Schwab’s 1099 Dashboard, or when we’ve mailed you a paper copy. (This will depend on the delivery preferences you’ve set on schwab.com.) After we’ve produced your 1099 Composite, you can access it any time, either on schwab.com or the Schwab Mobile app.[1]

[1] https://www.schwab.com/learn/story/overview-brokerage-1099-tax-form#:~:text=When%20can%20I%20expect%20to,for%20each%20account%20you%20hold.

Broadridge Investor Communication Solutions, Inc. prepared Key Numbers and Tax tips for use by Scarlet Oak Financial Services. Broadridge Investor Communication Solutions, Inc. does not provide investment, tax, legal, or retirement advice or recommendations. The information presented here is not specific to any individual’s personal circumstances. To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on individual circumstances. Scarlet Oak Financial Services provides these materials for general information and educational purposes based upon publicly available information from sources believed to be reliable — we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

Custodial Account Holder Tax Information was sourced from LPL Financial and Charles Schwab. Scarlet Oak Financial Services presents the LPL Financial Tax Guide, LPL Financial Investor Guide, and Charles Schwab Tax Information with the best intentions, and the information is based on the latest available sources at the time of publication. However, it is crucial to note that the tax codes are dynamic and subject to rapid changes. The content of this report is meant for educational purposes only and should not be construed as tax or financial advice. LPL Financial and Charles Schwab do not provide tax advice. We suggest you consult with a tax-planning professional with regard to your personal circumstances.

Sources:

LPL End of Year Investor Guide 2023

Charles Schwab Tax Information

![Tax Center [2025]](https://scarletoakfs.com/wp-content/uploads/2024/01/Header-Blog-2025_Page_2.jpg)

![A piggy bank, an alarm clock, and wooden blocks that spell "TAX." Article title: Tax Center [2025]](https://scarletoakfs.com/wp-content/uploads/2024/01/Header-Blog-2025_Page_4.jpg)