Your credit score helps determine the interest rate and other costs you pay on a mortgage loan. Mortgage lenders don’t just pull one fico credit score but verify your fico score from each of the three credit bureaus: Equifax, Experian, and Transunion. A credit score is a rating of your past financial history- a risk score. It takes into consideration how you have used your credit in the past. Things like: have you paid your debts on time, not paid a debt at all (collections, tax liens, bankruptcies), how much of the credit available to you is being used, credit age, total accounts, and hard inquiries- these generally occur when a financial institution, such as a lender or credit card issuer, checks your credit when making a lending decision.

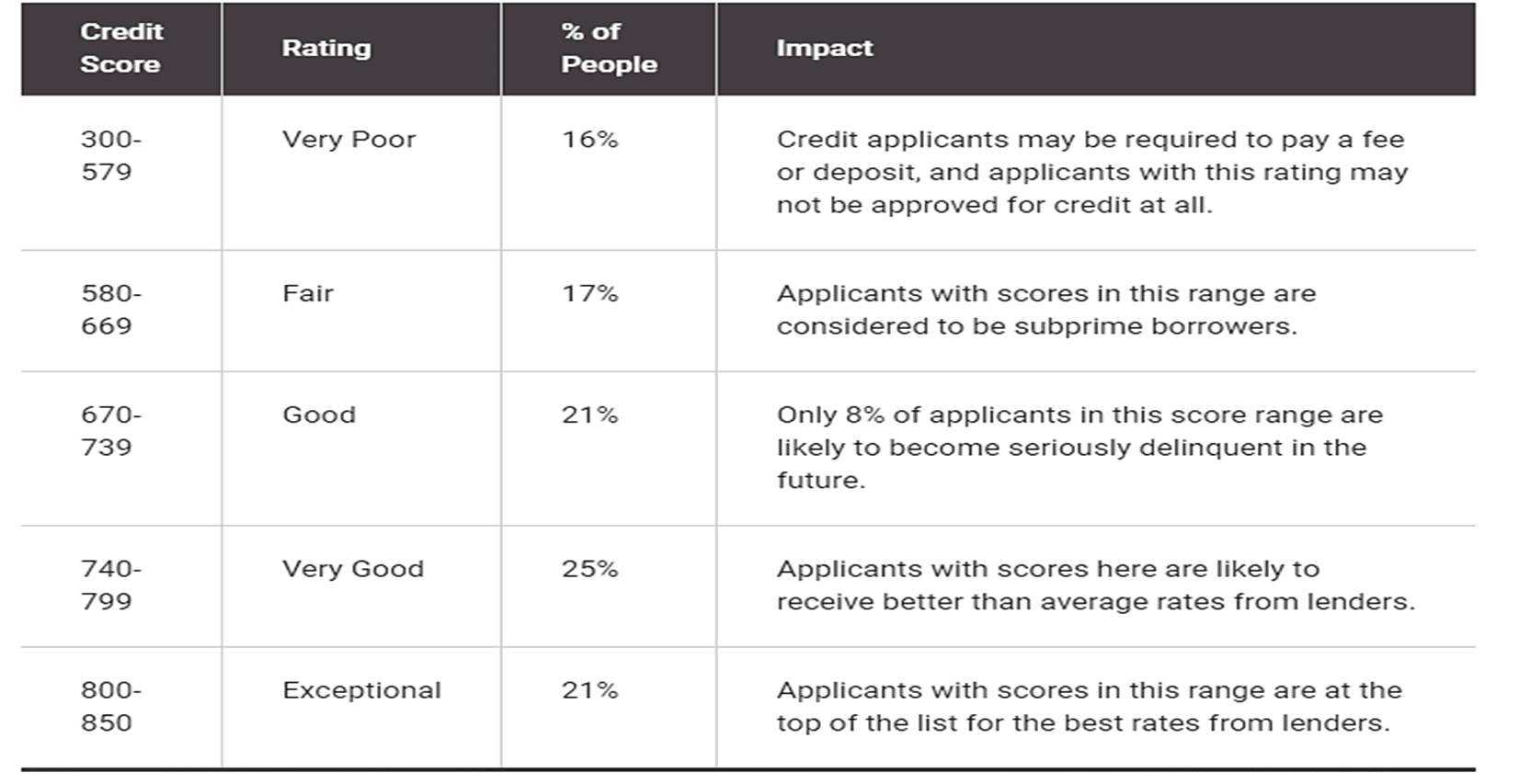

Your credit score is key for banks because they want to determine how likely you will pay back a loan. Banks ask the same questions you would ask if you were loaning money- did this person pay me back the last time he borrowed money? Did he pay me back the total amount? On-time? Your credit score is the track record for banks to make future lending decisions. There is a large range of scores with different impacts on buyer’s expenses in the short and long term.

Chart Source: https://www.experian.com/blogs/ask-experian/credit-education/score-basics/what-is-a-good-credit-score/

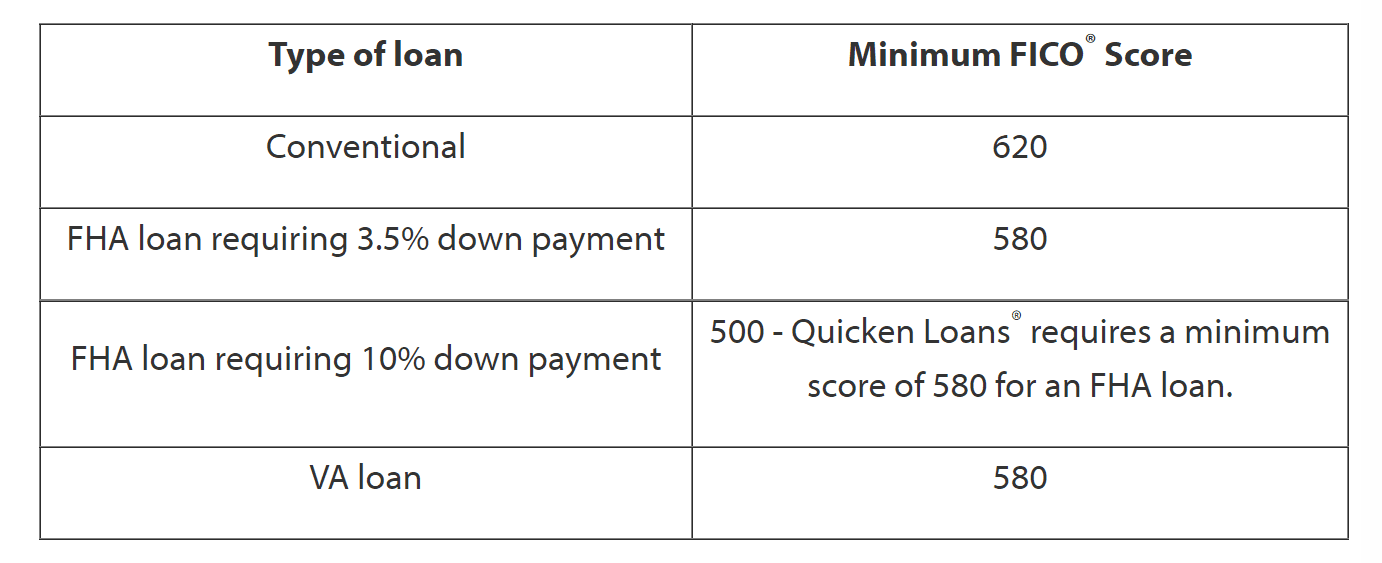

There are also minimum credit scores required for some loans even to qualify.

Chart Source:https://www.quickenloans.com/learn/credit-score-to-buy-a-house

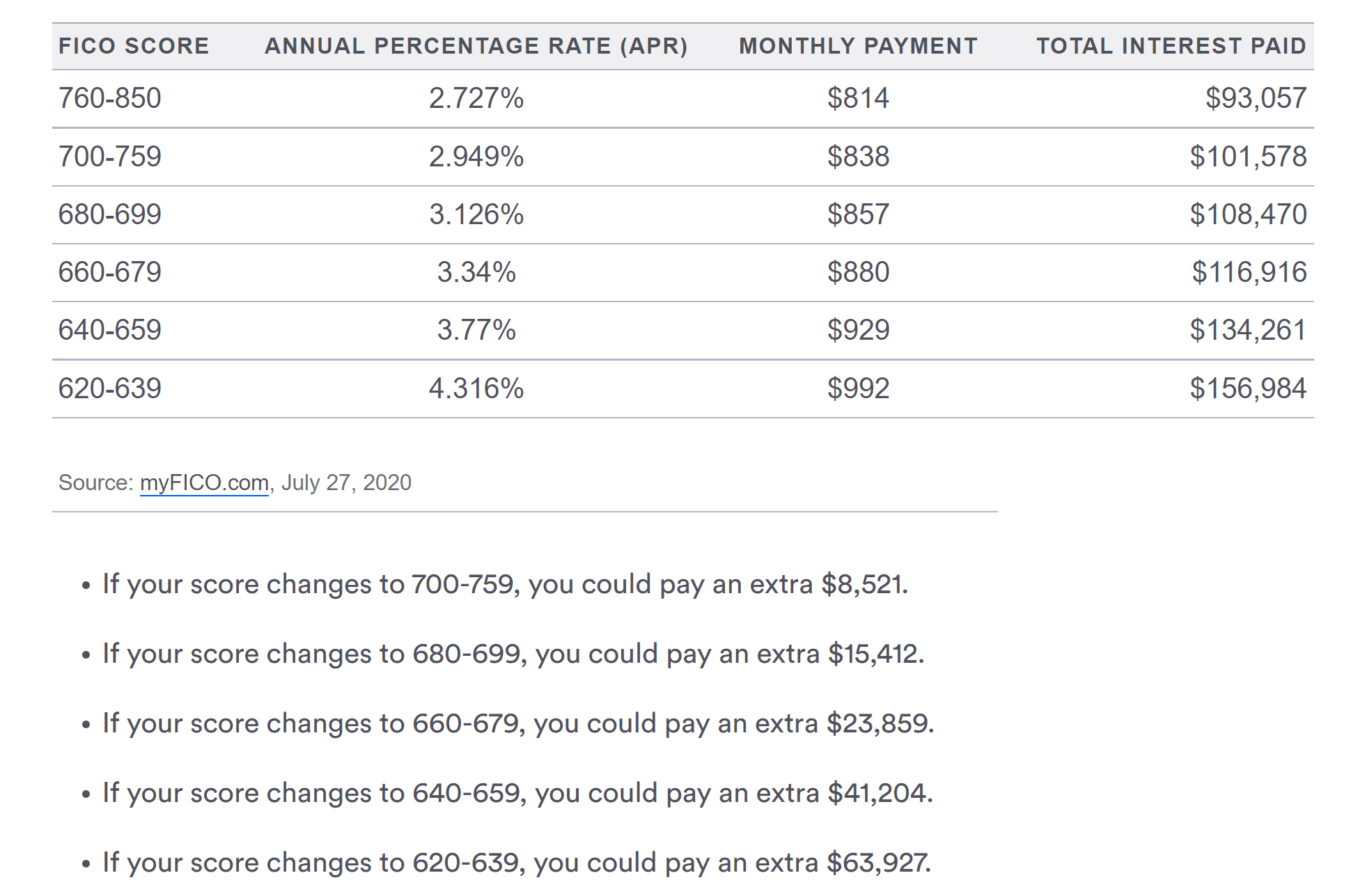

Chart Source:https://www.quickenloans.com/learn/credit-score-to-buy-a-house

The benefit of having a higher credit score is the long-term savings on the interest of the home and short-term savings on the monthly payments. Remember that even if you are not planning to stay in a home for the complete term of the loan, by having a lower interest rate, you are building equity faster because more of your monthly mortgage payment goes to the principle of the loan. Here are examples of the savings you can accrue by having a higher credit score.

These are based on national averages for a 30-year fixed loan of $200,000.

Chart Source: https://www.bankrate.com/mortgages/how-your-credit-score-affects-your-mortgage-rate/

Not sure what your score is? You can request a free copy of your credit report once each year at AnnualCreditReport.com or call toll-free at 1-877-322-8228. In addition, if you’d like a professional review of your finances before you start your home purchasing process, Scarlet Oak Financial Services can be reached at 800.871.1219 or contact us here.

Sources:

- https://www.wellsfargo.com/financial-education/credit-management/check-credit-score/

- https://loans.usnews.com/what-credit-score-do-you-need-to-buy-a-house

- https://www.credit.com/loans/mortgage-questions/check-your-credit-score-report-before-buying-home/

- https://www.creditkarma.com/advice/i/hard-credit-inquiries-and-soft-credit-inquiries/

- https://www.experian.com/blogs/ask-experian/credit-education/score-basics/what-is-a-good-credit-score/

- https://www.bankrate.com/calculators/mortgages/new-house-calculator.aspx

- https://www.experian.com/blogs/ask-experian/credit-education/improving-credit/improve-credit-score/

This material has been prepared for informational purposes.