A Traditional Individual Retirement Account (IRA) is a personal account that allows you to save for your retirement on top of employer sponsored plans like 401(k), 403(b), and 457 plans.

Key aspects of Traditional IRAs:

- They are a pre-tax investment account, meaning that the money you place in this account, you can deduct your taxes within the income limits, reducing your income for the year you put money in your IRA account.[1]

- With all investment accounts, you expose some or all your invested money to loss for the chance to earn a higher profit. Investment gains hinge on an ongoing and long-term investment strategy that uses your risk tolerance and diversification to mitigate some risks. Even with these in place, you are exposing your money to loss.[2]

- Traditional IRAs do not have the same level of creditor protection as employer-sponsored plans such as 401(k), 403(b), or 457 accounts. Employer plans are protected under ERISA and have unlimited federal creditor protection, while Traditional IRAs are protected only up to $1,512,350 in federal bankruptcy proceedings through March 31, 2025 (subject to adjustments every three years). Outside bankruptcy, protection varies by state law, and coverage can differ significantly. For individuals in higher-risk professions, understanding these differences may influence whether funds are kept in an employer plan, rolled into a Rollover IRA, or contributed directly to a Traditional IRA. [15]

- Investment options include individual stocks, mutual funds, ETFs, annuities, UITs, etc. Investment vehicles not allowed in IRAs are Life Insurance, types of Derivatives Positions, antiques/collectibles, personal real estate, and most coins.[4]

- Fees vary from institution to institution. It is crucial to understand how much you are paying in fees.

- Investment control is either by your chosen institution or advisor or can be self-directed. With this type of account, you must know your risk tolerance and diversification strategy. These are especially important if you are self-directed and need to make changes to your investments as you make changes to your life and risk tolerance. [1]

- The earliest you can take penalty-free withdrawals is 59 ½. However, there are some exemptions to the early withdrawal penalty- if you are permanently and totally disabled, if you have medical expenses that exceed 10% of your modified adjusted gross income, the cost for your medical insurance while you’re unemployed, your qualified higher education expenses, the amount to buy, build or rebuild a first home (up to $10,000), your withdrawal is in the form of an annuity, your withdrawal is a qualified reservist distribution, you’re the beneficiary of a deceased IRA owner, or the withdrawal is the result of an IRS levy.[5]

- Beginning in 2024, SECURE 2.0 allows an individual to withdraw up to $10,000 from their IRA without incurring the 10% early withdrawal penalty if the distribution is taken due to domestic abuse. The amount can be repaid to the IRA for up to three years, restoring the tax-advantaged treatment. This exception adds to the existing list of early withdrawal penalty exemptions available under IRS rules. [14]

Traditional IRA: SECURE Act 2.0 Required Minimum Distribution (RMD) Ages

Traditional IRAs must follow the federal RMD schedule established under the SECURE Act 2.0. The age at which RMDs begin is based on your birth year:

RMD Age by Birth Year

-

Born before July 1, 1949 → Age 70½

-

Born July 1, 1949 through 1950 → Age 72

-

Born 1951–1958 → Age 73

-

Born 1960 or later → Age 75

-

Born 1959 → Pending IRS clarification

(A technical drafting error in SECURE 2.0 created an overlap between ages 73 and 75. The IRS is expected to issue final guidance.)

- Rollovers into Traditional IRA can come from other pre-tax accounts such as SIMPLE IRA (after two years of being open), 401(k) accounts, 403(b) accounts, and 457(b) accounts.[7]

- Traditional IRAs are subject to the IRS one-per-year rule for 60-day IRA-to-IRA rollovers. If you take possession of the funds and redeposit them within 60 days, you can only perform one such rollover in a 12-month period across all your IRAs combined. This restriction does not apply to direct trustee-to-trustee transfers, and it does not apply to rollovers coming from employer-sponsored plans. Most investors use direct transfers instead, since they avoid withholding requirements and the one-per-year limitation. [13]

- You can convert funds from a traditional IRA to a Roth IRA. You will owe taxes on the converted money, but the funds will not be taxed at distribution, and Roth IRAs don’t have RMDs.[8],[9]

- If you make non-deductible contributions to a Traditional IRA, the IRS requires you to track the after-tax portion of your IRA using Form 8606. Traditional IRAs are treated as one combined account for tax purposes, so if you have multiple IRAs—Traditional, SEP, or SIMPLE—they are all aggregated when calculating the taxable and non-taxable portions of a distribution or Roth conversion. When you withdraw funds or convert to a Roth IRA, the IRS uses a pro-rata formula to determine how much of the amount comes from after-tax basis and how much comes from pre-tax amounts. Because of this rule, you cannot choose to convert only the after-tax money to a Roth IRA without including a proportional share of pre-tax funds. Understanding this rule is essential for anyone considering backdoor Roth contributions or taking distributions from IRAs that contain both pre-tax and after-tax money. [13]

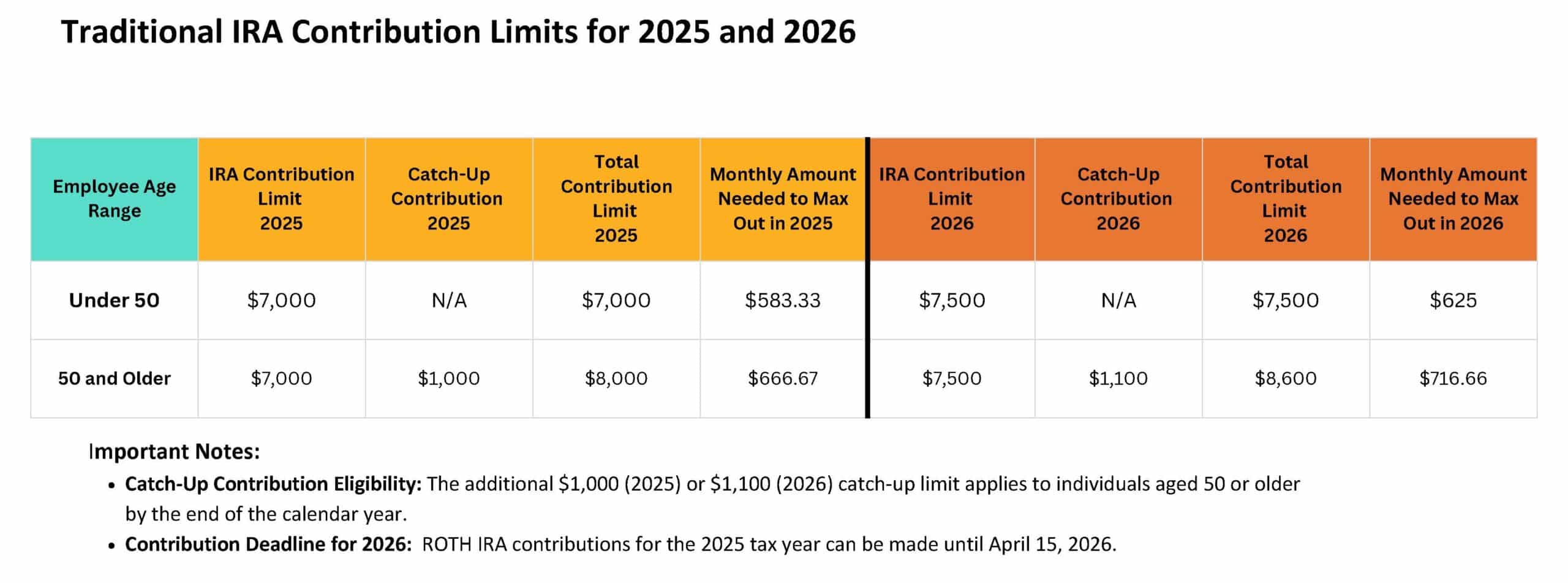

- If you have both a Traditional IRA and a Roth IRA, your total contribution limits for both accounts are $7,000 per year for those under 50 and $8,000 for those 50 and older.[10]

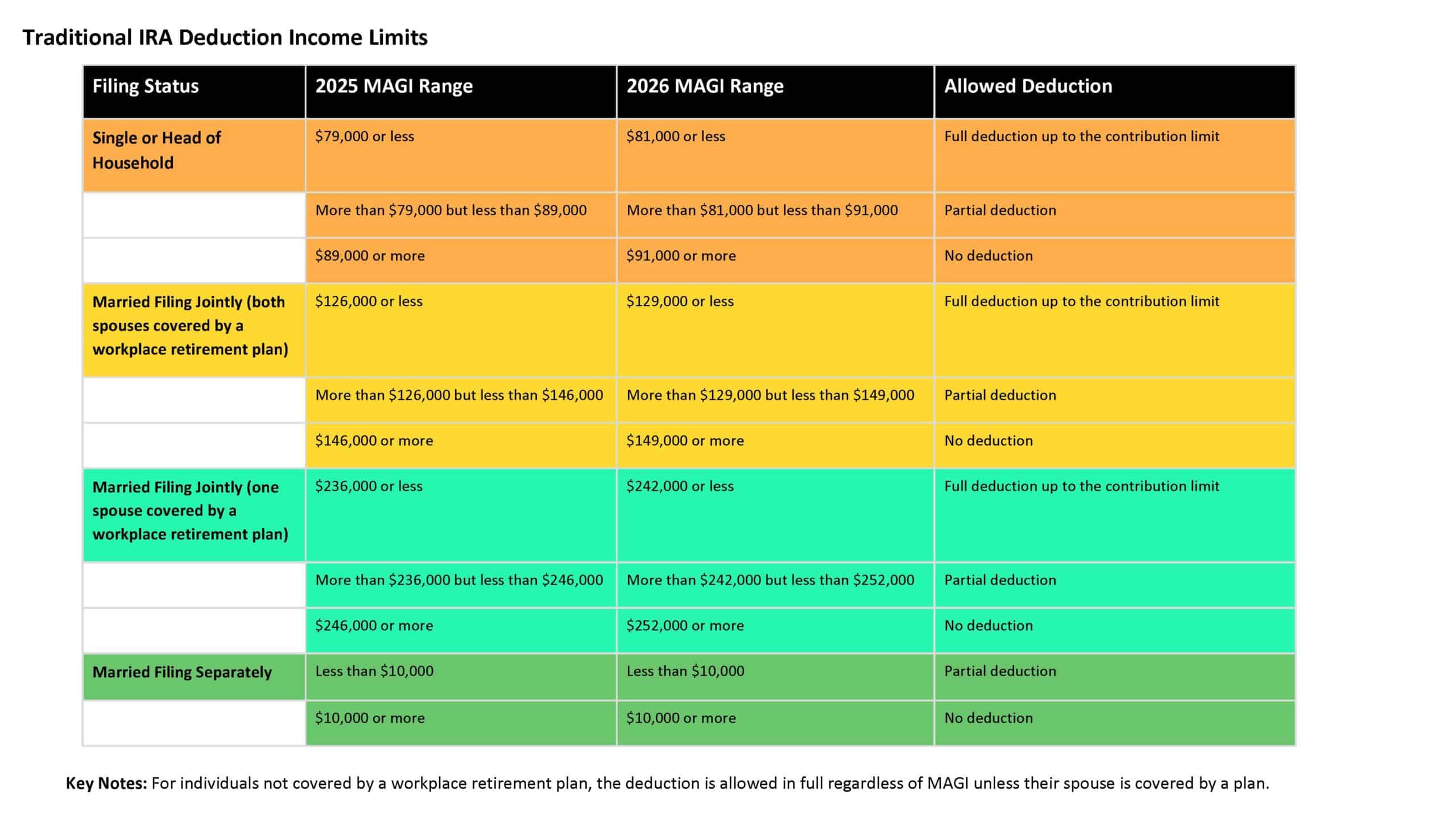

- There are no income limits to open and contribute to a Traditional IRA.1 But there are deduction income limits for individuals and spouses who also have an Employer Sponsored Retirement Plan at work, i.e., 401(k) plans, 403(b) plans, 457(b) plans, and an IRA.

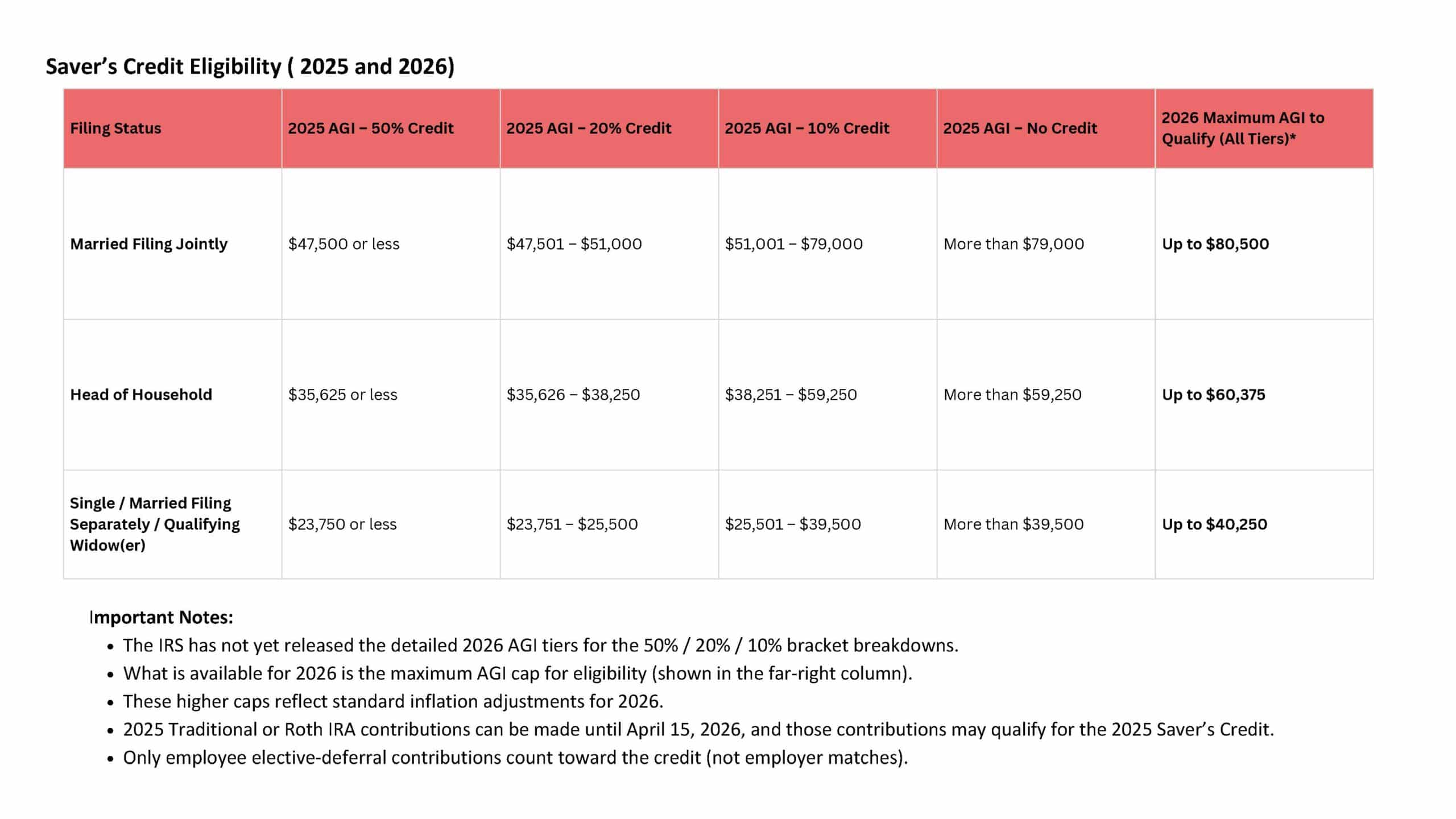

- Saver’s Credit (Retirement Savings Contributions Credit)

The Saver’s Credit provides a tax benefit for contributing to eligible retirement accounts, helping lower- and moderate-income earners boost their long-term savings.

If you would like to explore additional retirement investment accounts that could work for your goals, Scarlet Oak Financial Services can be reached at 800.871.1219, or you can contact us here. To sign up for our newsletter with the latest economic news, click here.

Sources:

[1] https://www.nerdwallet.com/article/investing/ira/what-is-a-traditional-ira

[2] https://www.investor.gov/sites/investorgov/files/2019-02/Saving-and-Investing.pdf

[3] https://www.irs.gov/newsroom/401k-limit-increases-to-23000-for-2024-ira-limit-rises-to-7000

[4] https://www.investopedia.com/articles/retirement/11/impermissable-retirement-investments.asp

[5] https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-tax-on-early-distributions

[6] https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-required-minimum-distributions-rmds

[7] https://www.irs.gov/pub/irs-tege/rollover_chart.pdf

[8] https://www.irs.gov/retirement-plans/plan-participant-employee/rollovers-of-retirement-plan-and-ira-distributions

[9] https://www.investopedia.com/roth-ira-conversion-rules-4770480

[10] https://www.investopedia.com/ask/answers/03/081503.asp

[11] https://www.irs.gov/newsroom/401k-limit-increases-to-23000-for-2024-ira-limit-rises-to-7000

[12] https://www.irs.gov/instructions/i8606

[13] https://www.irs.gov/publications/p590a

[14] https://www.irs.gov/pub/irs-drop/n-24-55.pdf

https://www.irs.gov/newsroom/401k-limit-increases-to-23500-for-2025-ira-limit-remains-7000

https://www.irs.gov/newsroom/401k-limit-increases-to-24500-for-2026-ira-limit-increases-to-7500

https://www.irs.gov/pub/irs-drop/n-25-67.pdf

This material has been prepared for informational purposes. *To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on individual circumstances.

![Understanding Traditional IRAs [2026]](https://scarletoakfs.com/wp-content/uploads/2025/01/Understanding-Traditional-IRAs-2025.jpg)