In this week’s recap: Stocks end up higher and oil ends up lower after an up-and-down week, as traders react to events in the Middle East and the data in the December unemployment report.

Weekly Economic Update

THE WEEK ON WALL STREET

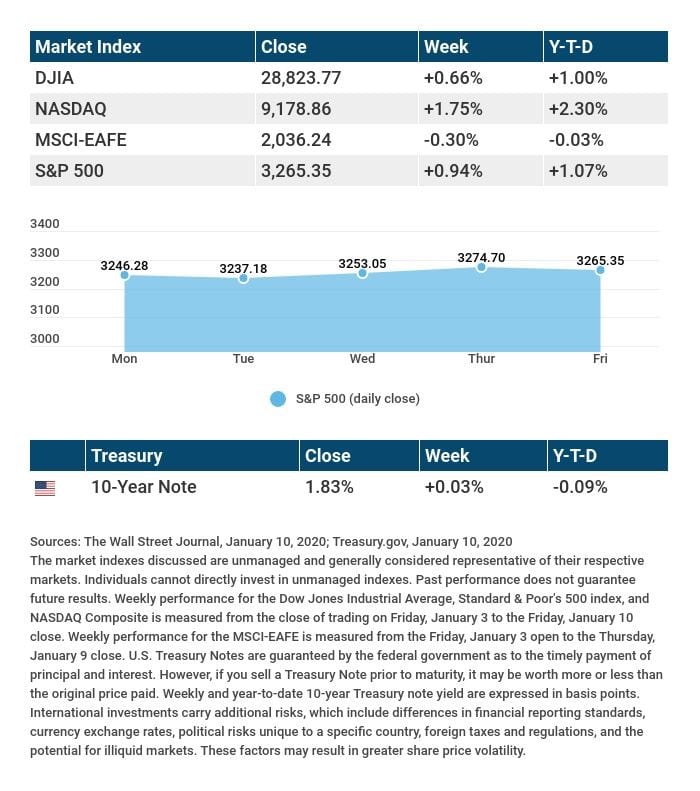

The market had a choppy five days, with traders reacting to geopolitical developments and weaker-than-expected jobs data. Even so, the three major U.S. equity indices posted weekly gains and continued their strong start to the new year. During Friday’s trading session, the Dow Jones Industrial Average topped 29,000 for the first time.

Rising 1.75% for the week, the Nasdaq Composite outgained both the Dow (up 0.66%) and the S&P 500 (up 0.94%). The story for foreign stocks was different: the MSCI EAFE index declined 0.30%.1,2

Holiday Hiring Numbers

Wall Street was unimpressed by the latest jobs report from the Department of Labor. Employers added 145,000 net new workers in December; economists surveyed by Dow Jones had forecast a gain of 160,000. Wages grew less than 3% year-over-year for the first time in 17 months.

Unemployment remained at a 50-year low of 3.5%, however. The broader U-6 jobless rate, which also includes the underemployed, decreased to 6.7%, the lowest in 26 years of recordkeeping.3

Oil Prices Decline

The rally in crude oil spurred by strained U.S.-Iran relations ebbed this past week. At Friday’s closing bell, WTI crude was worth $59.04 a barrel on the New York Mercantile Exchange, down 6.36% for the week and 3.31% year-to-date.4

What’s AHEAD

A new earnings season starts Tuesday, with big banks leading off and reporting fourth-quarter results. Chinese Vice Premier Liu He will be in Washington, D.C., through Wednesday, and during his visit, he and President Trump are expected to sign the phase-one trade deal between the U.S. and China.5

THE WEEK AHEAD: KEY ECONOMIC DATA

- Tuesday: The December Consumer Price Index, providing a look at inflation last month and for all of 2019.

- Thursday: December retail sales figures from the Department of Commerce.

- Friday: The University of Michigan’s preliminary January Consumer Sentiment Index, assessing consumer confidence levels from multiple angles.

Source: MarketWatch, January 10, 2020

The MarketWatch economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

- Tuesday: Citigroup (C), Delta Air Lines (DAL), JPMorgan Chase (JPM), Wells Fargo (WFC)

- Wednesday: Bank of America (BAC), Goldman Sachs (GS), United Health (UNH), US Bancorp (USB)

- Thursday: Morgan Stanley (MS)

- Friday: Schlumberger (SLB)

Source: Zacks, January 10, 2020

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Any investment should be consistent with your objectives, time frame and risk tolerance. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

Scarlet Oak Financial Services may be reached at 800.871.1219 or contact us here.

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. All economic and performance data is historical and not indicative of future results. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is a market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor’s 500 (S&P 500) is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. The MSCI EAFE Index is a stock market index that is designed to measure the equity market performance of developed markets outside of the U.S. and Canada. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world’s largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. All economic and performance data is historical and not indicative of future results. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is a market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor’s 500 (S&P 500) is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. The MSCI EAFE Index is a stock market index that is designed to measure the equity market performance of developed markets outside of the U.S. and Canada. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world’s largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

CITATIONS:

1 – wsj.com/market-data [1/10/20]

2 – quotes.wsj.com/index/XX/MSCI%20GLOBAL/990300/historical-prices [1/10/20]

3 – cnbc.com/2020/01/10/us-nonfarm-payrolls-december-2019.html [1/10/20]

4 – marketwatch.com/investing/future/crude%20oil%20-%20electronic [12/3/20]

5 – cnbc.com/2020/01/09/chinas-vice-premier-liu-to-sign-us-trade-deal-in-washington-next-week.html [1/9/20]

CHART CITATIONS:

wsj.com/market-data [1/10/20]

quotes.wsj.com/index/XX/MSCI%20GLOBAL/990300/historical-prices [1/10/20]

quotes.wsj.com/index/SPX/historical-prices [1/10/20]

treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=yieldAll [1/10/20]