A Spousal Individual Retirement Account (Spousal IRA) is a personal account that allows a couple where one partner helps a non-working spouse or a spouse with very little income save for retirement. The higher-earning spouse can put aside money into a Traditional or Roth IRA in the non-breadwinning spouse’s name and control. [1] ,[2],[3]

Key aspects of Spousal IRAs:

- Contributions are either pre-or post-tax, depending on whether the Spousal IRA is Roth or Traditional.1

- There are no age limits on spousal IRA contributions– as long as one spouse earns income.

- With all investment accounts, you expose some or all your invested money to loss for the chance to earn a higher profit. Investment gains hinge on an ongoing and long-term investment strategy that uses your risk tolerance and diversification to mitigate some risks. Even with these in place, you are exposing your money to loss.[4]

- Investment options are almost anything- individual stocks, mutual funds, ETFs, annuities, UITs, etc. There are investment vehicles that are not allowed in IRAs, including Life Insurance, types of Derivatives Positions, antiques/collectibles, personal real estate, and most coins.[6]

- Fees vary from institution to institution. It is crucial to understand how much you are paying in fees.

- Investment control is either by your chosen institution or advisor or can be self-directed. With this type of account, you must know your risk tolerance and diversification strategy. These are especially important if you are self-directed and need to make changes to your investments as you make changes to your life and risk tolerance.[7]

- The earliest you can take penalty-free withdrawals is 59 ½. However, there are some exemptions to the early withdrawal penalty- if you are permanently and totally disabled, if you have medical expenses that exceed 10% of your modified adjusted gross income, the cost for your medical insurance while you’re unemployed, your qualified higher education expenses, the amount to buy, build or rebuild a first home (up to $10,000), your withdrawal is in the form of an annuity, your withdrawal is a qualified reservist distribution, you’re the beneficiary of a deceased IRA owner or the withdrawal is the result of an IRS levy.[8]

Secure Act 2.0: Required Minimum Distribution (RMD) ages for Traditional Spousal IRAs.

Born before 7/1/1949 → 70½

Born 7/1/1949–1950 → 72

Born 1951–1958 → 73

Born 1960 or later → 75

Born in 1959 → Federal clarification pending (age 73 or 75)

- Roth IRAs have no RMDs. [9]

- Only earned income can be contributed to a Spousal Roth IRA. You cannot contribute from alimony (nontaxable), child support, Social Security retirement benefits, or unemployment benefits.1

- Rollovers into account can come from other pre-tax or post-tax accounts if the designations match. [10]

- You can convert funds from a Spousal Traditional IRA to a Spousal Roth IRA. You will owe taxes on the converted money, but the funds will not be taxed at distribution.[11]

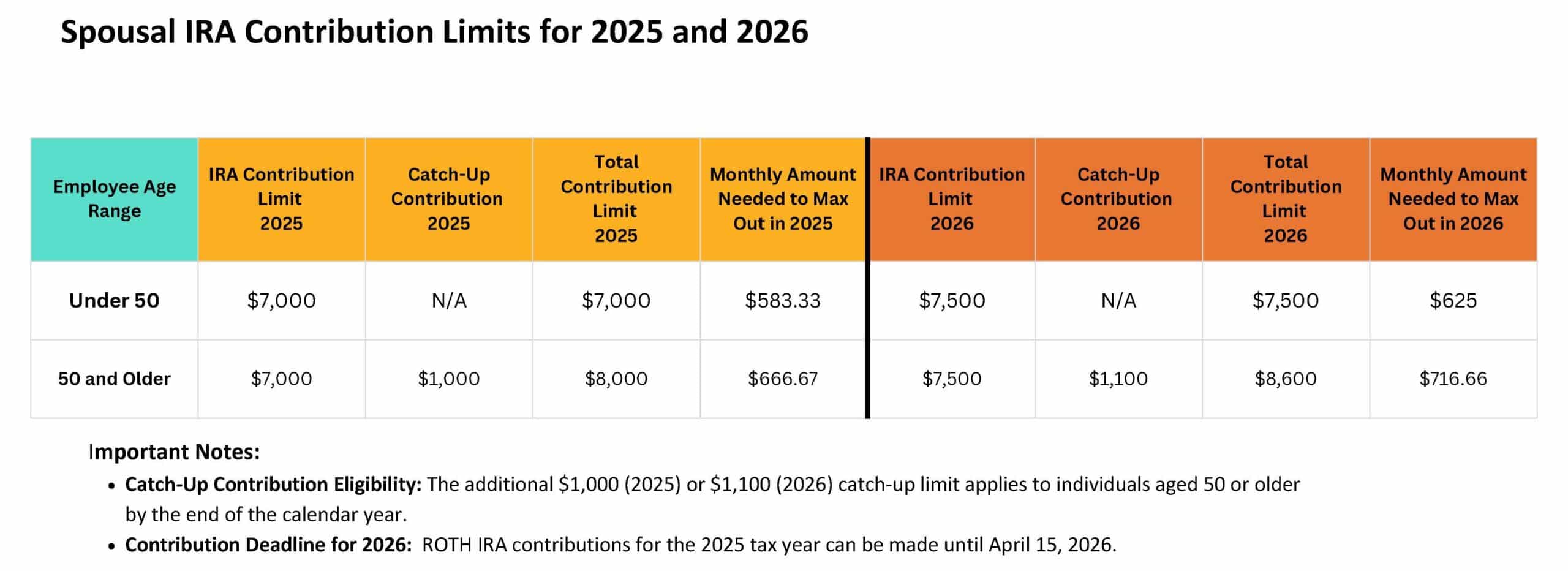

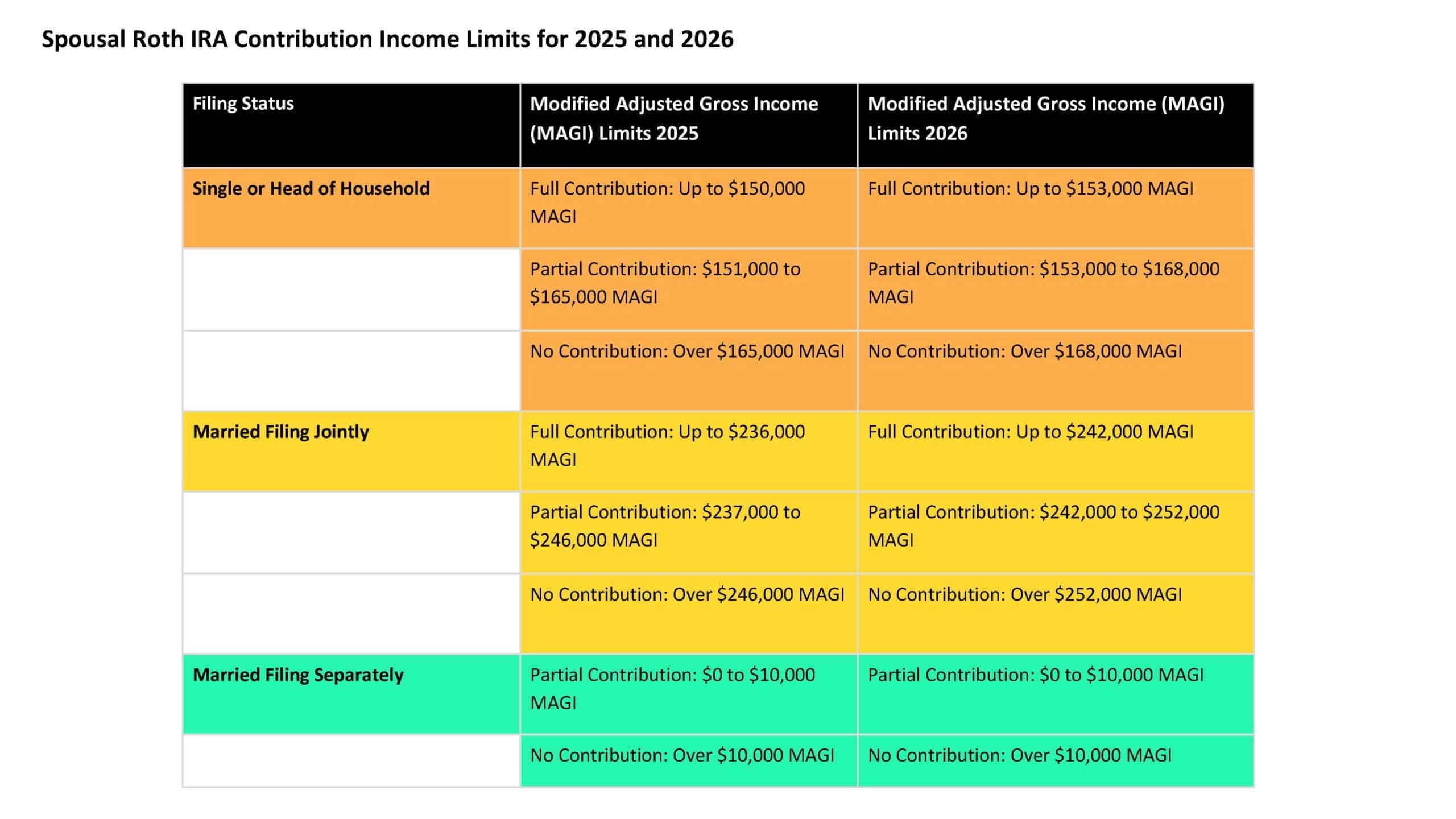

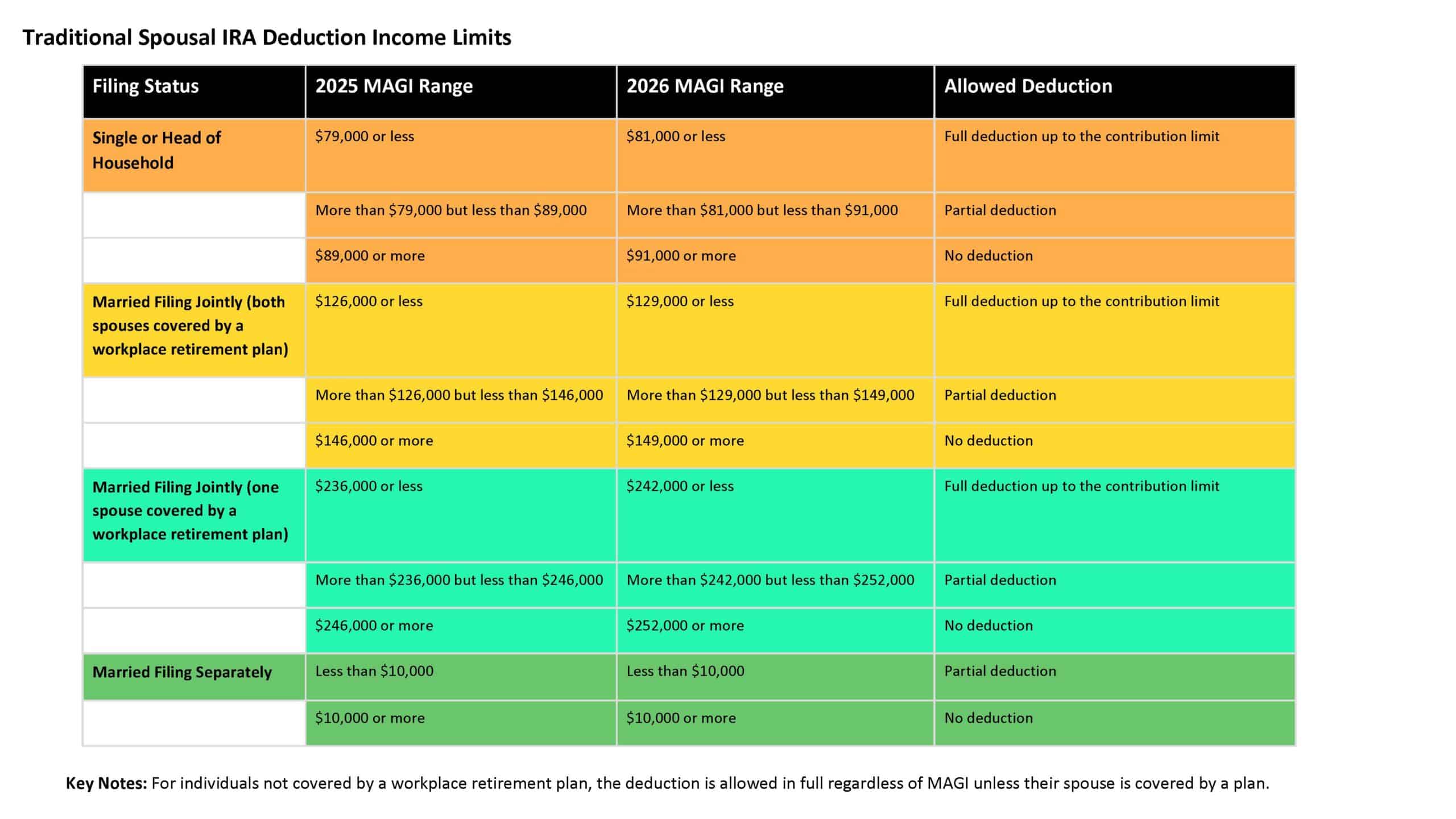

- Contribution limits apply per person, not per account—even if each spouse has both IRA types—with a maximum of $7,000 per person in 2025 ($8,000 if age 50+), and $7,500 per person in 2026 ($8,600 if age 50+). 1,[12],[13]

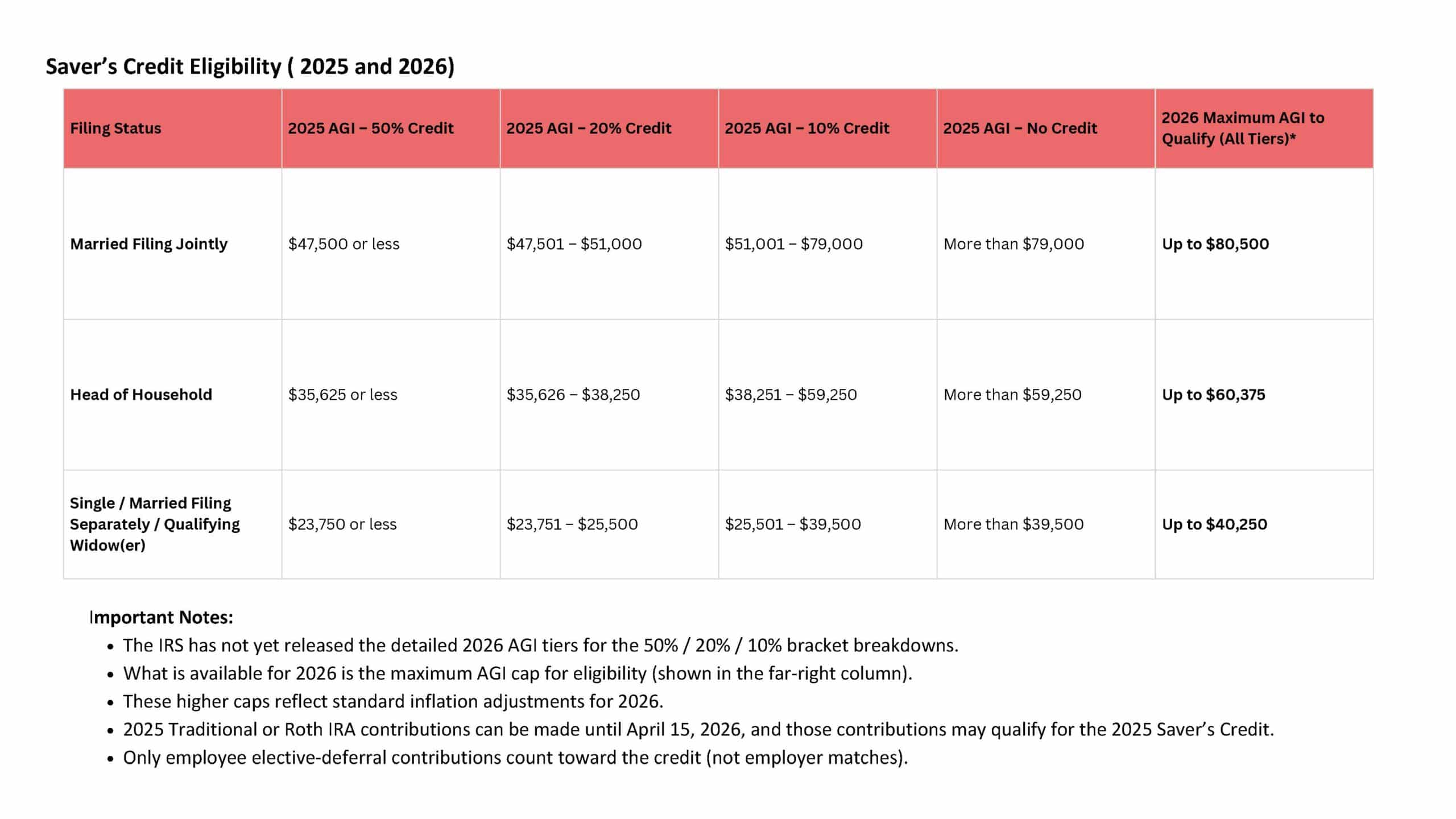

The Saver’s Credit provides a tax benefit for contributing to eligible retirement accounts, helping lower- and moderate-income earners boost their long-term savings.

If you want to explore additional retirement strategies or need help choosing the right type of IRA, Scarlet Oak Financial Services can be reached at 800.871.1219 or contact us here. To sign up for our newsletter with the latest economic news, click here.

Citations:

[1] https://www.investopedia.com/terms/s/spousal-ira.asp

[2] https://www.forbes.com/advisor/investing/spousal-ira/

[3] https://www.nerdwallet.com/article/investing/spousal-ira-what-it-is-and-why-you-should-open-one

[4] https://www.investor.gov/sites/investorgov/files/2019-02/Saving-and-Investing.pdf

[5] https://www.irs.gov/newsroom/401k-limit-increases-to-23000-for-2024-ira-limit-rises-to-7000

[6] https://www.investopedia.com/articles/retirement/11/impermissable-retirement-investments.asp

[7] https://www.nerdwallet.com/article/investing/ira/what-is-a-traditional-ira

[8] https://www.irs.gov/retirement-plans/retirement-plans-faqs-regarding-iras-distributions-withdrawals

[9] https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-required-minimum-distributions-rmds

[10] https://www.irs.gov/pub/irs-tege/rollover_chart.pdf

[11] https://www.investopedia.com/roth-ira-conversion-rules-4770480

[12] https://www.investopedia.com/ask/answers/03/081503.asp

[13] https://www.irs.gov/newsroom/401k-limit-increases-to-22500-for-2023-ira-limit-rises-to-6500#:~:text=Highlights%20of%20changes%20for%202023,to%20%246%2C500%2C%20up%20from%20%246%2C000.

[14] https://www.investopedia.com/what-is-a-spousal-roth-ira-4770888#:~:text=Do%20I%20have%20to%20file,taxes%20as%20married%20filing%20jointly.

[15] https://www.irs.gov/newsroom/401k-limit-increases-to-24500-for-2026-ira-limit-increases-to-7500

[16] https://www.irs.gov/newsroom/401k-limit-increases-to-24500-for-2026-ira-limit-increases-to-7500

https://www.irs.gov/newsroom/401k-limit-increases-to-23500-for-2025-ira-limit-remains-7000

This material has been prepared for informational purposes. *To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on individual circumstances.

![Understanding Spousal IRAs [2026]](https://scarletoakfs.com/wp-content/uploads/2025/01/Understanding-Spousal-IRAs-2025-h.jpg)