A SIMPLE (Savings Incentive Match Plan for Employees) IRA is a retirement plan for small businesses that might not have the resources for a more extensive plan like 401(k) but still want to offer retirement benefits to their employees. It is for businesses that have 100 or fewer employees.[1]

Key aspects of SIMPLE IRAs:

- They are a pre-tax investment account, meaning the money you place in this account is deducted from your check before taxes are collected.[2]

- With all investment accounts, you expose some or all your invested money to loss for the chance to earn a higher profit. Investment gains hinge on an ongoing and long-term investment strategy that uses your risk tolerance and diversification to mitigate some risks. Even with these in place, you are exposing your money to loss.[3]

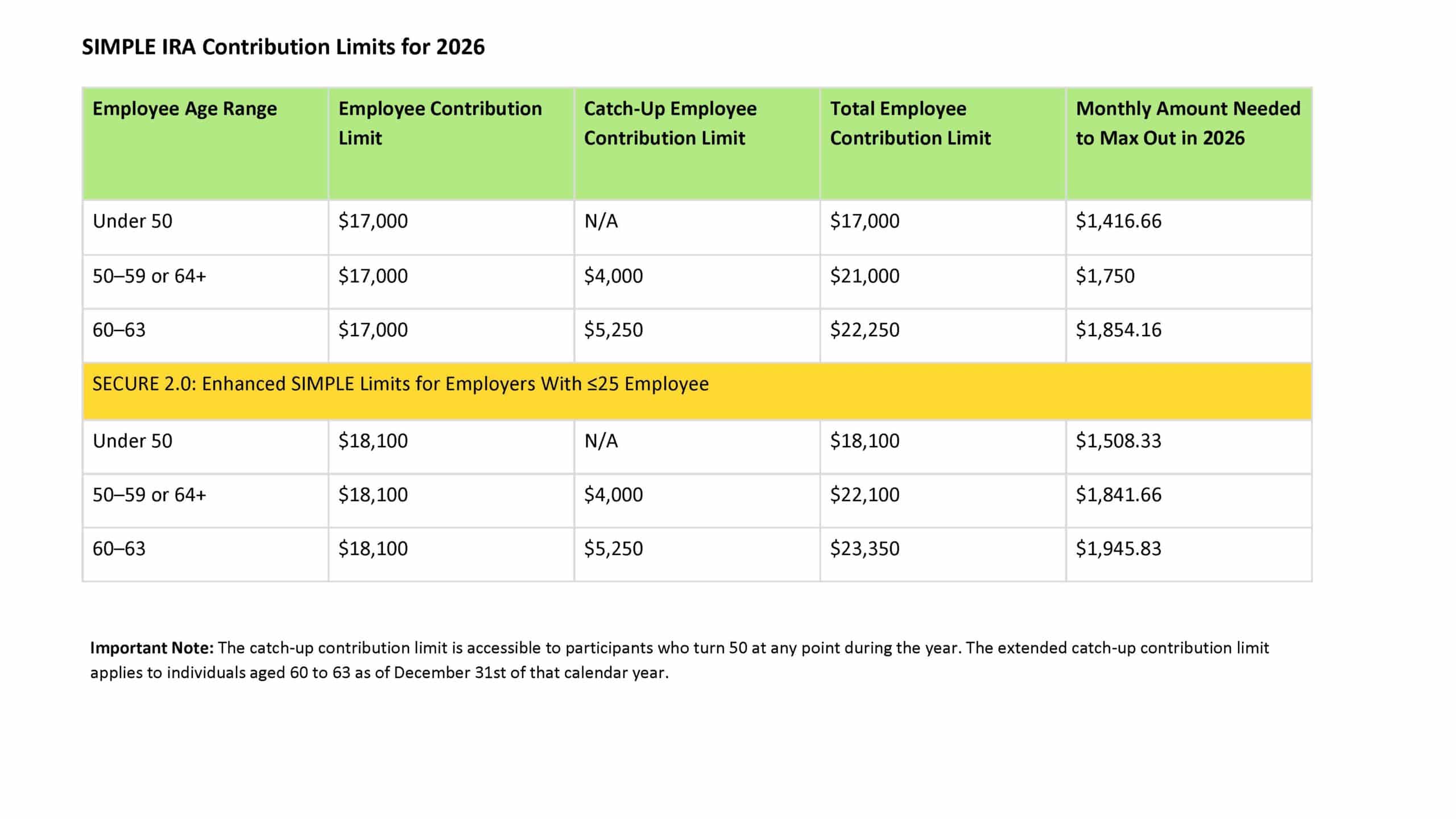

Catch Up Groups:

Employees age 50 or older (the standard catch-up eligibility age). Enhanced catch-up limits apply separately for ages 60–63 beginning in 2025 under SECURE 2.0.

How the $145,000 Threshold Is Determined

Based on Box 3 Social Security wages from the prior calendar year, it applies separately by employer under controlled group rules.

- Employers must allow employees who have received at least $5,000 in compensation in the last two years or those who expect to receive at least $5,000 during the current calendar year to participate, excluding employees covered by a union agreement and non-US citizens.1

- Employers must match contributions. These plans can either have a mandatory match or non-elective contribution- mandatory is 3%, or non-elective is 2%. A mandatory match means the employer must match up to 3% of the employee’s contribution. If the employee contributes 1% of their salary, then the employer contributes 1%; if the employee contributes 2%, then the employer puts in 2%, and so on to 3%. A non-elective contribution means that the employer will contribute 2% of the employee’s salary, regardless of whether the employee contributes to their account. But the employer never has to match beyond that 3%, which can be less than most 401(k) plans. [5]

- The “Non-elective” contribution formula mandates that eligible employees receive an employer contribution to their SIMPLE IRA, even if they don’t contribute themselves. [6]

- You are 100% vested whenever the employer deposits contributions into your account. Unlike 401(k) plans, vesting happens when the funds hit your account, not on a vesting schedule based on years of employment.[7]

- Investment options include individual stocks, mutual funds, ETFs, or CDs.6

- Investment control can be at an employer-chosen institution, or some plans allow employees to select the institution or participate in self-directed investing.[9]

- If you try to cash out or roll over a SIMPLE IRA less than two years after it was opened instead of the standard 10% penalty of a 401(k) account, 403(b) account, Traditional IRA, or Roth IRA, you will be subject to a 25% penalty in addition to ordinary income tax.[10]

- You can take the money with you. After the account has been opened for two years, you can roll it over to another pre-tax IRA account or traditional 401(k), 403(b), or 457(b) plans. If you cash the account out at this point, you will pay a 10% penalty on top of the 10% taxes you will owe.1

- The earliest you can take penalty-free withdrawals is 59 ½. However, there are some exemptions to the early withdrawal penalty- if you are permanently and totally disabled, if you have medical expenses that exceed 10% of your modified adjusted gross income, the cost for your medical insurance, while you’re unemployed, your qualified higher education expenses, the amount to buy, build or rebuild a first home (up to $10,000), your withdrawal is in the form of an annuity, your withdrawal is a qualified reservist distribution, you’re the beneficiary of a deceased SIMPLE IRA owner or the withdrawal is the result of an IRS levy.[11]

Secure Act 2.0: Required Minimum Distribution (RMD) ages for Traditional SIMPLE IRAs follow the same federal rules as other pre-tax IRAs.

Born before 7/1/1949 → RMD begins at 70½

Born 7/1/1949–1950 → RMD begins at 72

Born 1951–1958 → RMD begins at 73

Born 1960 or later → RMD begins at 75

Born in 1959 → Federal clarification pending (age 73 or 75)

If you want to explore additional retirement investment accounts that could work for your goals, Scarlet Oak Financial Services can be reached at 800.871.1219, or you can contact us here. To sign up for our newsletter with the latest economic news, click here.

Sources:

[1] https://www.irs.gov/retirement-plans/plan-sponsor/simple-ira-plan

[2] https://www.nerdwallet.com/article/investing/simple-ira-contribution-limits

[3] https://www.investor.gov/sites/investorgov/files/2019-02/Saving-and-Investing.pdf

[4] https://www.irs.gov/newsroom/401k-limit-increases-to-23000-for-2024-ira-limit-rises-to-7000

[5] https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-simple-ira-contribution-limits

[6] https://www.irs.gov/retirement-plans/plan-sponsor/simple-ira-plan

[7] https://www.goodfinancialcents.com/simple-ira-rules-limits/

[8] https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-notices

[9] https://www.ramseysolutions.com/retirement/what-is-a-simple-ira

[10] https://www.fidelity.com/retirement-ira/small-business/simple-ira/overview

[11] https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-tax-on-early-distributions

[12] https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-required-minimum-distributions-rmd

[13] https://www.tiaa.org/public/support/faqs/required-minimum-distributions

https://www.irs.gov/newsroom/401k-limit-increases-to-24500-for-2026-ira-limit-increases-to-7500https://www.irs.gov/pub/irs-drop/n-25-67.pdf

https://www.irs.gov/pub/irs-drop/n-25-67.pdf

To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on individual circumstances.

![Understanding SIMPLE IRAs [2026]](https://scarletoakfs.com/wp-content/uploads/2025/01/Understanding-SIMPLE-IRAs-2025-h.jpg)