When an employer sets up a Safe Harbor 401(k) plan instead of a Traditional 401(k), they create a retirement benefit program with predetermined contribution rules. By adhering to the same rules for all employees, wherever their level is in an organization- entry-level to CEO- these plans can automatically pass nondiscrimination tests (NDTs) or sometimes don’t need to participate in NDTs. NDTs are performed to ensure that 401(k) retirement plans benefit all employees, not just high earners or company owners. By choosing a Safe Harbor 401(k) plan, businesses avoid the costs associated with participating in an NDT that could fail and need to be fixed and the compliance hassles of ongoing maintenance of a conventional 401(k) plan.[1],[2],[3]

Key aspects of Safe Harbor 401(k) plans:

- Generally, they are a pre-tax investment account, meaning the money you place in this account is deducted from your check before taxes are collected. However, some plans can be set up to have post-tax contributions or both pre-and post-tax contributions choices. [4]

Unique to Safe Harbor 401(k) plans: These plans can be set up to match contributions in three ways. 2,[5]

- Basic– Employee contributions of 3% are 100% matched by employers. If the employee contributes 2% above that, the employer will match those contributions by 50%. To earn a full match, employees must contribute 5% of their income to have a total 4% match.

- Enhanced– Employee contributions up to 4% are matched 100% by employers. This is a straight dollar-per-dollar match of employee contributions up to 4%.

- Nonelective– Employers contribute 3% based on the employee’s salary to every employee’s account, whether the employee is contributing or not. These contributions do not involve the employee but are automatically made to the employee’s account from the employer.

Note: Safe Harbor matching formulas generally must remain in place for the full plan year. However, employers may switch to a 3% nonelective Safe Harbor contribution mid-year if IRS notice and amendment requirements are met.

- These matching structures are minimums; an employer could not set up a Safe Harbor 401(k) plan that fell below the Basic or Enhanced matching percentages outlined above, but an employer can increase matching up to 6% of employee contributions if they do so for all employees within the organization.

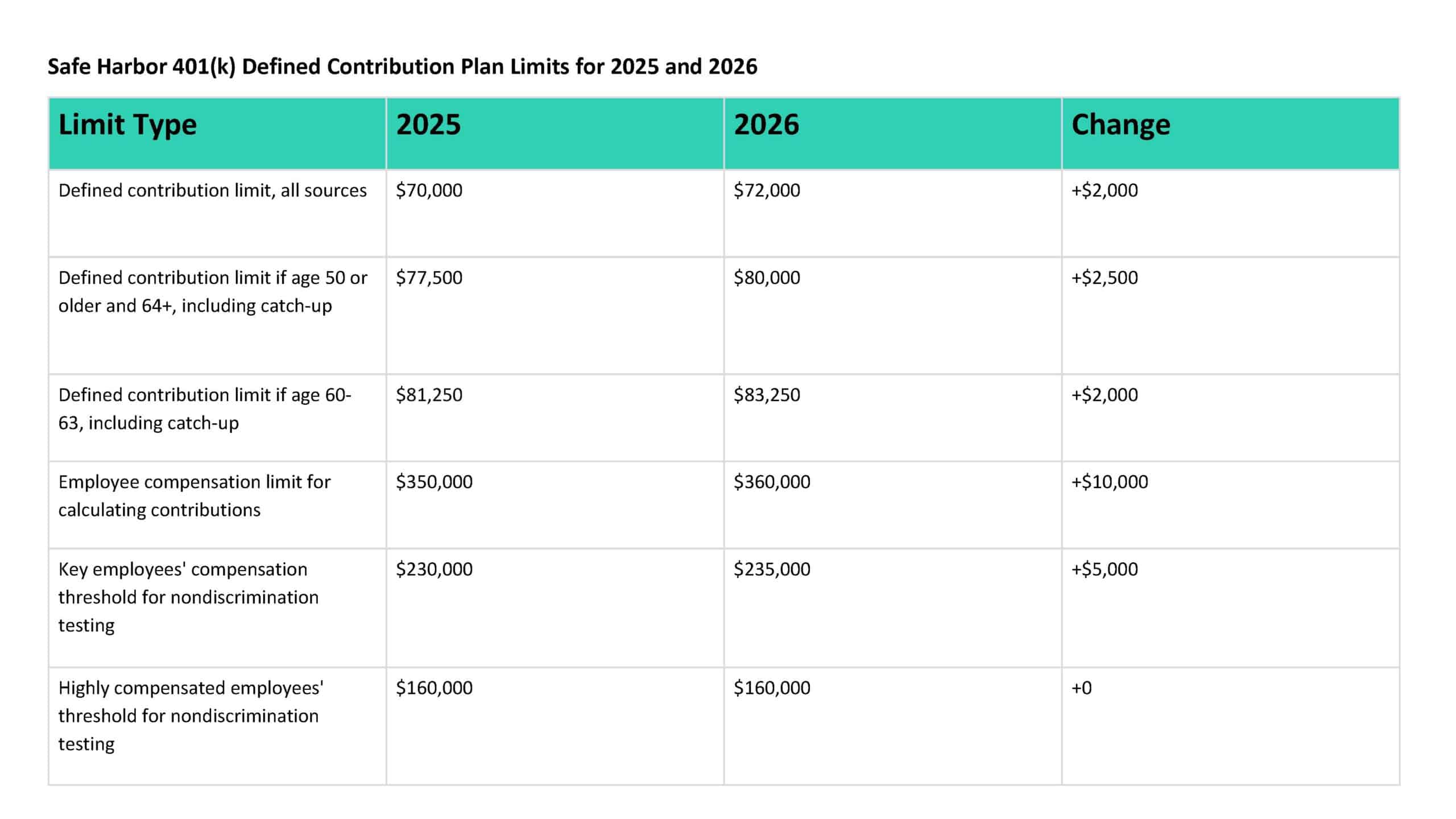

- Nonelective Contribution Limit: The aggregate limit for contributions to a participant’s account includes both employee and employer contributions. See Chart Below for limits. 2,[6],[7]

- Employers may calculate Safe Harbor matching contributions per pay period or on full-year compensation. If using per-pay-period matching, plans often include an annual ‘true-up’ to ensure employees receive the full Safe Harbor match even if their contributions vary throughout the year. [23]

- You are 100% vested whenever the employer deposits contributions into your account. Unlike other 401(k) plans, vesting happens when the funds hit your account, not on a vesting schedule based on years of employment. [4]

- Traditional Safe Harbor matching and nonelective contributions must be 100% vested immediately. However, a special Safe Harbor design called a Qualified Automatic Contribution Arrangement (QACA) allows employers to apply a vesting schedule of up to two years. QACA plans also include automatic enrollment features: new employees are enrolled at a default contribution rate—generally between 3% and 10% of compensation—with automatic yearly increases until the rate reaches at least 10% (up to a maximum of 15%). This makes QACA the only Safe Harbor structure that permits delayed vesting and requires default enrollment and auto-escalation features. [22]

- Beginning in 2025, newly established 401(k) and 403(b) plans must automatically enroll eligible employees unless an employee affirmatively opts out. Under this requirement, employees must be enrolled at a default contribution rate of 3%–10%. Plans must then automatically increase this contribution by at least 1% per year until it reaches at least 10% of compensation, not to exceed 15%. This rule applies to plans created after December 29, 2022, with exemptions for certain small businesses, new employers, church plans, and government plans. [17]

High Earners (New Roth Requirement)

Beginning Jan. 1, 2026, employees with prior-year Social Security wages over $145,000 must make all catch-up contributions as Roth contributions, only if the plan allows them. If the plan does not allow Roth, High Earners cannot make catch-up contributions.

Catch Up Groups:

Employees age 50 or older (the standard catch-up eligibility age). Enhanced catch-up limits apply separately for ages 60–63 beginning in 2025 under SECURE 2.0.

How the $145,000 Threshold Is Determined

Based on Box 3 Social Security wages from the prior calendar year, it applies separately by employer under controlled group rules.

To Follow the New Roth Requirement in 2026 for Employers:

If your plan doesn’t currently offer Roth contributions, you must add a Roth feature by the end of the 2026 plan year to continue allowing catch-up contributions for High Earners. Employers cannot require all participants to make Roth catch-up or restrict them to High Earners—Roth catch-up must be available to all eligible participants. The rules clarify implementation details for plan administrators—including wage aggregation, corrections, and deemed Roth elections—and allow early adoption using a reasonable good-faith interpretation before 2027.

- With all investment accounts, you expose some or all your invested money to loss for the chance to earn a higher profit. Investment gains hinge on an ongoing and long-term investment strategy that uses your risk tolerance and diversification to mitigate some risks. Even with these in place, you are exposing your money to loss.[10]

- Safe Harbor 401(k) plans do not impose income limits on participation. Employees at all income levels may contribute, and employers must allow eligible employees to participate based on age and service requirements—not income. Although traditional 401(k) plans also have no income-based participation limits, Safe Harbor plans differ because their predetermined matching structure eliminates the risk of contribution refunds for Highly Compensated Employees. This ensures all eligible participants—including high earners—can contribute up to the annual limits without being restricted by nondiscrimination testing results.[11]

- Employers must allow all employees to participate if they are 21 and above, have one year of service, and have 1000 hours per year. Employers can build plans that expand these perimeters to include more employees but never narrow them. 4

- To comply with the safe harbor requirements, employers must provide the rights and obligations of the employee under the plan and how an employee can contribute to their account each year to all eligible employees. This reach-out needs to happen at least 30 days before the plan’s year begins but not more than 90 days before. 2

- Safe Harbor plans must include Safe Harbor provisions in a written plan document. Any changes to Safe Harbor matching formulas, nonelective contributions, or plan structure typically must be adopted before the plan year begins, unless using the permissible mid-year amendment rules defined by IRS Notice 2016-16. [20]

- Safe Harbor 401(k) plans automatically satisfy ADP and ACP testing, but they are still subject to top-heavy rules. Employers that use the 3% nonelective Safe Harbor contribution often satisfy the top-heavy minimum contribution requirements automatically. This provides additional protection against having to make separate top-heavy contributions for non-key employees in years when key employees hold a large share of plan assets. However, ACP testing may still apply to plans offering after-tax employee contributions or additional employer matching contributions outside the Safe Harbor formula. [21]

- Fees vary from plan to plan. It is crucial to understand how much you are paying in fees.

- If you leave an employer, you can take your money with you. You can roll over these accounts to non-Safe Harbor plans if they match the tax designation of the original account. [12]

- The earliest you can take penalty-free withdrawals is 59 ½; the penalty is an extra 10% on top of the taxes collected. However, there are some exemptions to the early withdrawal penalty- if you are permanently and totally disabled, if you lose your job at 55 or older, if you have medical expenses that exceed 10% of your modified adjusted gross income, with some divorce settlement types and if you die. 4

SECURE Act 2.0 Required Minimum Distribution (RMD) Ages

Safe Harbor 401(k) Plans must follow the federal RMD schedule established under the SECURE Act 2.0. The age at which RMDs begin is based on your birth year:

RMD Age by Birth Year

-

Born before July 1, 1949 → Age 70½

-

Born July 1, 1949 through 1950 → Age 72

-

Born 1951–1958 → Age 73

-

Born 1960 or later → Age 75

-

Born 1959 → Pending IRS clarification

(A technical drafting error in SECURE 2.0 created an overlap between ages 73 and 75. The IRS is expected to issue final guidance.)

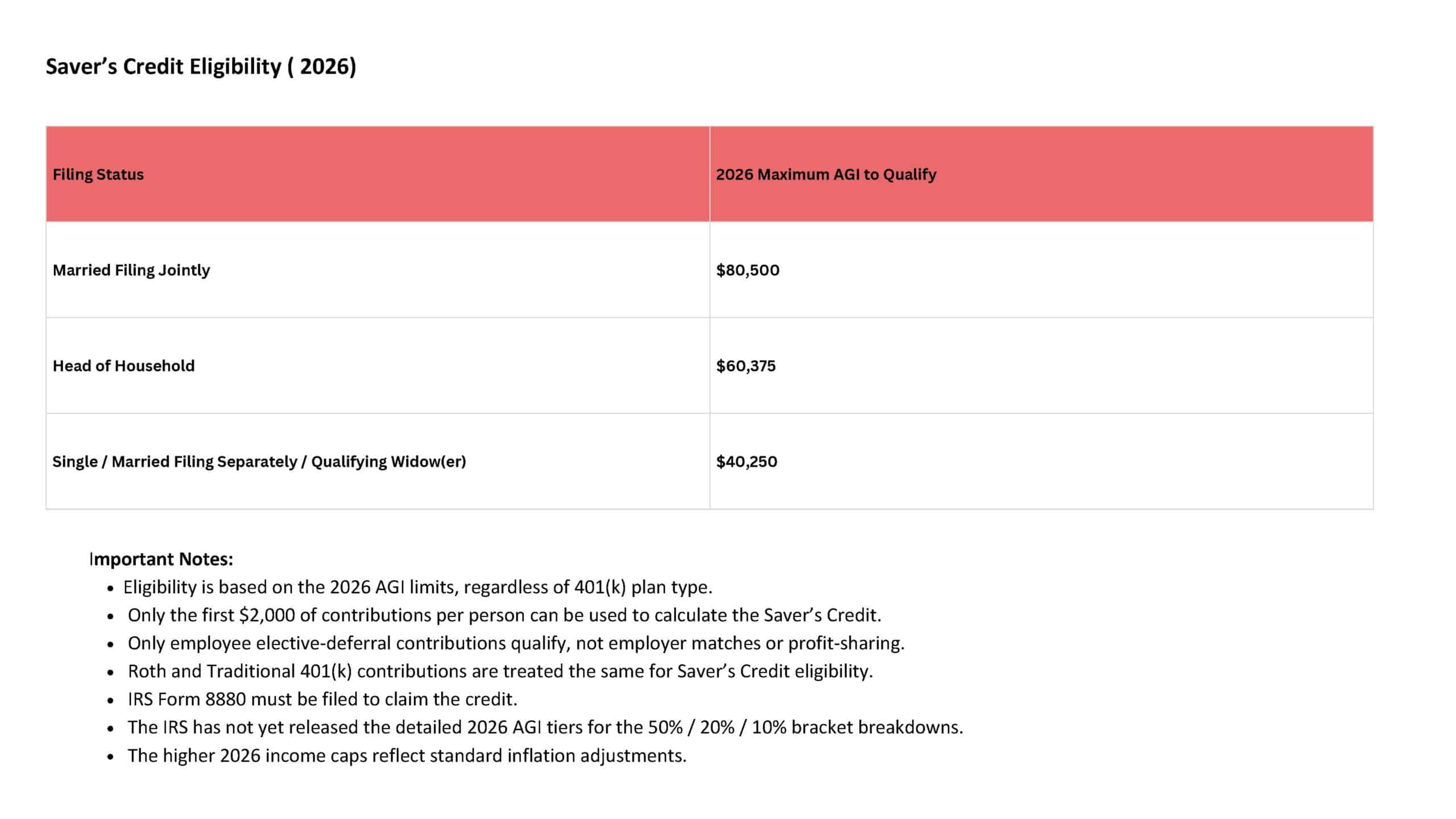

- Saver’s Credit (Retirement Savings Contributions Credit) — 2026 Overview

The Saver’s Credit provides a tax benefit for contributing to eligible retirement accounts, helping lower- and moderate-income earners boost their long-term savings.Eligible Contribution Types

Employee contributions to the following accounts qualify:

• Traditional or Roth IRAs

• 401(k) plans — including Traditional, Roth, Safe Harbor, Solo/Individual, and SIMPLE 401(k)

• 403(b) plans

• 457(b) governmental plans

• SIMPLE IRAs

• SEP IRAs

- You can take a low-interest loan on 401(k) accounts, up to $50,000 or 50% of your account balance. Still, you will have to pay it back sometimes within 90 days but definitely within five years (this period may be extended if the money is used to buy a primary home) or at leaving that job, or it becomes taxable income. The payments will most likely be held back from your paycheck. Some plans don’t let you contribute to your account until the loan is paid back. Interest charges go directly back into your retirement account. 4,[15]

If you want to explore investment accounts for your business, Scarlet Oak Financial Services can be reached at 800.871.1219 , or you can contact us here. To sign up for our newsletter with the latest economic news, click here.

Sources:

[1] https://www.thebalance.com/what-is-a-safe-harbor-401-k-2894205

[2] https://www.guideline.com/blog/safe-harbor-401k-plan/

[3] https://money.usnews.com/money/retirement/401ks/articles/what-you-need-to-know-about-a-safe-harbor-401-k

[4] https://www.rbcwm-usa.com/resources/file-687825.pdf

[5] https://www.bankrate.com/retirement/safe-harbor-401k/

[6] https://www.investopedia.com/terms/n/non-electivecontribution.asp

[7] https://www.irs.gov/pub/irs-drop/n-22-55.pdf

[8] https://www.irs.gov/newsroom/401k-limit-increases-to-22500-for-2023-ira-limit-rises-to-6500#:~:text=Highlights%20of%20changes%20for%202023,to%20%246%2C500%2C%20up%20from%20%246%2C000.

[9] https://www.irs.gov/newsroom/401k-limit-increases-to-23000-for-2024-ira-limit-rises-to-7000

[10] https://www.investor.gov/sites/investorgov/files/2019-02/Saving-and-Investing.pdf

[11] https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-401k-and-profit-sharing-plan-contribution-limits

[12] https://budgeting.thenest.com/can-roll-over-safe-harbor-401k-plan-ira-account-29971.html

[13] https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-required-minimum-distributions-rmd

[14] https://www.tiaa.org/public/support/faqs/required-minimum-distributions

[15] https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-loans

[16] https://www.irs.gov/newsroom/401k-limit-increases-to-23500-for-2025-ira-limit-remains-7000

[19] https://www.irs.gov/retirement-plans/mid-year-changes-to-safe-harbor-401k-plans-and-notices

[20] https://www.irs.gov/pub/irs-drop/n-16-16.pdf

[21] https://www.irs.gov/retirement-plans/is-my-401k-top-heavy#:~:text=Are%20some%20401(k)%20plans,or%203%25%20non%2Delective)

[22] https://www.employeefiduciary.com/blog/401k-nonelective-contributions#:~:text=with%20specific%20rules.-,Safe%20Harbor%20Nonelective%20Contributions,employee%20eligibility%20and%20vesting%20requirements.

[23] https://slavic401k.com/resources/true-up-contributions-explained/#:~:text=When%20an%20employer%20matching%20contribution,stop%20%E2%80%93%20so%20does%20their%20match.

https://www.irs.gov/newsroom/401k-limit-increases-to-24500-for-2026-ira-limit-increases-to-7500

https://www.irs.gov/pub/irs-drop/n-25-67.pdf

This material has been prepared for informational purposes. To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on individual circumstances.

![Understanding Safe Harbor 401(k) Plans [2026]](https://scarletoakfs.com/wp-content/uploads/2025/01/Understanding-Safe-Harbor-401k-Plans-2025-h.jpg)