Roth 403(b) plans are offered to employees in education, non-profit organizations, and certain religious organizations. These plans are a hybrid of traditional 403(b) plans and Roth IRAs, and they were introduced in 2001 to help offset some of the economic effects of a recession.[1]

Key aspects of Roth 403(b) plans:

- Roth contributions are post-tax contributions taxed when you earn the income, not when the retirement distribution is made. So, say you earn $2000 per paycheck and contribute $200 as a Roth contribution. You will still pay taxes on the $2000. Whereas if you had made a traditional 401(k) contribution of $200, you’d pay taxes on an adjusted paycheck of $1800.[2]

- Employers must allow all employees to participate except those who work less than 20 hours per week, professors on sabbaticals, certain students, union employees, and non-resident aliens.[3]

- With all investment accounts, you expose some or all your invested money to loss for the chance to earn a higher profit. Investment gains hinge on an ongoing and long-term investment strategy that uses your risk tolerance and diversification to mitigate some risks. Even with these in place, you are exposing your money to loss.[4]

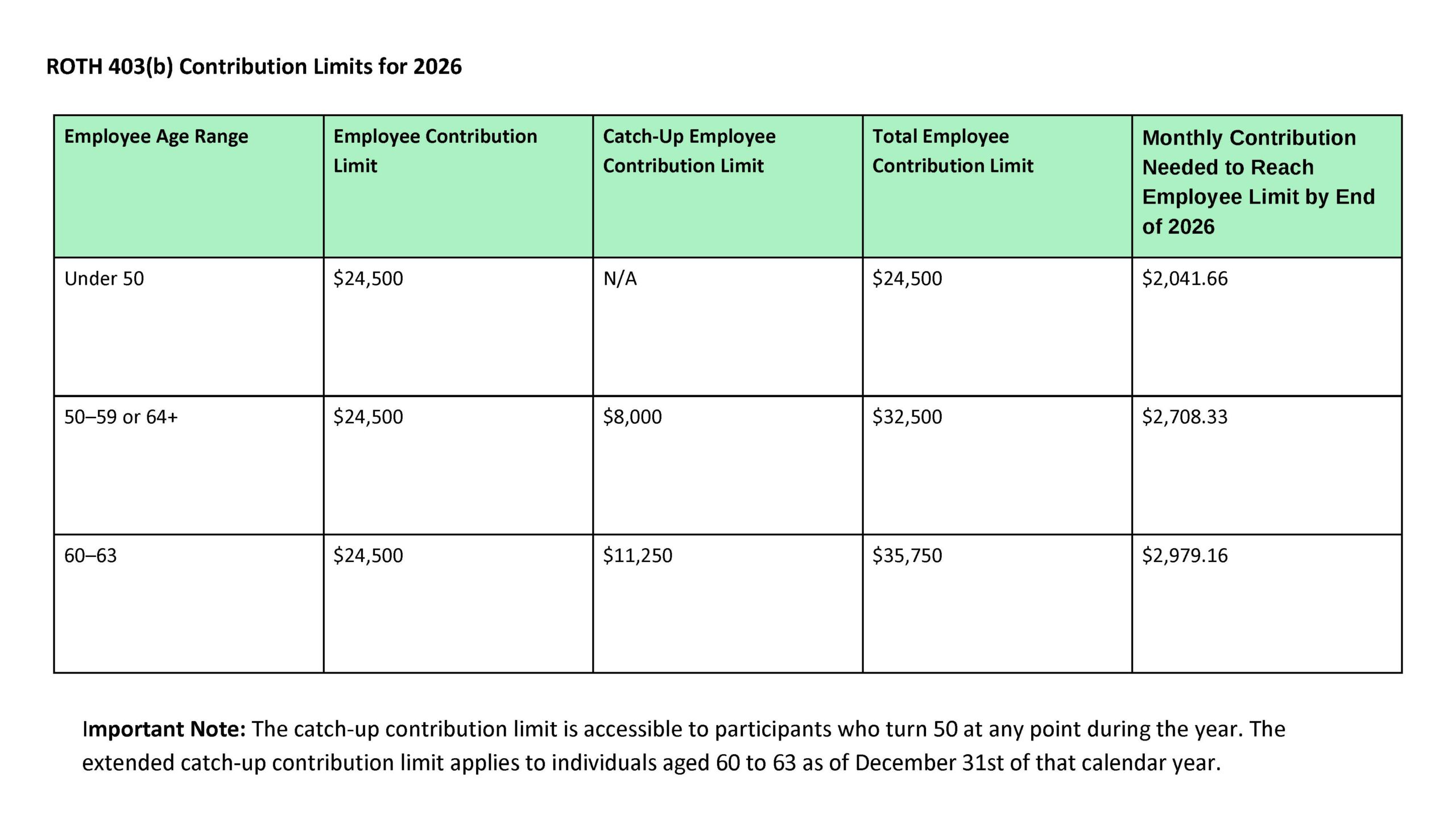

Catch Up Groups:

Employees age 50 or older (the standard catch-up eligibility age). Enhanced catch-up limits apply separately for ages 60–63 beginning in 2025 under SECURE 2.0.

How the $145,000 Threshold Is Determined

Based on Box 3 Social Security wages from the prior calendar year, it applies separately by employer under controlled group rules.

- Effective 2025, Roth 403(b) accounts will no longer be subject to RMDs, aligning them with Roth IRAs, which do not have RMD requirements. This change allows for greater flexibility in retirement planning and the potential for continued tax-free growth. Traditional 403(b) accounts still require RMDs based on federal age rules.

- Matching is not common for these types of plans. Employers often limit their role and do not provide employer contributions to the plan to remain exempt from the Employee Retirement Income Security Act (ERISA) of 1974 rules. ERISA was implemented to safeguard employees who participate in employer-run retirement plans.[8],[9]

- These plans usually have lower fees with less oversight and no annual nondiscrimination tests (NDTs) since those costs don’t need to be offset.7

- The vesting schedule is often much shorter than 401(k) plans.3

- Effective 2025, newly established 401(k) and 403(b) plans are generally required to automatically enroll eligible employees, with an initial deferral rate of at least 3% of compensation. Eligible employees must be auto-enrolled at a 3% minimum contribution rate, increasing annually by 1% until reaching 10-15%. This applies to plans established after December 29, 2022, excluding new/small businesses, church, and government plans.

- Starting in 2025, 403(b) plans are required to allow long-term, part-time employees to participate. This change ensures that employees who have worked at least 500 hours per year for two consecutive years are eligible to contribute to their employer’s 403(b) plan.

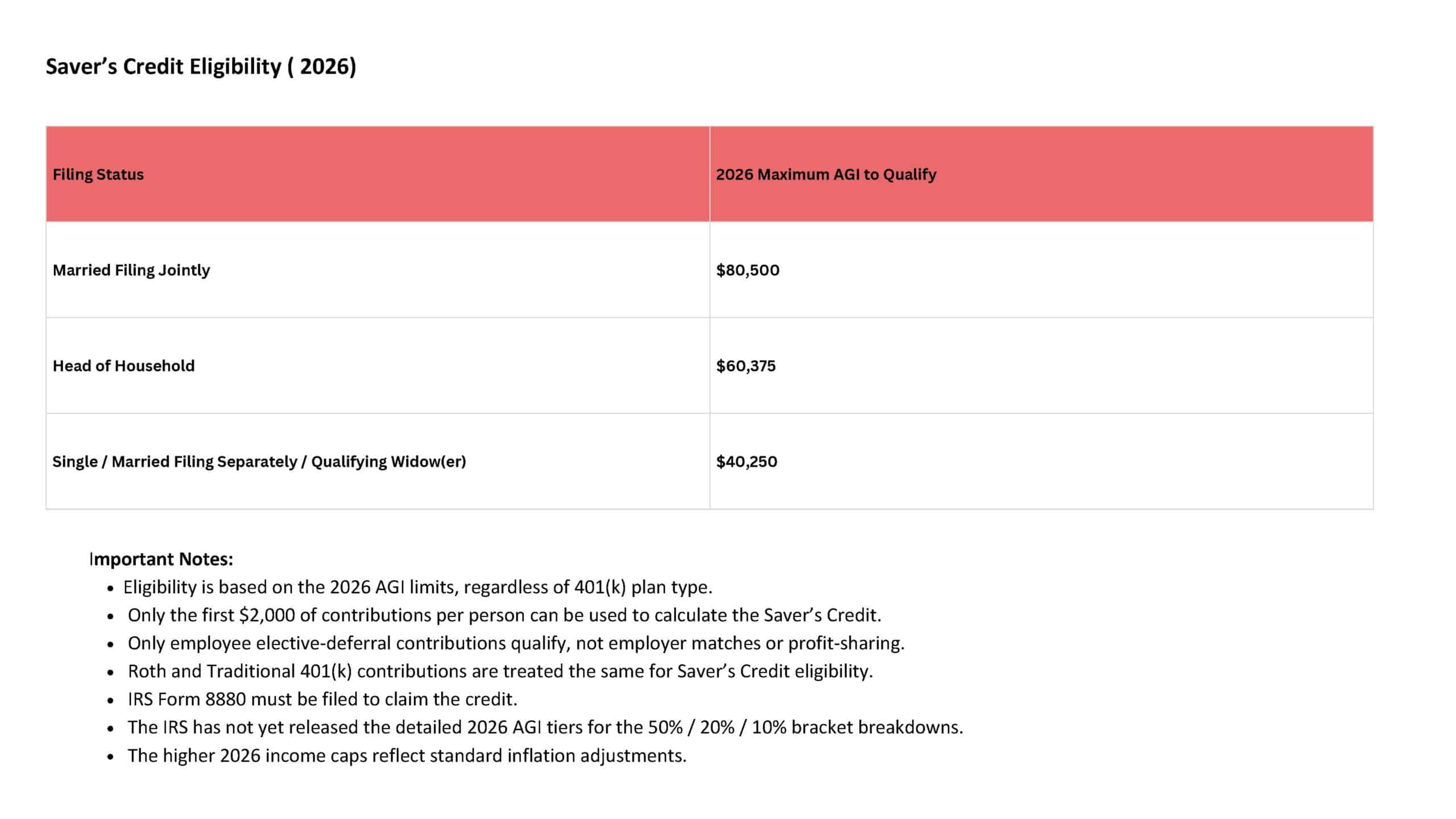

The Saver’s Credit provides a tax benefit for contributing to eligible retirement accounts, helping lower- and moderate-income earners boost their long-term savings.

Eligible Contribution Types

Employee contributions to the following accounts qualify:

• Traditional or Roth IRAs

• 401(k) plans — including Traditional, Roth, Safe Harbor, Solo/Individual, and SIMPLE 401(k)

• 403(b) plans

• 457(b) governmental plans

• SIMPLE IRAs

• SEP IRAs

(Only employee elective-deferral contributions qualify—not employer matches or profit-sharing.)

After-Tax Matching Contributions: Employers now have the option to offer after-tax (Roth) matching contributions, providing participants with more flexibility in how their retirement savings are taxed.

- Investment options are only Mutual funds and annuities. If your employer offers both a traditional 403(b) and a Roth 403(b) options, they may look identical in terms of cost and what you can invest in.3

- If you leave an employer, you can take your money with you. A Roth 403(b) can be rolled over to a new or existing Roth IRA, Roth 401(k), or Roth 403(b). Remember, Roth money has to stay in Roth accounts.[10]

- Profit-sharing, where a company offers stock options to its employees, is not available with these types of plans since these organizations are non-profit.7

Automatic Rollover Threshold: Previously, if a former employee’s 403(b) balance was less than $5,000, plan administrators could transfer the funds into an IRA without the employee’s consent. The SECURE 2.0 Act raised this limit to $7,000, effective from 2025.

- The earliest you can make penalty-free withdrawals is 59 ½; the penalty is an extra 10% on top of the taxes collected. However, there are some exemptions to the early withdrawal penalty- if you are permanently and totally disabled, if you lose your job at 55 or older, if you have medical expenses that exceed 10% of your modified adjusted gross income, with some divorce settlement types and if you die.9

- You can take a low-interest loan on Roth 403(b) accounts, up to $50,000 or 50% of your account balance. You can take out the full amount if your balance is $10,000 or less. You must repay the loan within five years (this period may be extended if the money is used to buy a primary home) or upon leaving that job, or it becomes taxable income. The payments will most likely be held back from your paycheck.[13]

Simplified Hardship Withdrawals: The SECURE 2.0 Act allows for self-certification of hardship withdrawals, simplifying the process for participants to access funds in case of financial emergencies.

If you would like to explore investment accounts that would work for your personal or retirement goals, Scarlet Oak Financial Services can be reached at 800.871.1219, or you can contact us here. To sign up for our newsletter with the latest economic news, click here.

Sources:

[1] https://smartasset.com/retirement/roth-403-b

[2] https://www.investopedia.com/terms/r/rothira.asp

[3] https://www.rbcwm-usa.com/resources/file-687824.pdf

[4] https://www.investor.gov/sites/investorgov/files/2019-02/Saving-and-Investing.pdf

[5] https://www.irs.gov/pub/irs-drop/n-22-55.pdf

[6] https://www.irs.gov/retirement-plans/403b-plan-fix-it-guide-an-employee-making-a-15-years-of-service-catch-up-contribution-doesnt-have-the-required-15-years-of-full-time-service-with-the-same-employer

[7] https://www.irs.gov/newsroom/401k-limit-increases-to-23000-for-2024-ira-limit-rises-to-7000#:~:text=Highlights%20of%20changes%20for%202024,to%20%247%2C000%2C%20up%20from%20%246%2C500.

[8] https://www.fool.com/retirement/plans/401k/401k-vs-403b/

[9] https://www.investopedia.com/terms/e/erisa.asp

[10] https://www.fool.com/retirement/plans/403b/withdrawal/

[11] https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-required-minimum-distributions-rmds

[12] https://www.tiaa.org/public/support/faqs/required-minimum-distributions

[13] https://www.investopedia.com/articles/retirement/08/borrow-from-401k-loan.asp

[14] https://www.irs.gov/retirement-plans/403b-plans-catch-up-contributions

401(k) limit increases to $23,500 for 2025, IRA limit remains $7,000

https://www.irs.gov/pub/irs-drop/n-25-67.pdf

https://www.irs.gov/newsroom/401k-limit-increases-to-24500-for-2026-ira-limit-increases-to-7500

This material has been prepared for informational purposes. To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on individual circumstances.

![Understanding Roth 403(b) Plans [2026]](https://scarletoakfs.com/wp-content/uploads/2025/01/Understanding-Roth-403b-Plans-2024.jpg)