403(b) plans are employer-sponsored retirement plans offered to education, nonprofit, and certain religious organizations..[1]

Key aspects of 403(b) plans:

- These are pre-tax accounts, so you lessen your tax burden in the present but will have to pay taxes when you start using the money in retirement.[2]

- Traditional vs. Roth 403(b) Contributions: Many 403(b) plans now offer both Traditional (pre-tax) and Roth (after-tax) contribution options. Traditional 403(b) contributions reduce your taxable income today but are fully taxable when withdrawn in retirement. Roth 403(b) contributions are made with after-tax dollars, but qualified withdrawals in retirement are tax-free.

- 403(b) 15-Year Service Catch-Up (Unique to 403(b) Plans): Some 403(b) plans offer a special catch-up contribution for long-tenured employees. If you have at least 15 years of service with the same eligible employer (such as a school, hospital, church, or certain nonprofits), you may be able to contribute up to an extra $3,000 per year, with a $15,000 lifetime maximum, beyond the standard annual deferral limit. The actual amount allowed is determined by IRS formulas and must be calculated by the plan or recordkeeper. [14]

- Matching is not common for these types of plans. Employers often limit their role and do not provide employer contributions to the plan to remain exempt from the Employee Retirement Income Security Act (ERISA) of 1974. ERISA was established to safeguard employees who participate in employer-run retirement plans.[7],[8]

- These plans usually have lower fees, less oversight, and no annual nondiscrimination tests (NDTs) since those costs don’t need to be offset.6

- The vesting schedule is often much shorter than 401(k) plans.2

Unique to 403(b) plans: Employers must allow all employees to participate except those who work less than 20 hours per week, professors on sabbaticals, certain students, union employees, and non-resident aliens.[2]

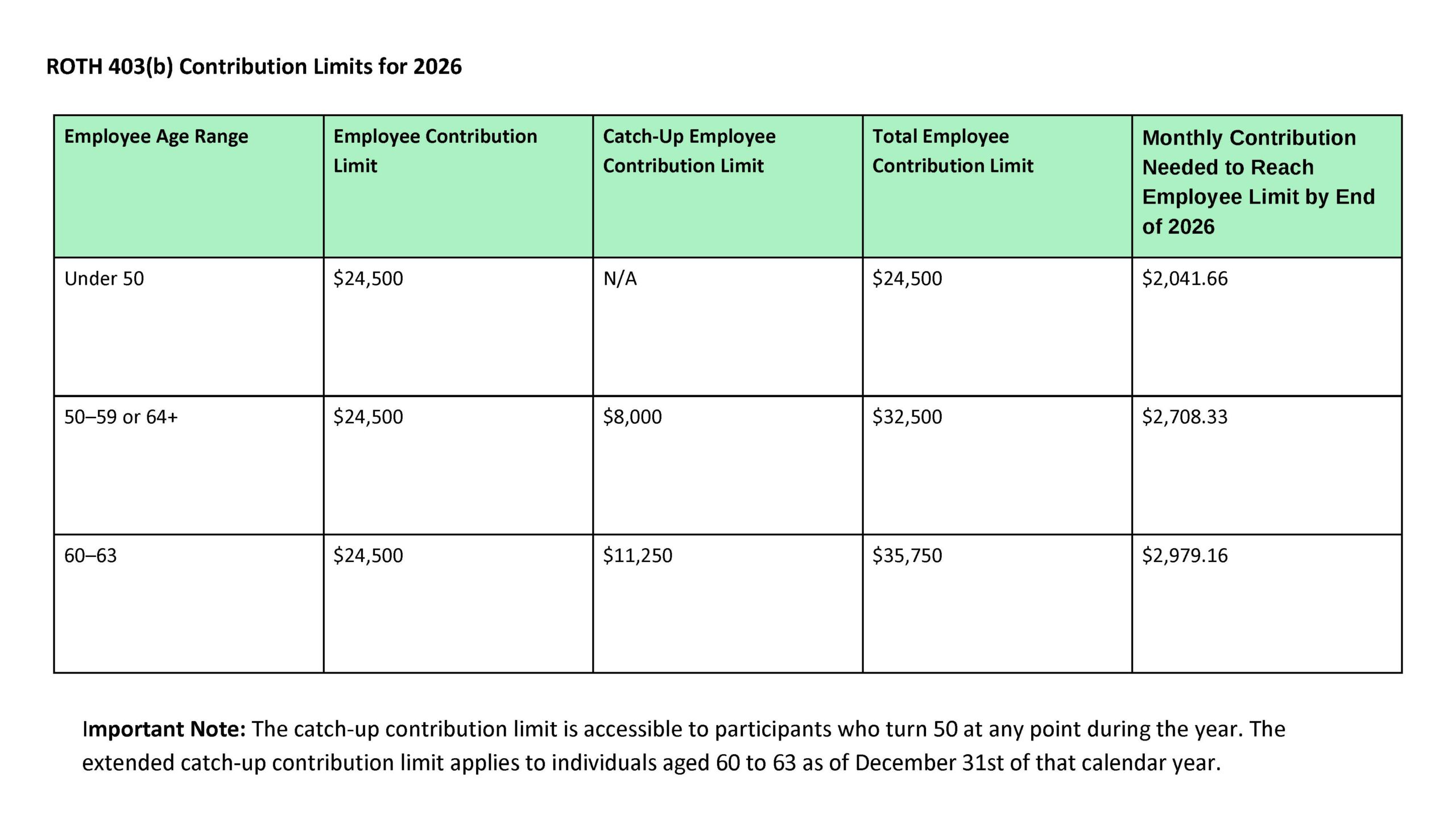

Catch Up Groups:

Employees age 50 or older (the standard catch-up eligibility age). Enhanced catch-up limits apply separately for ages 60–63 beginning in 2025 under SECURE 2.0.

How the $145,000 Threshold Is Determined

Based on Box 3 Social Security wages from the prior calendar year, it applies separately by employer under controlled group rules.

- With all investment accounts, you expose some or all your invested money to loss for the chance to earn a higher profit. Investment gains hinge on an ongoing and long-term investment strategy that uses your risk tolerance and diversification to mitigate some risks. Even with these in place, you are exposing your money to loss.[3]

Automatic Enrollment Requirement: Starting in 2025, newly established 401(k) and 403(b) plans are generally required to automatically enroll eligible employees, with an initial deferral rate of at least 3% of compensation. Eligible employees must be auto-enrolled at a 3% minimum contribution rate, increasing annually by 1% until reaching 10-15%. This applies to plans established after December 29, 2022, excluding new/small businesses, church, and government plans.

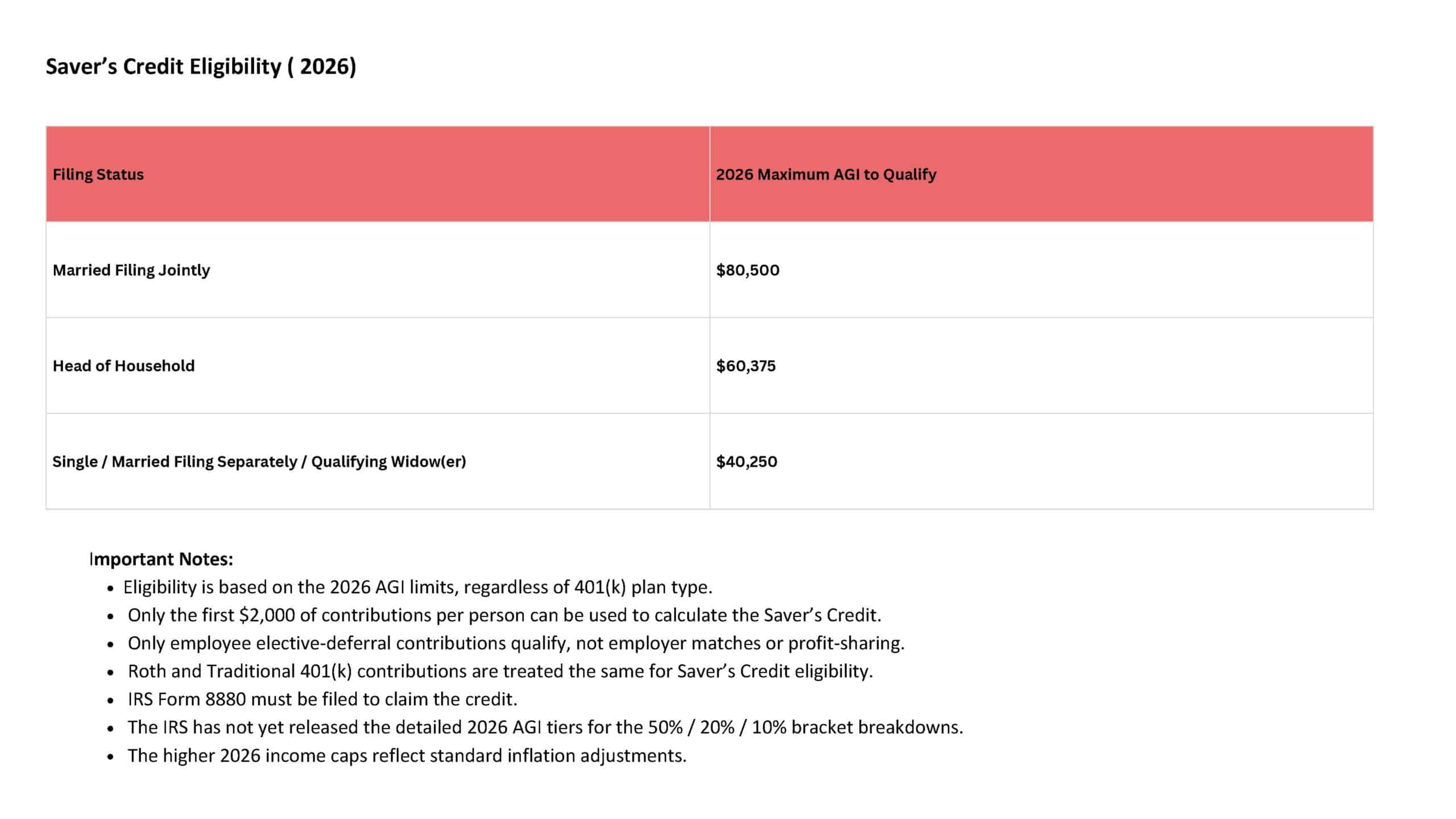

Saver’s Credit (Retirement Savings Contributions Credit) — 2026 Overview: The Saver’s Credit provides a tax benefit for contributing to eligible retirement accounts, helping lower- and moderate-income earners boost their long-term savings.

Eligible Contribution Types

Employee contributions to the following accounts qualify:

• Traditional or Roth IRAs

• 401(k) plans — including Traditional, Roth, Safe Harbor, Solo/Individual, and SIMPLE 401(k)

• 403(b) plans

• 457(b) governmental plans

• SIMPLE IRAs

• SEP IRAs

(Only employee elective-deferral contributions qualify—not employer matches or profit-sharing.)

Simplified Hardship Withdrawals: The SECURE 2.0 Act allows for self-certification of hardship withdrawals, simplifying the process for participants to access funds in case of financial emergencies.

- Investment options are generally limited to mutual funds and annuity contracts..2

- If you leave an employer, you can take your money with you.[9]

- Profit-sharing, where a company offers stock options to its employees, is not available with these types of plans since these organizations are non-profit.6

Automatic Rollover Threshold: Previously, if a former employee’s plans balance was less than $5,000, plan administrators could transfer the funds into an IRA without the employee’s consent. The SECURE 2.0 Act raised this limit to $7,000, effective from 2025.

- The earliest you can take penalty-free withdrawals is 59 ½; the penalty is an extra 10% on top of the taxes collected. However, there are some exemptions to the early withdrawal penalty- if you are permanently and totally disabled, if you lose your job at 55 or older, if you have medical expenses that exceed 10% of your modified adjusted gross income, with some divorce settlement types and if you die.8

- You can take a low-interest loan on 403(b) accounts, up to $50,000 or 50% of your account balance. You can take out the full amount if your balance is $10,000 or less. You will have to repay the loan within five years (this period may be extended if the money is used to buy a primary home) or upon leaving that job, or it becomes taxable income. The payments will most likely be held back from your paycheck.[11]

Secure Act 2.0: Required Minimum Distribution (RMD) Age for 403(b) Accounts: Traditional 403(b) accounts must follow the federal Required Minimum Distribution (RMD) schedule established under the SECURE Act and SECURE 2.0. The age at which RMDs begin depends on your birth year:

-

Born before 7/1/1949 → RMD age 70½

-

Born 7/1/1949–1950 → RMD age 72

-

Born 1951–1958 → RMD age 73

-

Born 1960 or later → RMD age 75

-

Born in 1959 → Federal clarification pending (age 73 or 75)

Additional Notes for 403(b) Plans

• RMDs apply even if you are still employed, unless your employer allows a “still-working exception.”

• Roth 403(b) accounts became exempt from RMDs beginning in 2024, aligning them with Roth IRAs.

• Pre-2024 Roth 403(b) balances rolled into a Traditional IRA become subject to RMDs, but rolling into a Roth IRA preserves RMD-free treatment.

If you want to explore investment accounts that would work for your personal or retirement goals, Scarlet Oak Financial Services can be reached at 800.871.1219 or contact us here. To sign up for our newsletter with the latest economic news, click here.

Sources:

[1] https://www.fool.com/retirement/plans/401k/401k-vs-403b/

[2] https://www.rbcwm-usa.com/resources/file-687824.pdf

[3] https://www.investor.gov/sites/investorgov/files/2019-02/Saving-and-Investing.pdf

[4] https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-403b-contribution-limits

[5] https://www.irs.gov/retirement-plans/403b-plan-fix-it-guide-an-employee-making-a-15-years-of-service-catch-up-contribution-doesnt-have-the-required-15-years-of-full-time-service-with-the-same-employer

[6] https://www.irs.gov/newsroom/401k-limit-increases-to-23000-for-2024-ira-limit-rises-to-7000#:~:text=Highlights%20of%20changes%20for%202024,to%20%247%2C000%2C%20up%20from%20%246%2C500.

[7] https://www.fool.com/retirement/plans/401k/401k-vs-403b/

[8] https://www.investopedia.com/terms/e/erisa.asp

[9] https://www.fool.com/retirement/plans/403b/withdrawal/

[10] https://www.tiaa.org/public/support/faqs/required-minimum-distributions

[11] https://www.investopedia.com/articles/retirement/08/borrow-from-401k-loan.asp

[12] https://www.irs.gov/retirement-plans/403b-plans-catch-up-contributions

https://www.investopedia.com/articles/retirement/08/borrow-from-401k-loan.asp

https://www.irs.gov/pub/irs-drop/n-25-67.pdf

https://www.irs.gov/newsroom/401k-limit-increases-to-24500-for-2026-ira-limit-increases-to-7500

This material has been prepared for informational purposes. To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on individual circumstances.

![Understanding 403(b) Plans [2026]](https://scarletoakfs.com/wp-content/uploads/2025/01/Understanding-403b-Plans-2025.jpg)