In this week’s recap: The White House makes plans to reopen the economy, as analysts examine the first-hard economic data reckoning the U.S. reaction to COVID-19.

Weekly Economic Update

THE WEEK ON WALL STREET

Stock prices pushed higher last week as news of a White House plan to reopen the economy and reports of a potential COVID-19 treatment helped the market overcome weak economic data and an ugly start to the corporate earnings season.

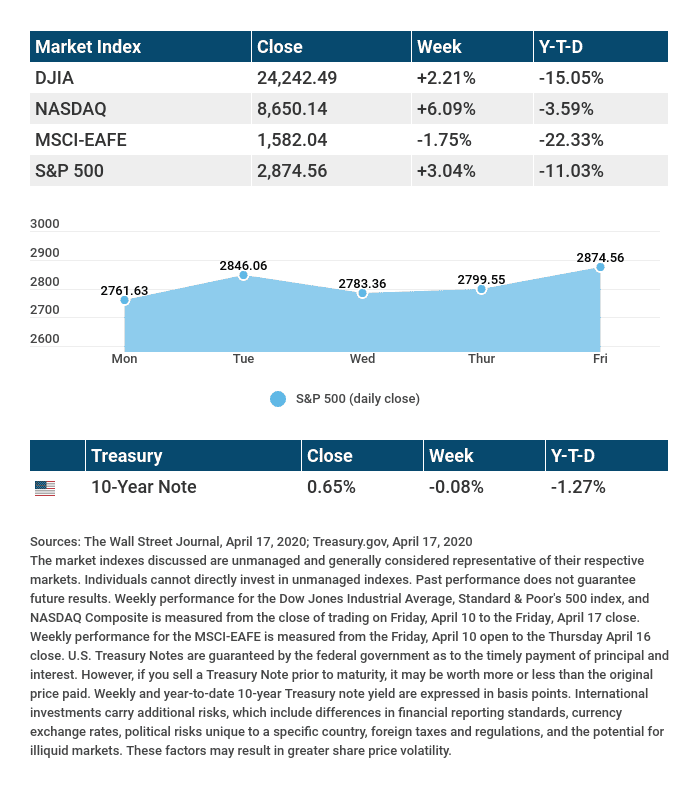

The Dow Jones Industrial Average rose 2.21%, while the Standard & Poor’s 500 advanced 3.04%. The Nasdaq Composite Index gained 6.09% for the week. The MSCI EAFE Index, which tracks developed overseas stock markets, slumped 1.75%.1,2,3

Reality Hits

Until last week, the extent of the economic damage from COVID-19 lacked a lot of hard data. With the release of retail sales (down 8.7% for March), industrial production (down 5.4% in March), and new jobless claims of 5.2 million (bringing the four-week total to 22 million), the scope of economic trouble became clearer.4,5,6

Stocks wavered throughout the week as investors digested the economic data and balanced the reports against signs that the pandemic may have peaked. With news of a plan to restart the economy and promising test results of a COVID-19 treatment, market sentiment turned positive, sending stocks higher on the final day of trading and cementing the second consecutive week of gains.

Corporate Earnings

Large banks kicked off the quarterly earnings season, reporting declines in profits as they hiked loan loss reserves and saw a contraction in consumer credit card use. The large loan loss reserves represent a sobering view on just how much the banks believe small businesses and consumers may be affected by the economic downturn.

Final Thought

With bank earnings reports, investors got an important – but limited – view of the state of the economy. This week’s earnings reports are expected to provide a much broader cross-section of the economy, with a number of consumer products, technology, industrial, transportation, and communication services companies reporting.

THE WEEK AHEAD: KEY ECONOMIC DATA

- Tuesday: Existing Home Sales.

- Thursday: New Home Sales. Jobless Claims.

- Friday: Durable Goods Orders. Consumer Sentiment.

Source: Econoday, April 17, 2020

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

- Monday: IBM (IBM), Halliburton (HAL)

- Tuesday: Netflix (NFLX), Procter & Gamble (PG), Coca-Cola (KO), United Airlines (UA)

- Wednesday: Facebook (FB), AT&T (T), Boeing (BA), Tesla (TSLA), Visa (V)

- Thursday: Amazon (AMZN), Intel (INTC), Starbucks (SBUX), 3M Company (MMM), Southwest Airlines (LUV)

- Friday: Verizon (VZ), American Airlines (AAL), American Express (AXP)

Source: Zacks, April 17, 2020

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Any investment should be consistent with your objectives, time frame and risk tolerance. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

Scarlet Oak Financial Services can be reached at 800.871.1219 or contact us here.

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. All economic and performance data is historical and not indicative of future results. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is a market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor’s 500 (S&P 500) is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world’s largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional. The market indexes discussed are unmanaged and generally considered representative of their respective markets. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost.

originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. All economic and performance data is historical and not indicative of future results. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is a market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor’s 500 (S&P 500) is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world’s largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional. The market indexes discussed are unmanaged and generally considered representative of their respective markets. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost.

CITATIONS:

1 – The Wall Street Journal, April 17, 2020.

2 – The Wall Street Journal, April 17, 2020.

3 – The Wall Street Journal, April 17, 2020.

4 – The Wall Street Journal, April 15, 2020.

5 – MarketWatch, April 15, 2020.

6 – The Wall Street Journal, April 16, 2020.

CHART CITATIONS:

The Wall Street Journal, April 17, 2020.

The Wall Street Journal, April 17, 2020.

Treasury.gov, April 17, 2020.