How your investment strategy is like a long-term partnership.

Your investment strategy is a lot like a marriage. One day you may feel like everything’s going swimmingly. The next day, there might be an argument over who forgot to load the dishwasher. And even the best marriages and partnerships have moments where one or both partners look around and go, “Is this as good as it gets?”

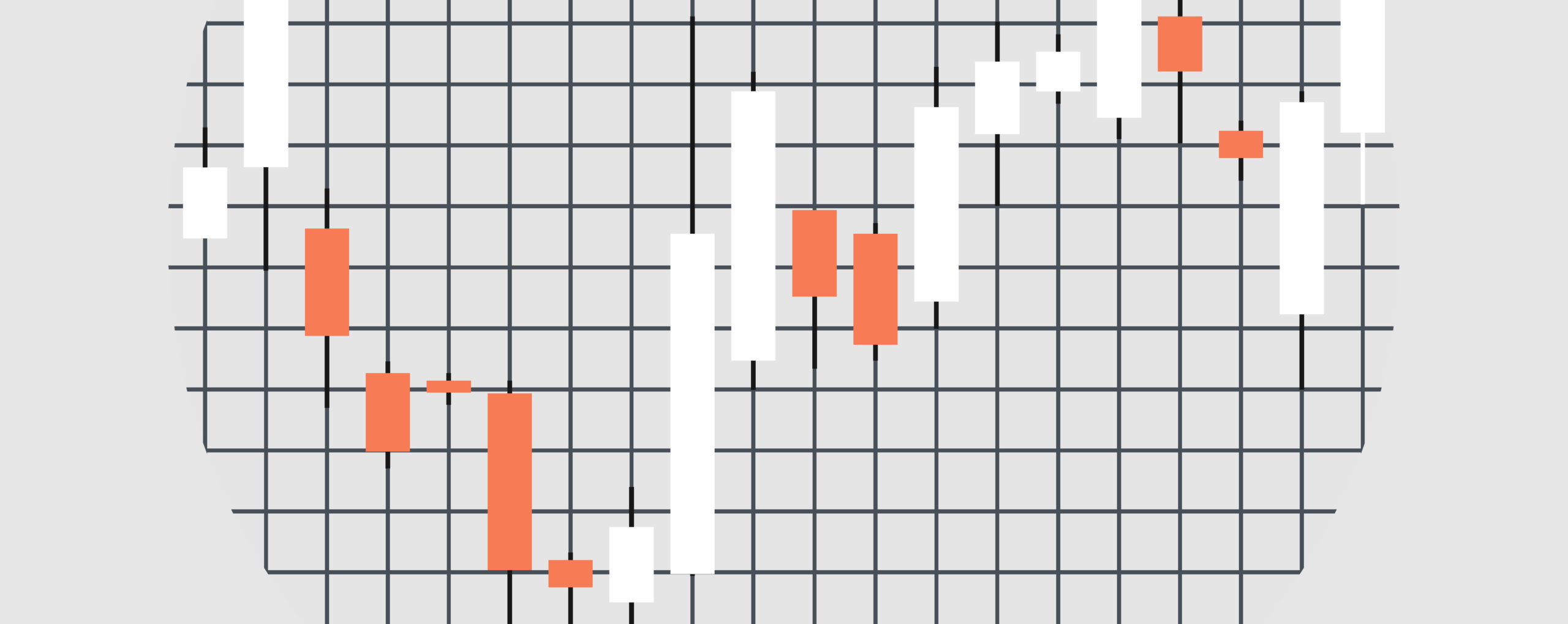

The stock market, much like a marriage, has days of ups and downs. Just look at what happened within the last few weeks. During the first week of December, the stock market jumped 200 points, only for that gain to disappear a week later.1,2

Investors cheered an upbeat consumer spending report, and stock prices rallied again when home sales stayed near a 14-year high. But the enthusiasm faded on mixed news about the job market, and selling continued on concerns about the rollout of the COVID-19 vaccine.3

Trying to make sense of the market and the economy during a pandemic is like trying to determine the health of a long-term relationship based on one day. The market may be fickle or have a roving eye, but it’s important to remember that your investing strategy was created based on your goals, time horizon, and risk tolerance.

If you have any questions about what you’re seeing in the news, please give us a call. We’d welcome the chance to hear your perspective on “what’s next” for the economy.

Scarlet Oak Financial Services can be reached at 800.871.1219 or contact us here.

Citations

- CNBC.com, December 8, 2020

- CNBC.com, December 2, 2020

- WSJ.com, December 9, 2020

Disclosures

Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost.

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. This information has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All indices are unmanaged and are not illustrative of any particular investment.