In this week’s recap: a hiring surge, a noteworthy remark from Jerome Powell, a dip for a respected household confidence index, and gains on Wall Street.

Weekly Economic Update

February BEGINS WITH SOME EXCELLENT ECONOMIC DATA

Payrolls swelled with 304,000 net new jobs last month, according to the Department of Labor’s February employment report. (A Bloomberg survey of economists had projected a gain of 165,000.) The number of Americans temporarily laid off or working part time for economic reasons increased greatly in January as a consequence of the partial federal government shutdown; that left the unemployment rate (4.0%) and underemployment rate (8.1%) higher. Average hourly wages were up 3.2% year-over-year. Additionally, the factory sector expanded at a faster pace last month: the Institute for Supply Management’s purchasing manager index improved 2.5 points to a mark of 56.6.1,2

FED HINTS AT THE POSSIBILITY OF PAUSING RATE HIKES

The Federal Reserve made no interest rate move last week, but at its January 30 press conference, Fed chairman Jerome Powell had an interesting comment for the media: “We believe we can best support the economy by being patient before making any future adjustment to policy.” To investors large and small, that remark sounded like a declaration that the central bank was ready to exercise extra caution in considering future rate increases. Powell noted the recent emergence of “some crosscurrents and conflicting signals about the [economic] outlook” as a factor.3

HOW ARE CONSUMERS FEELING?

The latest readings on the country’s two most-watched consumer confidence indices look good, but one just took a major fall. The Conference Board’s monthly index went from a December mark of 126.6 to 120.2 in January. In its final January edition, the University of Michigan’s consumer sentiment gauge displayed a 91.2 reading, up 0.5 points from its preliminary version.2

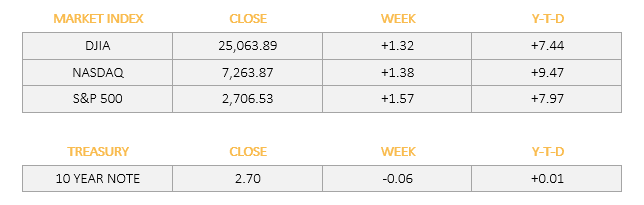

MAJOR INDICES MAKE ANOTHER WEEKLY ADVANCE

Last week, the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite all gained more than 1.3%, thanks in part to some of the developments mentioned above. The S&P rose 7.87% during January. Oil ended the week at $55.31 on the NYMEX; gold, at $1,322.60 on the COMEX.4,5

THIS WEEK

- Alphabet, Beazer Homes, Clorox, Gilead Sciences, Panasonic, Seagate Technology, Sysco, and The Hartford release earnings news Monday.

- On Tuesday, ISM’s January non-manufacturing PMI complements earnings from Allstate, AmeriGas, Anadarko Petroleum, Archer Daniels Midland, BP, Chubb, Electronic Arts, Estee Lauder, Genworth Financial, Mitsubishi, Pitney Bowes, Ralph Lauren, Snap, Viacom, Voya Financial, and Walt Disney Co.

- Wednesday, earnings arrive from Chipotle, Cummins, Eli Lilly, General Motors, GlaxoSmithKline, Humana, MetLife, Prudential Financial, Spotify, Take-Two Interactive, and Valvoline; in the evening, Federal Reserve chair Jerome Powell takes questions at a Washington, D.C. town hall meeting.

- On Thursday, the earnings roll call includes news from ArcelorMittal, Dunkin’ Brands, Fiat Chrysler, Kellogg, L’Oréal, Marathon Petroleum, Mattel, Motorola Solutions, News Corp., Philip Morris, Twitter, Tyson Foods, and Yum! Brands.

- Friday, Exelon, Hasbro, and Phillips 66 present Q4 results.

Sources: wsj.com, treasury.gov – 2/1/194,6,7

Indices are unmanaged, do not incur fees or expenses, and cannot be invested into directly. These returns do not include dividends. Weekly and year-to-date market index returns are expressed as percentages. 10-year Treasury note yield = projected return on investment, expressed as a percentage, on the U.S. government’s 10-year bond. Weekly and year-to-date 10-year Treasury note yield differences are expressed in basis points.

Know someone who could use information like this?

Please feel free to send us their contact information via phone or email. (Don’t worry – we’ll request their permission before adding them to our mailing list.)

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs, or expenses. Investors cannot invest directly in indices. All economic and performance data is historical and not indicative of future results. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is a market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor’s 500 (S&P 500) is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world’s largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs, or expenses. Investors cannot invest directly in indices. All economic and performance data is historical and not indicative of future results. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is a market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor’s 500 (S&P 500) is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world’s largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

CITATIONS:

1 – fortune.com/2019/02/01/jobs-numbers-january/ [2/1/19]

2 – marketwatch.com/economy-politics/calendars/economic [2/1/19]

3 – washingtonpost.com/business/2019/01/30/federal-reserve-says-it-will-be-patient-rate-hikes-change-likely-please-trump/ [1/30/19]

4 – markets.wsj.com [2/1/19]

5 – us.spindices.com/indices/equity/sp-500 [1/31/19]

6 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=yield [2/1/19]

7 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=yieldAll [2/1/19]