A SIMPLE (Savings Incentive Match Plan for Employees) 401(k) plan combines aspects of SIMPLE IRAs and Traditional 401(k) plans. This allows small businesses that might not have the resources for a more extensive plan, like a Traditional 401(k), but want to offer more than what’s provided with a SIMPLE IRA.[1]

Key aspects of SIMPLE 401(k) plans:

- They are a pre-tax investment account, meaning the money you place in this account is deducted from your check before taxes are collected.[2]

- With all investment accounts, you expose some or all your invested money to loss for the chance to earn a higher profit. Investment gains hinge on an ongoing and long-term investment strategy that uses your risk tolerance and diversification to mitigate some risks. Even with these in place, you are exposing your money to loss.

- Investment Options: SIMPLE 401(k) plans typically offer a menu of professionally managed investment options similar to traditional 401(k)s. These may include mutual funds, target-date funds, stable value funds, and bond or equity portfolios. Unlike SIMPLE IRAs, which are held at custodians with broad investment access, SIMPLE 401(k) participants are limited to their plan’s curated investment lineup.

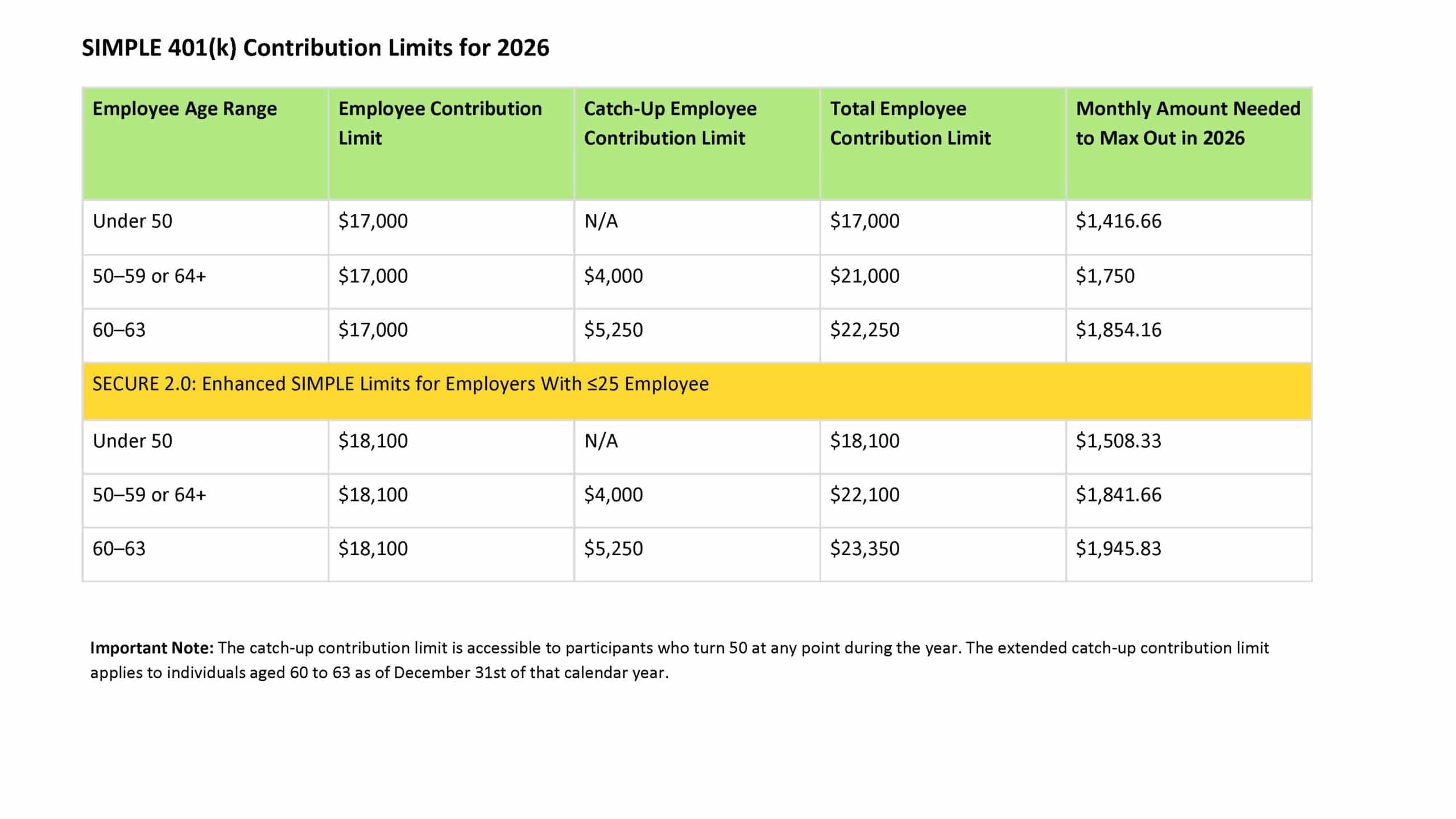

Catch Up Groups:

Employees age 50 or older (the standard catch-up eligibility age). Enhanced catch-up limits apply separately for ages 60–63 beginning in 2025 under SECURE 2.0.

How the $145,000 Threshold Is Determined

Based on Box 3 Social Security wages from the prior calendar year, it applies separately by employer under controlled group rules.

Employer Eligibility (Often Overlooked Rule): SIMPLE 401(k) plans are available only to small employers who meet strict IRS criteria. To establish a SIMPLE 401(k), an employer must:

-

- Have 100 or fewer employees who earned at least $5,000 in the prior year

- Not maintain any other employer-sponsored retirement plan, except for plans that exclude certain employees such as union workers or nonresident aliens

- Agree to provide mandatory employer contributions (3% match or 2% nonelective)

If an employer exceeds the 100-employee threshold, a two-year grace period may apply if the excess employees occurred due to business growth rather than a merger or acquisition.

- Employers must match contributions. These plans can either have a mandatory match or non-elective contribution- mandatory is 3%, or non-elective is 2%. A mandatory match means the employer must match up to 3% of the employee’s contribution. If the employee contributes 1% of their salary, then the employer contributes 1%; if the employee contributes 2%, then the employer puts in 2%, and so on to 3%. A non-elective contribution means that the employer will contribute 2% of the employee’s salary, regardless of whether the employee contributes to their account. But the employer never has to match beyond that 3%, which can be less than most 401(k) plans. [4],[5]

- No Profit-Sharing Contributions: SIMPLE 401(k) plans do not permit employer profit-sharing contributions. Employers are limited to either a 3% matching contribution or a 2% nonelective contribution. This is a key difference from traditional 401(k) plans, which may offer additional profit-sharing features.

- Employers must allow all employees to participate if they are at least 21 years old and have completed at least one year of service. The employee must also have earned at least $5,000 in compensation for the previous year.1

- You are 100% vested whenever the employer deposits contributions into your account. Unlike Traditional 401(k) plans, vesting happens when the funds hit your account, not on a vesting schedule based on years of employment. 4

- Roth SIMPLE 401(k) Contributions: Some SIMPLE 401(k) plans allow Roth contributions, permitting after-tax savings with tax-free qualified withdrawals in retirement. Whether a Roth option is available depends on the employer’s plan design.

- IRA Limits Are Separate: Contributing to a SIMPLE 401(k) does not affect eligibility to contribute to a Traditional or Roth IRA. These contribution limits operate independently.

- Employer Contribution Deadline: Employer contributions—whether matching or nonelective—must be deposited by the employer’s tax filing deadline, including extensions, consistent with IRS rules for SIMPLE 401(k) plans.

- Deadline to Deposit Employee Elective Deferrals: Employee elective deferrals must be deposited as soon as administratively feasible. For small employers, the Department of Labor generally considers deposits made within 7 business days to be compliant.

- Automatic Enrollment Requirement: Enacted in 2025, newly established 401(k) and 403(b) plans are generally required to automatically enroll eligible employees, with an initial deferral rate of at least 3% of compensation. Eligible employees must be auto-enrolled at a 3% minimum contribution rate, increasing annually by 1% until reaching 10-15%. This applies to plans established after December 29, 2022, excluding new/small businesses, church, and government plans.

- Automatic Rollover Threshold: Previously, if a former employee’s 401(k) balance was less than $5,000, plan administrators could transfer the funds into an IRA without the employee’s consent. The SECURE 2.0 Act raised this limit to $7,000, effective from 2025.

Compensation Limit for Contributions: For SIMPLE 401(k) plans, the IRS caps the amount of compensation that can be used when calculating employer contributions. The maximum compensation limit is $350,000 for 2025 and $360,000 for 2026. This cap directly affects the 2% nonelective employer contribution:

-

2025: 2% of $350,000 = $7,000

-

2026: 2% of $360,000 = $7,200

Employers cannot base the 2% nonelective contribution on compensation above these IRS limits.

- ERISA Applicability: Unlike SIMPLE IRAs, SIMPLE 401(k) plans are subject to ERISA rules. This requires employers to maintain a written plan document, provide fiduciary oversight, issue annual participant notices, complete nondiscrimination testing, and file Form 5500 each year (with exceptions). There are very limited exceptions, most SIMPLE 401(k) plans still file Form 5500-SF. Because of these ERISA requirements, SIMPLE 401(k) plans involve more administrative responsibilities than SIMPLE IRAs.

- Nondiscrimination Testing (NDT): While SIMPLE IRAs are exempt from nondiscrimination testing, SIMPLE 401(k) plans are not. SIMPLE 401(k)s must undergo annual ADP (Actual Deferral Percentage) and ACP (Actual Contribution Percentage) tests to ensure that Highly Compensated Employees (HCEs) do not disproportionately benefit compared to Non-Highly Compensated Employees (NHCEs). If the plan fails testing, corrective distributions or adjustments may be required.

- HCE Rules Apply: Because SIMPLE 401(k)s fall under ERISA, the plan must identify Highly Compensated Employees (HCEs) and incorporate HCE status into annual compliance testing.

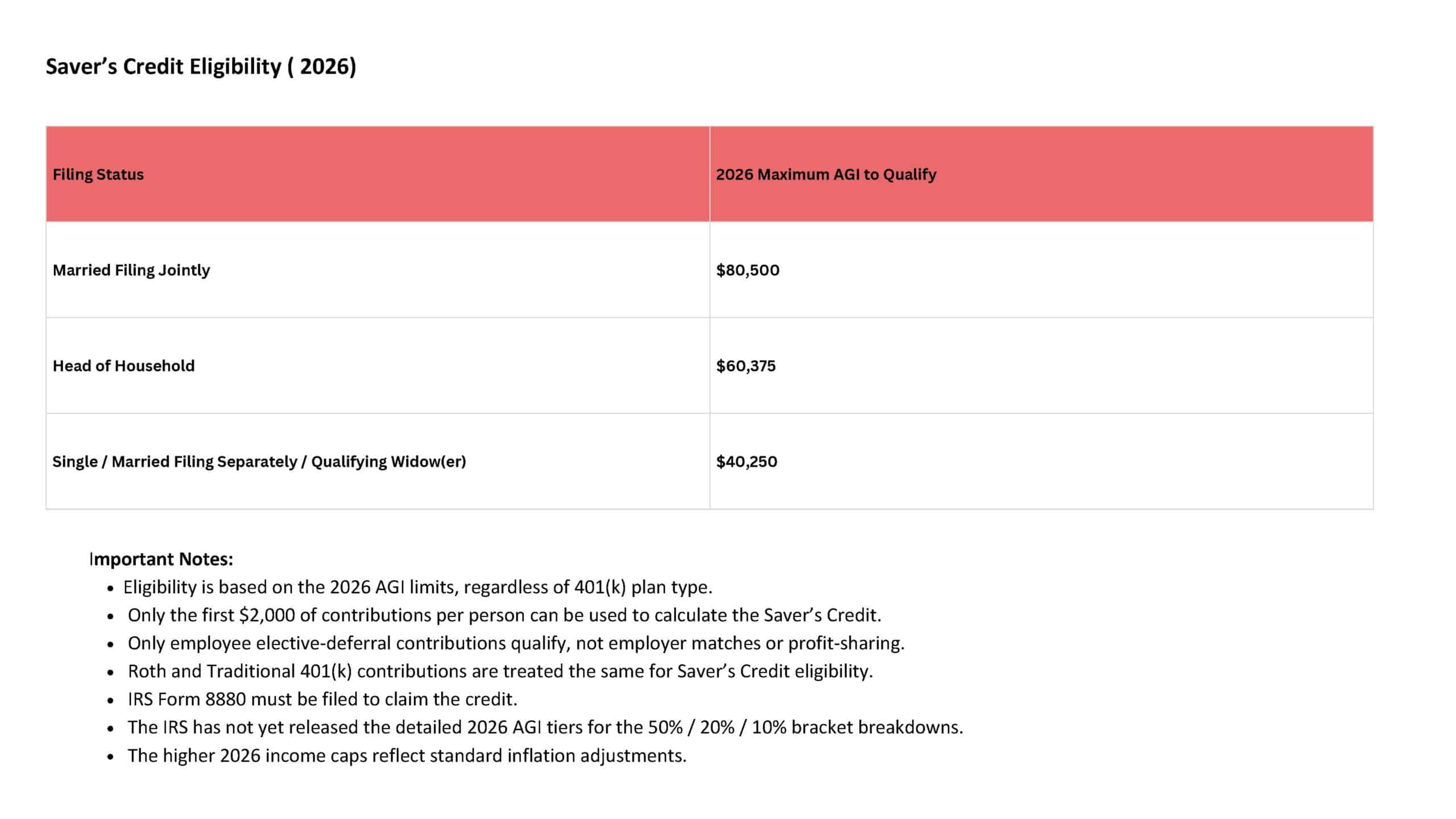

Eligible Contribution Types

Employee contributions to the following accounts qualify:

• Traditional or Roth IRAs

• 401(k) plans — including Traditional, Roth, Safe Harbor, Solo/Individual, and SIMPLE 401(k)

• 403(b) plans

• 457(b) governmental plans

• SIMPLE IRAs

• SEP IRAs

(Only employee elective-deferral contributions qualify—not employer matches or profit-sharing.)

Simplified Hardship Withdrawals: The SECURE 2.0 Act allows for self-certification of hardship withdrawals, simplifying the process for participants to access funds in case of financial emergencies.

- Withdrawal Restrictions Unique to SIMPLE 401(k)s (Two-Year Rule): SIMPLE 401(k) plans follow the same two-year withdrawal restriction that applies to SIMPLE IRAs. If you take a distribution or roll funds into another retirement account within the first two years of participating in the plan, the early withdrawal penalty increases from 10% to 25% unless an IRS exception applies. This higher penalty also applies to rollovers made to other employer plans during this two-year period.

- Fees vary from plan to plan. It is crucial to understand how much you are paying in fees.

- If you leave an employer, you can take your money with you. You can roll it over to another pre-tax IRA account or traditional 401(k), 403(b), or 457(b) plans. If you cash the account out before age 59 ½, you will pay a 10% penalty on top of the 10% taxes you will owe. 1

- The earliest you can take penalty-free withdrawals is 59 ½; the penalty is an extra 10% on top of the taxes collected. However, there are some exemptions to the early withdrawal penalty- if you are permanently and totally disabled, if you lose your job at 55 or older, if you have medical expenses that exceed 10% of your modified adjusted gross income, with some divorce settlement types and if you die. 1, 3

- Loan Rules Follow Standard 401(k) Requirements: Unlike SIMPLE IRAs, SIMPLE 401(k) plans permit participant loans. Loan limits follow standard 401(k) rules: up to $50,000 or 50% of the account balance, whichever is less, with required repayment schedules.

Secure Act 2.0: Required Minimum Distribution (RMD) Age for SIMPLE 401(k) Accounts: Traditional SIMPLE 401(k) accounts must follow the federal Required Minimum Distribution (RMD) schedule established under the SECURE Act and SECURE 2.0. The age at which RMDs begin depends on your birth year:

Born before 7/1/1949 → RMD age 70½

Born 7/1/1949–1950 → RMD age 72

Born 1951–1958 → RMD age 73

Born 1960 or later → RMD age 75

Born in 1959 → Federal clarification pending (age 73 or 75)

Additional Notes for SIMPLE 401(k) Plans

-

RMDs apply even if you are still employed, unless your employer applies a “still-working exception” (plan-dependent).

-

SIMPLE 401(k) Roth accounts are exempt from RMDs beginning in 2024, aligning with Roth IRAs.

-

Pre-2024 Roth SIMPLE 401(k) balances rolled into a Traditional IRA become subject to RMDs; rolling into a Roth IRA preserves RMD-free treatment.

- You can take a low-interest loan on 401(k) accounts, up to $50,000 or 50% of your account balance. Still, you will have to pay it back sometimes within 90 days but definitely within five years (this period may be extended if the money is used to buy a primary home) or at leaving that job, or it becomes taxable income. The payments will most likely be held back from your paycheck. Some plans don’t let you contribute to your account until the loan is paid back. Interest charges go directly back into your retirement account. 4

If you want to explore investment accounts that would work for your personal or retirement goals, Scarlet Oak Financial Services can be reached at 800.871.1219, or you can contact us here. To sign up for our newsletter with the latest economic news, click here.

Sources:

[1] https://www.investopedia.com/articles/retirement/04/052604.asp

[2] https://www.investopedia.com/articles/retirement/04/060904.asp

[3] https://www.irs.gov/newsroom/401k-limit-increases-to-23000-for-2024-ira-limit-rises-to-7000

[4] https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-simple-ira-contribution-limits

[5] https://www.irs.gov/retirement-plans/choosing-a-retirement-plan-simple-401k-plan

6 https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-required-minimum-distributions-rmd

7 https://www.tiaa.org/public/support/faqs/required-minimum-distributions

8 https://www.irs.gov/pub/irs-drop/n-22-55.pdf

http://www.annuityadvisors.com/Forms/integrity-life/misc/Retirement%20Planning%20Guide%202021.pdf

https://www.irs.gov/retirement-plans/choosing-a-retirement-plan-simple-401k-plan

https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-loans

https://www.irs.gov/newsroom/401k-limit-increases-to-24500-for-2026-ira-limit-increases-to-7500

https://www.irs.gov/pub/irs-drop/n-25-67.pdf

This material has been prepared for informational purposes. To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on individual circumstances.

![Understanding SIMPLE 401(k) Plans [2026]](https://scarletoakfs.com/wp-content/uploads/2025/01/Understanding-SIMPLE-401k-Plans-2025.jpg)