With the wide variety of stocks in the market, figuring out which ones you want to invest in can be a challenging task. Many investors feel it’s useful to have a system for finding stocks that might be worth buying, deciding what price to pay, and identifying when a stock should be sold. Bull markets, periods in which prices as a group tend to rise, and bear markets, periods of declining prices, can lead investors to make irrational choices. Having objective criteria for buying and selling can help you avoid emotional decision making.

worth buying, deciding what price to pay, and identifying when a stock should be sold. Bull markets, periods in which prices as a group tend to rise, and bear markets, periods of declining prices, can lead investors to make irrational choices. Having objective criteria for buying and selling can help you avoid emotional decision making.

Even if you don’t want to select stocks yourself and many people would much prefer to have a professional do the work of researching specific investments it can be helpful to understand the concepts that professionals use in evaluating and buying stocks.

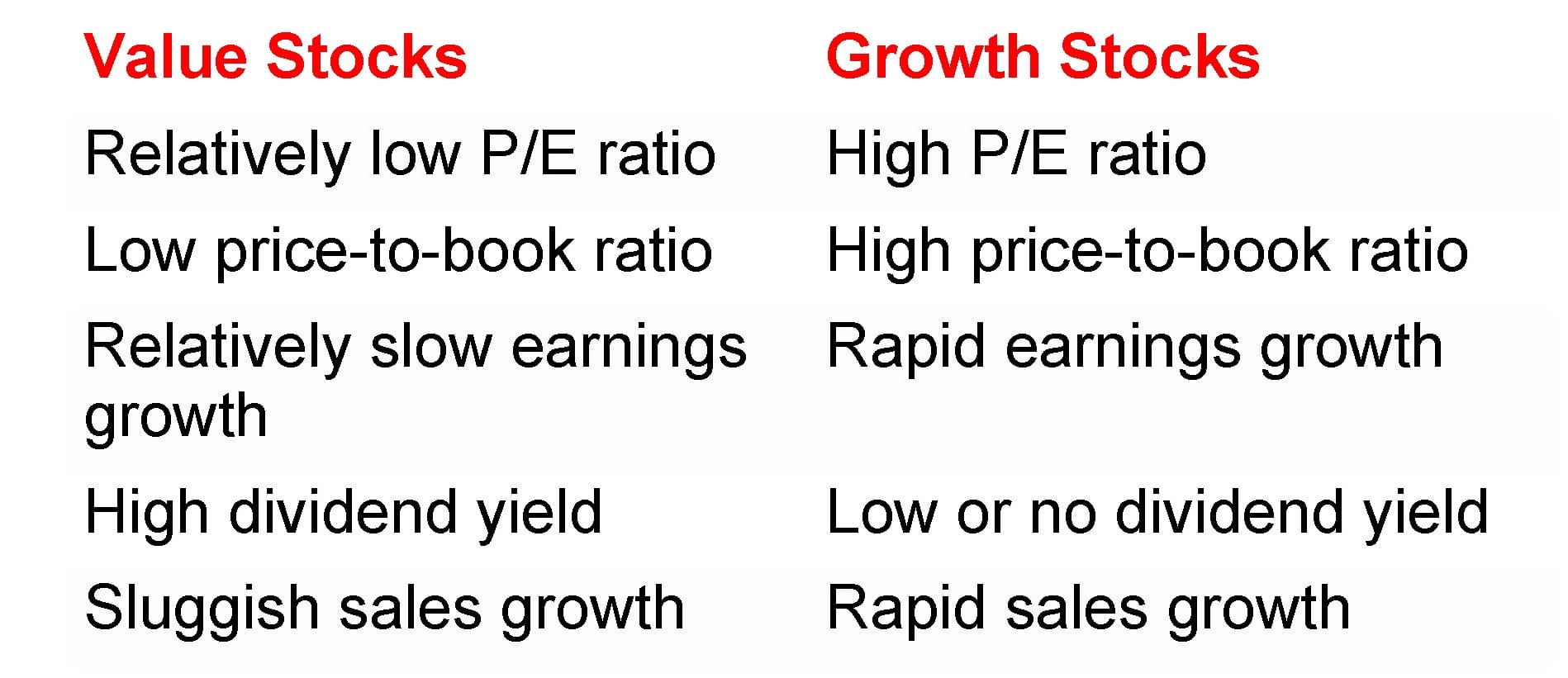

There are generally two schools of thought about how to choose stocks that may be worth investing in. Value investors generally buy stocks that appear to be bargains relative to the company’s intrinsic worth. Growth investors prefer companies that are growing quickly and are less concerned with undervalued companies than with finding companies and industries that have the greatest potential for appreciation in share price. Either approach can help you better understand just what you’re buying and why when you choose a stock for your portfolio.

Value investing

Value investing

Value investors look for stocks with share prices that don’t fully reflect the value of the companies and that are effectively trading at a discount to their true worth. A stock can have a low valuation for many reasons. The company may be struggling with business challenges such as legal problems, management difficulties, or tough competition. It might be in an industry that is currently out of favor with investors. It may be having difficulty expanding. It may have fallen on hard times. Or it could simply have been overlooked by other investors.

A value investor believes that eventually the share price will rise to reflect what he or she perceives as the stock’s fair value. Value investing takes into account a company’s prospects but is equally focused on whether it’s a good buy. A stock’s price-earnings (P/E) ratio its share price divided by its earnings per share is of particular interest to a value investor, as are the price-to-sales ratio, the dividend yield, the price-to-book ratio, and the rate of sales growth.

Value-Oriented Data

Here are some of the questions a value investor might ask about a company:

- What would the company be worth if all its assets were sold?

- Does the company have hidden assets the market is ignoring?

- What would the business be worth if another company acquired it?

- Does the company have intangible assets, such as a high level of brand-name recognition, strong new management, or dominance in its industry?

- Is the company on the verge of a turnaround?

Contrarians: Marching to A Different Drummer

A contrarian investor is one example of a value investor. Contrarians believe that the best way to invest is to buy when no one else wants to, or to focus on stocks or industries that are temporarily out of favor with the market.

The challenge for any value investor, of course, is figuring out how to tell the difference between a company that is undervalued and one whose stock price is low for good reason. Value investors who do their own stock research typically comb the company’s financial reports, looking for clues about the company’s management, operations, products, and services.

Growth Investing

Growth Investing

A growth-oriented investor looks for companies that are expanding rapidly. Stocks of newer companies in emerging industries are often especially attractive to growth investors because of their greater potential for expansion and price appreciation despite the higher risks involved. A growth investor would give more weight to increases in a stock’s sales per share or earnings per share (EPS) than to its P/E ratio, which may be irrelevant for a company that has yet to produce any meaningful profits. However, some growth investors are more sensitive to a stock’s valuation and look for what’s called “Growth At a Reasonable Price” (GARP). A growth investor’s challenge is to avoid overpaying for a stock in anticipation of earnings that eventually prove disappointing.

Growth-Oriented Data

A growth investor might ask some of these questions about a stock:

- Has the stock’s price been rising recently?

- Is the stock reaching new highs?

- Are sales and earnings per share accelerating from quarter to quarter and year to year?

- Is the volume of trading in the stock rising or falling?

- Is there a recent or impending announcement from or about the company that might generate investor interest?

- Is the industry going up as a whole?

Momentum Investing: Growth to The Max

A momentum investor generally looks not just for growth but for accelerating growth that is attracting a lot of investors and causing the share price to rise. Momentum investors believe you should buy a stock only when earnings growth is accelerating, and the price is moving up. They often buy even when a stock is richly valued, assuming that the stock’s price will go even higher. If a stock falls, momentum theory suggests that you sell it quickly to prevent further losses, then buy more of what’s working.

Some momentum investors may hold a stock for only a few minutes or hours, then sell before the market closes that day. Momentum investing obviously requires frequent monitoring of the fluctuations in each of your stock holdings, however. A momentum strategy is best suited to investors who are prepared to invest the time necessary to be aware of those price changes. The risk of loss from this type of trading strategy can be substantial. You should therefore consider whether such a strategy is suitable for you based on your individual circumstances and financial resources.

Why understand investing styles?

Growth stocks and value stocks often alternate in popularity. One style may be favored for a while but then give way to the other. Also, a company can be a growth stock at one point and later become a value stock. Some investors buy both types, so their portfolios have the potential to benefit regardless of which is doing better at any given time. Investing based on data rather than stock tips or guesswork can not only assist you as you evaluate a possible purchase; it also can help you decide when to sell because your reasons for buying are no longer valid.

Scarlet Oak Financial Services can be reached at 800.871.1219 or contact us here. Click here to sign up for our weekly newsletter with the latest economic news.

Source:

Broadridge Investor Communication Solutions, Inc. prepared this material for use by Scarlet Oak Financial Services.

Broadridge Investor Communication Solutions, Inc. does not provide investment, tax, legal, or retirement advice or recommendations. The information presented here is not specific to any individual’s personal circumstances. To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on individual circumstances. Scarlet Oak Financial Services provide these materials for general information and educational purposes based upon publicly available information from sources believed to be reliable — we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.