Introduction

Evaluating a life insurance policy goes beyond simply comparing premiums and death benefits. For policies with a savings or investment component, it is equally important to understand the return you are earning on that portion of your policy. The Belth Yearly Rate of Return Method, developed by Joseph Belth, offers a straightforward way to measure the annual rate of return on the cash value portion of a life insurance policy. By applying this method, you can independently assess whether your policy’s investment performance is competitive, identify potential underperformance, and make more informed decisions about keeping, replacing, or adjusting your coverage. This approach is valuable for both new policy comparisons and ongoing reviews of existing policies, helping ensure that your life insurance aligns with your long-term financial objectives.

What is the Belth yearly rate of return method?

Created by Joseph Belth (who also created the Belth yearly price of protection method), the Belth yearly rate of return method is a way of evaluating a life insurance policy with a savings (investment) component. It enables you to measure the yearly rate of return you’re getting on your investment so that you can determine whether this rate of return is reasonable.

The Belth yearly rate of return formula

The formula and the figures used in it

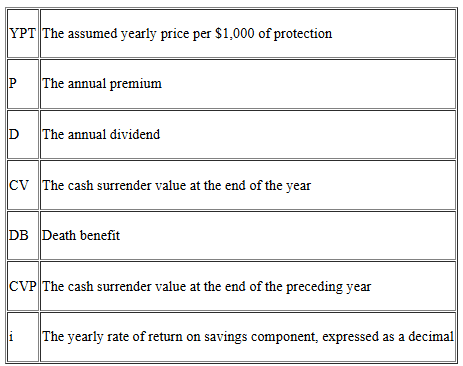

The yearly rate of return method calculates the rate of return you’re getting annually on the savings (investment) component of your life insurance policy. The figures used in the formula are the same as those used in the Belth yearly price of protection method, although their meanings differ slightly:

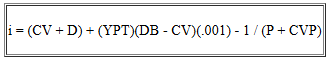

The formula itself is as follows:

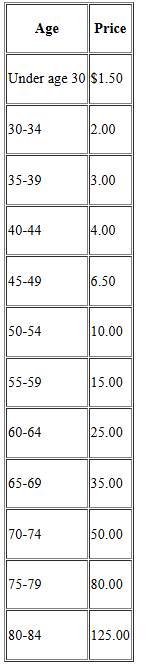

To complete the calculation, you’ll also need to refer to Belth’s list of benchmark prices:

What the formula means

The following is an explanation of what the formula means:

- Numerator: (CV + D) is the amount of cash value at the end of the year (including dividends). To find the value for YPT, refer to the list of benchmark prices and choose the price that corresponds with your age. This is the assumed yearly price per $1,000 of protection. Then, multiply this figure (YPT) by the yearly amount of life insurance protection expressed in thousands of dollars (calculate this by subtracting the policy’s cash value at the end of the year from the policy’s death benefit, DB – CV multiplied by .001). Next, add the result of the first part of the formula to the result of the second part of the formula. Then, move on to calculate the denominator of the formula.

- Denominator: (P + CVP) is the annual premium plus the cash value at the end of the preceding year. Once you’ve calculated this, you can calculate the yearly rate of return for the policy.

Calculating the yearly rate of return

Divide the numerator by the denominator, then subtract 1. This will give you the rate of return expressed as a decimal. To convert this into a percentage, move the decimal point two places to the right.

i = (4,400 + 40) + (6.50)(100,000 – 4,400)(.001) – 1 / (1,100 + 3,800)

i = 5061.40 -1 / 4900

i = 1.032 – 1

Thus, i = .032, or 3.2%.

This is Lisa’s rate of return on the policy for that year.

Interpreting the data

Once you’ve calculated the yearly rate of return for a policy year, consider the following interpretations proposed by Belth to determine whether your rate of return is good, fair, or poor.

If the yearly rate of return calculated is around 6 percent or more, the rate of return is good. If the yearly rate of return calculated is around 5 percent or more, the rate of return is fair. If the rate of return is around 4 percent or less, the rate of return is poor.

Strengths

Calculation is simple

The Belth yearly rate of return calculation is easily completed, once you have the information you need at hand. The method can be completed by consumers, insurance professionals, and financial planners, without the help of a computer.

Useful as a tool to measure independently the savings component of a cash value life insurance policy

When you consider purchasing a life insurance policy, you will be provided with a sales illustration (often using an interest-adjusted cost method) designed to help you evaluate a policy’s cost of protection, which often assumes an interest rate of 6 percent. The Belth yearly rate of return method, however, allows you to independently determine the yearly rate of return on the policy rather than relying solely on insurance company calculations. If performed for more than one year, this method can allow you to see how the policy you own or are considering may perform over time.

Tradeoffs

Yearly rates of return may be inaccurate measures of policy’s performance

One of the tradeoffs of the Belth yearly rate of return method is that it relies, in part, on assumptions of the yearly cost of insurance that may not be entirely realistic. However, if the rates of return are calculated for several years instead of just one, the results will be more reliable. False rates of return may also result when the cash value of the policy is small, so this method should not be used in this case.

Conclusion

The Belth Yearly Rate of Return Method provides policyholders and advisors with a clear, repeatable framework for measuring the investment component of a life insurance policy. While it should not be the sole measure of policy performance, using it over multiple years can reveal important trends and help verify whether the return justifies the cost of coverage. When combined with other evaluation tools, such as the Belth Yearly Price of Protection Method and interest-adjusted cost indices, this method can significantly enhance your ability to compare policies and optimize your insurance strategy. Ultimately, understanding and applying this calculation empowers you to make confident, data-driven decisions that protect both your loved ones and your financial goals.

Scarlet Oak Financial Services can be reached at 800.871.1219 or contact us here. Click here to sign up for our newsletter with the latest economic news.

Source:

Broadridge Investor Communication Solutions, Inc. prepared this material for use by Scarlet Oak Financial Services.

Broadridge Investor Communication Solutions, Inc. does not provide investment, tax, legal, or retirement advice or recommendations. The information presented here is not specific to any individual’s personal circumstances. To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on individual circumstances. Scarlet Oak Financial Services provide these materials for general information and educational purposes based upon publicly available information from sources believed to be reliable — we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.