Thrift Savings Plans are retirement plans offered to federal employees and uniformed service members. These plans mirror 401(k) programs provided to employees in the private sector. [1]

Key aspects of Thrift Savings Plans (TSPs):

- Contributions are either pre- or post-tax. Participants can contribute to the plan with their tax needs in mind. With Traditional contributions, they could lower their tax burden in the present with pre-tax contributions but pay taxes when they withdraw the money later. And with the Roth version, they would face no taxes at distribution but pay taxes on the income in the present. [2],[3]

- Most employees of the United States government are eligible to participate in TSPs. You can contribute to a TSP account if you are a part of the Federal Employees Retirement System (FERS) hired on or after January 1, 1984, if you are covered by the Civil Service Retirement System (CSRS) hired before January 1, 1984, and did not convert to FERS, if you are a member of the uniformed services (active duty or Ready Reserve), or if you are civilian in specific categories of government service. Participants must also be actively employed by the federal government as a civilian employee or member of the uniformed services, in a pay status to contribute, and working full- or part-time. 2

- Under both FERS and the military’s Blended Retirement System (BRS), TSP participants receive valuable government contributions. Agencies and services automatically deposit 1% of basic pay into your TSP each pay period, even if you contribute nothing. When you do contribute, the first 5% of basic pay is matched—dollar-for-dollar on the first 3% and 50 cents on the dollar for the next 2%. BRS members may also contribute bonus, incentive, or special pay to their TSP, but matching applies only to contributions made from basic pay. 2

- Members of uniformed services can contribute from 1% to 100% of any incentive pay, special pay, or bonus pay if they choose to contribute beyond the automatic Agency/Service Automatic (1%) Contributions. However, they cannot contribute from sources such as housing or subsistence allowances. Under TSP rules, service members may also contribute up to 100% of basic pay while deployed in a combat zone (subject to the annual additions limit). Matching contributions apply only to basic pay—not to bonus, special, or incentive pay. 2

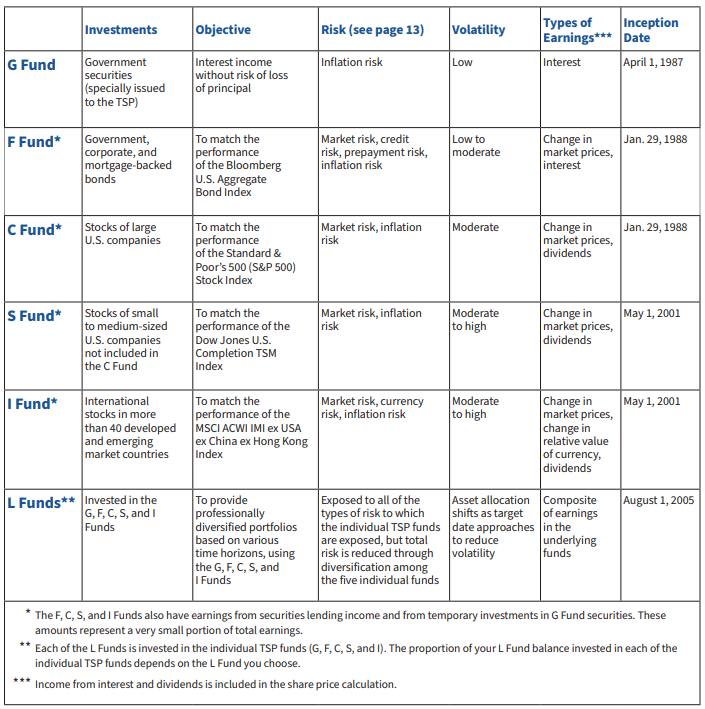

Image Source: https://www.tsp.gov/publications/tspbk08.pdf

More Information about Lifecycle Funds: https://www.tsp.gov/funds-lifecycle/l-2075/

Lifecycle (L) Funds Update: Introduction of L 2075 Fund: A new Lifecycle Fund, L 2075, has been introduced to accommodate participants with longer investment horizons, allowing for strategic asset allocation tailored to a 2073 or later retirement target date.

The Saver’s Credit provides a tax benefit for contributing to eligible retirement accounts, helping lower- and moderate-income earners boost their long-term savings.

Eligible Contribution Types

Employee contributions to the following accounts qualify:

• Traditional or Roth IRAs

• 401(k) plans — including Traditional, Roth, Safe Harbor, Solo/Individual, and SIMPLE 401(k)

• 403(b) plans

• 457(b) governmental plans

• SIMPLE IRAs

• SEP IRAs

(Only employee elective-deferral contributions qualify—not employer matches or profit-sharing.)

- There are three ways the employee can invest their TSP account: choose their own mix of investments from individual TSP investment funds (G, F, C, S, and I Funds), a Lifecycle Fund, or invest with the Mutual fund window. Lifecycle Fund is a predetermined ratio of all the funds, which changes as you age. Investing with the Lifecycle Fund option, your investment risk tolerance adjusts automatically, growing more conservative as you near retirement. In the Mutual Fund Window option, you can invest some of your TSP savings in the mutual funds of your choice through the mutual fund window, given that you meet the eligibility criteria and pay the required fees.2,5,[6]

- With all investment accounts, you expose some or all your invested money to loss for the chance to earn a higher profit. Investment gains hinge on an ongoing and long-term investment strategy that uses your risk tolerance and diversification to mitigate some risks. Even with these in place, you are exposing your money to loss.

- Vesting is when you must stay with an employer to keep any money they match. FERS employees in congressional and certain noncareer positions and BRS members become vested in Agency Automatic (1%) Contributions after two years of service. 2

- Fees depend on which funds the employee is invested in. [7]

- If you leave an employer, you can take your money with you. These types of accounts can move into 401(k) plans, IRAs, or other like tax-type accounts. 3

- You can take a low-interest loan on your TSP account for two reasons: A general-purpose loan with a repayment period of 1 to 5 years or a Residential loan; this loan is only for the purchase or construction of a primary residence and will need to be repaid within 1 to 15 years. You must be in pay status to make loan repayments, and if you leave federal service with an outstanding TSP loan, the remaining balance becomes taxable unless it is repaid in full.[11]

SECURE Act 2.0: Required Minimum Distribution (RMD) Rules for TSP Accounts

TSP accounts follow the federal RMD schedule established under the SECURE Act and SECURE 2.0:

-

Born before 7/1/1949 → RMD age 70½

-

Born 7/1/1949–1950 → RMD age 72

-

Born 1951–1958 → RMD age 73

-

Born 1960 or later → RMD age 75

-

Born in 1959 → Federal clarification pending (age 73 or 75)

Important TSP-specific notes:

-

TSP participants must take RMDs from the TSP even if they are still working, unless they are still employed by the federal government in the year they reach RMD age.

-

Roth TSP accounts became exempt from RMDs starting in 2024, aligning with Roth IRAs. However, any pre-2024 Roth TSP balances that were previously transferred to a traditional IRA remain subject to RMDs; only funds rolled into a Roth IRA retain RMD-free treatment.

-

For separated federal employees, the TSP calculates and distributes RMDs automatically unless the participant transfers the balance to an IRA or other plan before year-end.[8],[9]

- The earliest you can take penalty-free withdrawals is 59 ½; the penalty is an extra 10% on top of the taxes collected. However, there are some Financial Hardship Withdrawal exemptions to the early withdrawal penalty- if you are experiencing Negative Cash Flow or Extraordinary Expenses, it can include certain medical expenses, personal casualty losses, or legal expenses. These Financial Hardship Withdrawals have rules regarding if the money is vested, what it can be used for, and how often it can be taken. [10]

- Early Withdrawal Penalty Exception (Age 55 Rule): TSP participants who separate from federal service in or after the year they turn age 55 (age 50 for special categories such as law enforcement, firefighters, and air traffic controllers) may withdraw TSP funds without the 10% early withdrawal penalty, even if under age 59½.

TSP Withdrawal Options (Retirement)

When you retire or separate from federal service, the Thrift Savings Plan offers several ways to access your savings. Participants can choose a single withdrawal method or combine multiple methods:

• Single Withdrawals

A one-time withdrawal of any amount, from partial to full account balance.

• Installment Payments

Payments can be taken monthly, quarterly, or annually. You may choose a fixed dollar amount or have payments based on life expectancy (IRS tables). You can change or stop installment payments at any time.

• Life Annuity Options

You may use all or part of your TSP balance to purchase a life annuity through TSP’s annuity provider. This creates guaranteed lifetime income for you (or for you and a joint annuitant). Several annuity types and features are available.

• Mixed Method Withdrawals

TSP allows combinations—for example, a partial lump sum plus ongoing installments, or an annuity plus a remaining account balance invested in TSP funds.

These flexible options allow participants to tailor their retirement income strategy to their financial goals, risk preferences, and tax planning needs. [16]

- You must designate a beneficiary directly within your TSP account, as TSP will not honor a will or any outside document. If no beneficiary is on file, the account is distributed according to the federal Order of Precedence:

- Spouse

- Children (equally; a deceased child’s share passes to their descendants)

- Parents

- Court-appointed executor or administrator

- Next of kin under state law.[12]

- Anyone employed after October 1, 2020, was automatically enrolled into a TSP account with an employee Traditional (pre-tax) contribution set to 5%. Between August 1, 2010, and September 30, 2020, new hires and rehires were automatically enrolled at 3%. Employees can change their contribution rates, stop contributing, and/or switch their contribution tax designation from Traditional to Roth (pre- to post-tax). Those in the uniformed services participating with the Blended Retirement System who elect to stop contributing will be reenrolled automatically every January 1 and will have to resubmit their wishes not to participate every year. 2

- In 2022, there was an effort to modernize the TSP system by:[13],[14]

- Offering a mobile app.

- Enhancing cybersecurity for online accounts.

- Offering a “concierge” service to help participants roll money into their accounts. Also, it is a way to make it easier for participants to manage their money with online forms, electronic signatures, the ability to digitally scan checks, pay loans online, and live customer service reps 24/7.

- Presenting a more extensive range of investment choices. The mutual fund window option allows eligible participants to invest in thousands of mutual funds.[15]

If you want to explore investment accounts that would work for your personal or retirement goals, Scarlet Oak Financial Services can be reached at 800.871.1219 , or you can contact us here. To sign up for our newsletter with the latest economic news, click here.

Sources:

[1] https://www.investopedia.com/terms/t/thrift_savings_plan.asp

[2] https://www.tsp.gov/publications/tspbk08.pdf

[3] https://www.tsp.gov/publications/tsp-536.pdf

[4] https://www.irs.gov/newsroom/401k-limit-increases-to-23000-for-2024-ira-limit-rises-to-7000

[5] https://www.ramseysolutions.com/retirement/what-is-the-thrift-savings-plan

[6] https://www.tsp.gov/investment-options/#:~:text=need%20your%20money.-,Individual%20TSP%20funds,made%20of%20stocks%20and%20bonds

[7] https://www.tsp.gov/tsp-basics/administrative-and-investment-expenses/

[8] https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-required-minimum-distributions-rmd

[9] https://www.tiaa.org/public/support/faqs/required-minimum-distributions

[10] https://www.tsp.gov/publications/tspbk12.pdf

[11] https://www.tsp.gov/publications/tspbk04.pdf

[12] https://www.tsp.gov/publications/tspbk08.pdf (pg. 19)

[13] https://stwserve.com/tsp-2022-contribution-limits/

[14] https://federalnewsnetwork.com/mike-causey-federal-report/2021/11/new-features-coming-to-the-tsp-heres-what-you-need-to-know/

[15] https://www.tsp.gov/publications/tspfs28.pdf

[16] https://www.tsp.gov/withdrawals-in-retirement/

https://www.irs.gov/pub/irs-drop/n-25-67.pdf

https://www.irs.gov/newsroom/401k-limit-increases-to-24500-for-2026-ira-limit-increases-to-7500

This material has been prepared for informational purposes To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on individual circumstances.

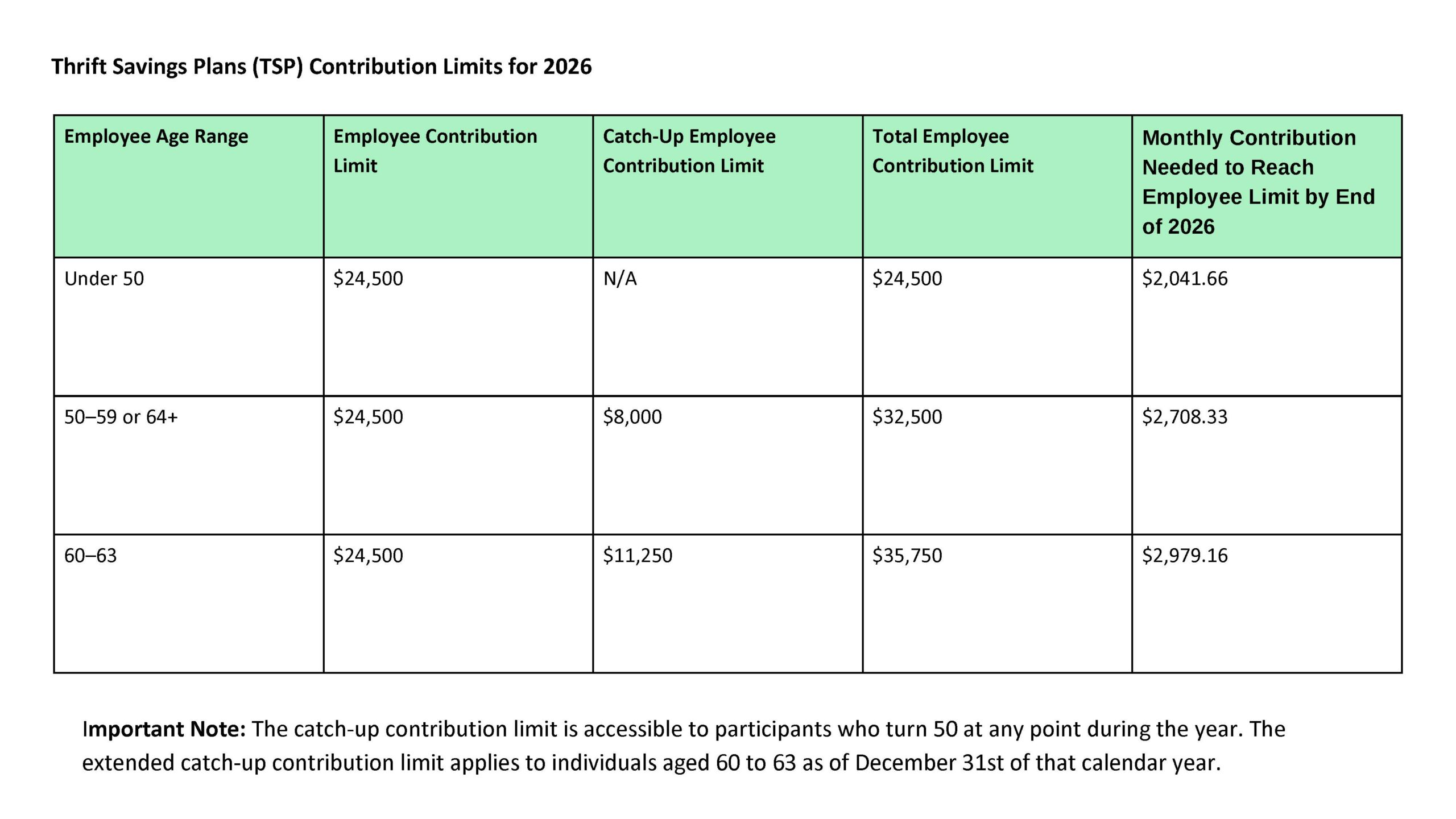

![Understanding Thrift Savings Plans [2026]](https://scarletoakfs.com/wp-content/uploads/2025/01/Understanding-Thrift-Savings-Plans-2025.jpg)