Introduction

Establishing a cash reserve is a foundational step in building a resilient financial plan. While long-term investments and insurance policies help protect your future, a dedicated reserve of liquid assets provides immediate protection against unexpected disruptions. Whether it is a sudden job loss, emergency medical expense, or urgent home repair, having funds readily available can help you avoid debt and reduce financial stress. A well-structured cash reserve gives you time to respond thoughtfully to challenges rather than reacting under pressure, and it plays a critical role in maintaining overall financial stability.

What is a cash reserve?

A cash reserve is a pool of funds (and sometimes credit) that you hold in a readily available form to meet emergency and other highly urgent, short-term needs. Sometimes, it is referred to as an emergency or contingency fund.

The definition used here of a cash reserve is money set aside solely to cover critical, unexpected needs, such as a sudden loss of income. Consequently, it is not a fund for meeting anticipated expenses, large or small, such as real estate taxes, tuition, or a spontaneous vacation. Instead, a cash reserve protects you, your family, and your loved ones against unexpected financial crises.

Why is a cash reserve necessary?

A sound financial plan should ensure that you are protected when financial emergencies arise. In times of crisis, you do not want to shake pennies out of a piggy bank. Also, having a cash reserve may help prevent being forced to take on additional debt precisely when another financial challenge is the last thing you need. Consequently, the first step in the financial planning process should be to establish a cash reserve.

Determining how large a cash reserve should be

The amount of your cash reserve should be based on your own personal situation. While basic guidelines do exist, you should adjust them to reflect your unique circumstances. Some factors you should consider when determining a cash reserve goal include job security, the condition of your real estate, and the health of you and your dependents. Naturally, such factors change with time, so an annual review and adjustments are important elements of the planning process.

Three to six months of routine living expenses compose a typical cash reserve, but there are exceptions

Your should generally follow the 3-6 months rule: that is, your cash reserve should equal 3 to 6 months of ordinary living expenses. Occasionally, low job security or high income volatility might suggest having a reserve of up to 12 months of expenses. The actual number of months selected should reflect these and other significant risk factors, such as the adequacy of insurance coverage and the condition of any property you own.

Using credit provides a higher-risk secondary funds source

Credit available to you can be a secondary source of funds in a time of crisis. However, because borrowed money must be paid back (often at very high interest rates), using lenders as the primary source of your cash reserve can create more long-term financial problems than it solves. Credit as part of a cash reserve functions best when it’s part of a multi-tier cash reserve structure that includes multiple financial resources.

Taking stock of what you have

List the locations and amounts of your money that you can withdraw on an immediate (or nearly immediate) basis without incurring a loss. Typical sources include savings accounts, money market accounts, Treasury securities, and cash value life insurance. Be careful to exclude accounts set up to meet everyday needs or special objectives, such as education, vacations, or a new car. You can also include untapped credit resources, provided you count them separately from cash resources.

Are you missing the goal? If so, by how much?

This is almost as easy as subtracting what you have from what you need. If you elect to consider credit resources part of your cash reserve, the procedure is slightly more complex, since part of the total amount must be held as cash (noncredit) assets.

Ladder maturities of term deposits for better accessibility and lower interest rate risk

Laddering refers to staggering the maturity dates of fixed-term investment vehicles (i.e., those that pledge to return your principal plus interest on a given date). Certificates of deposit (CDs) and U.S. Treasury securities (T bills) are examples of savings vehicles you might consider as a second tier of your cash reserve. If so, spreading the maturity dates of such vehicles over a short time period (e.g., two to five months) assures their availability to meet sudden financial needs that may extend beyond a few months. Laddering enables you to seek a higher level of interest while preserving some accessibility and flexibility to adjust to changing financial circumstances.

Build a multi-tier cash reserve when using term deposits or credit lines

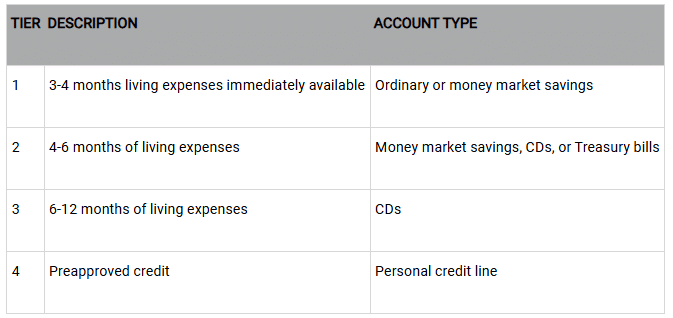

If your cash reserve includes more than two or three months of living expenses, you can consider dividing it into two or three tiers. You then have the option of using a different form of savings or credit for each tier. This method allows you to consider savings vehicles that offer higher interest rates, although such money will not be available immediately without penalty. If you choose to include credit as part of a multi-tier account structure for your cash reserve, always use it as the final tier, because payback requirements and related interest charges make it the least desirable form of emergency protection. The following table illustrates this point:

Review and adjust your cash reserve annually to reflect your changing circumstances

If anything is certain, it is that the personal and financial circumstances of you, your family, and your loved ones are very likely to change within the span of a year or two. A new child comes along, an aging parent becomes more dependent, a larger home or new car brings increased expenses, or maturing offspring leave the nest. Because your cash reserve is your first line of protection in a financial crisis, it is important to review it annually. If the amount and structure of your reserve no longer matches current needs, you should make the appropriate adjustments. An overly large reserve can mean that opportunities for better returns are being overlooked. In contrast, an undersized reserve increases the risk for financial chaos and stress in a time of sudden need.

Conclusion

A well-funded and carefully structured cash reserve is your first line of defense against financial uncertainty. It empowers you to manage emergencies without derailing long-term goals or incurring unnecessary debt. By evaluating your risks, setting an appropriate savings target, and using a combination of accessible and interest-bearing accounts, you can build a reserve that is both practical and effective. Periodic reviews are essential to ensure your reserve keeps pace with your evolving life circumstances. With a clear strategy and ongoing commitment, your cash reserve becomes more than just savings. It becomes peace of mind.

Scarlet Oak Financial Services can be reached at 800.871.1219 or contact us here. Click here to sign up for our newsletter with the latest economic news.

Source:

Broadridge Investor Communication Solutions, Inc. prepared this material for use by Scarlet Oak Financial Services.

Broadridge Investor Communication Solutions, Inc. does not provide investment, tax, legal, or retirement advice or recommendations. The information presented here is not specific to any individual’s personal circumstances. To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on individual circumstances. Scarlet Oak Financial Services provide these materials for general information and educational purposes based upon publicly available information from sources believed to be reliable — we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.