The second quarter of 2021 saw continued increases in most stock, bond, and commodity markets. As vaccine distribution has increased, so has business activity in those areas.

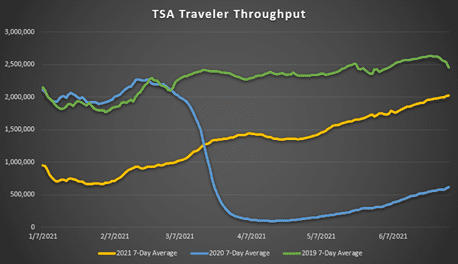

Using air traffic as a crude proxy for normal-economic-activity, you can see the yearly changes in passenger traffic. Using 2019 (in green) as a baseline, 2021 (in yellow) is trending towards previous norms. The speed of this trend is fairly unique to the United States. Most of Europe still has some sort of economic restrictions. The second quarter of 2021 saw continued increases in most stock, bond, and commodity markets. As vaccine distribution has increased, so has business activity in those areas.

Chart Source: TSA.gov

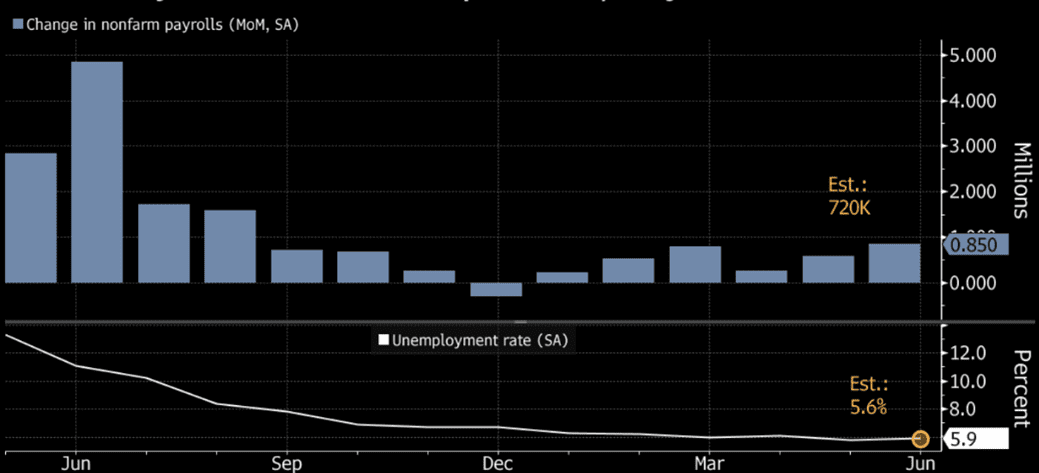

The labor market has recovered faster and stronger than most expected. The official Unemployment Rate has fallen back to 5.6%. A rate in the 5% area is generally considered full employment, as there will always be some people in-between jobs. There is now the “good problem” to have of a shortage of labor in many places. The lucrative unemployment benefits offered as part of economic relief bill have incented many people to stay unemployed for as long as possible. While this can create short-term pains, people with higher incomes can buy more stuff; advancing the economy. On the flip-side, higher wages could incent companies to expedite automation efforts that are already a trend.

Chart Source: Bureau of labor Statistics, Bloomberg

While the appreciation in stocks is consistent with the recent trend, where that appreciation happened is different. Smaller companies and value stocks had been growing fastest at the beginning of the year. During the second quarter, large growth stocks were the top performers. These swings in market leadership are normal and a good reminder that diversification is the best approach to investing most of the time. Chasing the hot dot can lead to buying high, and selling low. This is not a good way to earn profits.

International stocks were up also, though still lag US stock markets’ stellar performance. Being that vaccine roll-out has been more efficient in the US, this should be expected.

Bond markets saw stabilization after a poor start to the year. All of the stimulus pumped into the global economy has caused some inflation to start popping back up. Inflation is bad for most bondholders, as the lender gets paid back in the future. Rising inflation will decrease the purchasing power of the repayment. Bonds can still provide diversification benefits. However, at low yields, it is unlikely they will have the strong returns of the previous decades.

Gold is included to extend diversification beyond just bonds. Its price rebounded during the second quarter of 2021, after a poor Q1. Gold still offers diversification benefits, when combined with traditional stock-bond portfolios, and is being retained.

Scarlet Oak Financial Services can be reached at 800.871.1219 or contact us here.

Securities offered through Geneos Wealth Management, Inc. Member FINRA/SIPC.

This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor.

‘Past performance does not guarantee future results. Investing involves risk, including the loss of principal.

‘The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is a market value weighted index with each stock’s weight in the index proportionate to its market value.

‘Neither Asset Allocation nor Diversification guarantee a profit or protect against a loss in a declining market. They are methods used to help manage investment risk.

Please consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the investment company, can be obtained directly from the Fund Company or your financial professional. Be sure to read the prospectus carefully before deciding whether to invest.