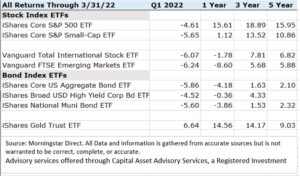

The first three months of 2022 were challenging for most investors, regardless of risk tolerance. Major US stock and bond markets were down in the five-percent area. Global stock markets fell in the six-percent area. Commodities rallied higher, as disruptions tend to increase their prices.

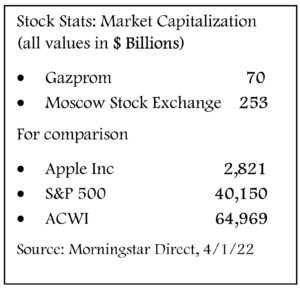

The Russia-Ukraine invasion is a culpable contributor to the bumpy ride. The humanitarian impacts are horrific and beyond the scope of this commentary. From an investment perspective, the Russian stock market is tiny, as a component of the global stock market (generally referred to as the All Country World Index, or ACWI). The Moscow Stock Exchange is 0.4% of the ACWI. It’s only about one tenth the size of Apple Inc.

beyond the scope of this commentary. From an investment perspective, the Russian stock market is tiny, as a component of the global stock market (generally referred to as the All Country World Index, or ACWI). The Moscow Stock Exchange is 0.4% of the ACWI. It’s only about one tenth the size of Apple Inc.

The bigger concerns (from an investment perspective) are how this could hurt global trade. Europe imported $108 Billion worth of energy from Russia in 2021. Building a new energy infrastructure could take years. Who would then be the buyer of all of that Russian oil? If it is China, then we could end up in a very precarious situation. The US and Europe can’t just start making everything that China produces immediately. It could take years, and billions, or even trillions of dollars, to reestablish supply chains.

All of this makes forecasting inflation a daunting task. Inflation has been an expectation by our Investment Committee for the past few years. Demand led inflation could be expected to remain if US consumers are still healthy. With a strong job-market, this is our baseline scenario. Restricted supply chains could cause the more nefarious form of inflation (“Supply-Push Inflation”), which has a chance to damage a solid economy.

Both forms of inflation put bond investors in a precarious situation. Raising interest rates is commonly used to rein in inflation. Existing bond owners often see their prices fall when interest rates increase. Bonds still provide income and diversification benefits, so avoiding them completely is not being suggested. However, we do allocate to other strategies to supplement our diversified portfolios.

Stocks can have different reactions to inflation, pending the type of inflation and the type of business. Supply-Push Inflation means that costs are increasing for raw goods. Only some businesses will benefit from this type of inflation. During the first three months of 2022, this describes energy companies. We all still need to fill our gas tanks, thus energy producers accelerate profits in this environment. However, if peoples paychecks are stretched, they may cut back on unnecessary items, creating a headwind for other businesses.

Demand-Pull Inflation (more buyers than sellers) can be part of a healthy and growing economy. As long as the labor force is making more money too, this can be a boon for businesses, and sustainable.

We saw this play out in Q1, with the energy sector of the stock market appreciate, while most other sectors fell. Likewise, European stock markets fell more than US, as they are more dependent on trade with Russia.

Our managed strategies do invest globally. There are many great businesses that happen to be domiciled outside of the United States. We do carry a bias towards US stock markets, as the US economy is structurally more attractive than most.

Diversification is still the best tool that we have to battle uncertainty. Making long-term decisions based on short-term events rarely leads to great outcomes. We match clients individual situations to portfolios with the long game in mind.

Scarlet Oak Financial Services can be reached at 800.871.1219 or contact us here. To sign up for our weekly newsletter with the latest economic news, click here.

Scarlet Oak Financial Services can be reached at 800.871.1219 or contact us here. To sign up for our weekly newsletter with the latest economic news, click here.

Securities offered through Geneos Wealth Management, Inc. Member FINRA/SIPC.

This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor.

‘Past performance does not guarantee future results. Investing involves risk, including the loss of principal.

‘The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is a market value weighted index with each stock’s weight in the index proportionate to its market value.

‘Neither Asset Allocation nor Diversification guarantee a profit or protect against a loss in a declining market. They are methods used to help manage investment risk.

Please consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the investment company, can be obtained directly from the Fund Company or your financial professional. Be sure to read the prospectus carefully before deciding whether to invest.